INTRODUCTION

It is hardly an exaggeration to say that the leadership of the Russian Federation over the past 20 years has been actively trying to solve the problem of the country’s technological modernization. Much has been done for this divergently: numerous regulatory documents have been adopted, significant amounts of money have been allocated for certain areas, specialized innovation centers have been created, etc. However, the results of all these efforts are quite poor. This raises a question of general scientific significance: what is the reason for Russia’s permanent failures? Can our country be a world technological leader at all?

Answers to these questions are complicated by the fact that at certain periods of time Russia achieved absolutely incredible scientific and technological successes, but most of the time it was a technologically lagging country.

The starting point is the report by Dmitrii Sorokin presented at the VI International Congress “Production, Science and Education” (PNO-2019). [1] According to D. Sorokin, Russia’s permanent failures in the technological modernization have their own political and economic logic. In a few words it is as follows: the vast territory of the country and its difficult climate require a strong central government to preserve its internal unity and ensure external security; otherwise, the country will either disintegrate itself, or undergo a military invasion from outside; in turn, strong power leads to the despotism of officials, who create endless obstacles to entrepreneurs and innovators. This institutional climate makes the domestic market for technological innovation relatively small and extremely sluggish. Abandoning authoritarian power to develop liberal–democratic foundations in Russian society usually contributes to increasing chaos with the most negative consequences. For example, the liberal regime of Nicholai II provoked the October Revolution of 1917, the collapse of the Russian Empire and its transformation into the USSR. The democratic reforms of M. Gorbachev led to the collapse of the USSR in 1991, which had grown over the years of its existence, into 15 separate countries. B. Yeltsin’s policy of granting unlimited freedom to the regions of the Russian Federation disintegrated the country again, which required the transition to V. Putin’s authoritarian methods in 2000 [1]. According to D. Sorokin, there is no alternative to a strong central government for Russia. Consequently, it will never become a world technology leader. The efforts must be focused on finding a bureaucratic management system that would prevent the state from critically lagging behind the leading countries.

This concept is quite interesting and meaningful. Although some parts of it are well known and discussed in the media, D. Sorokin integrated them, gave it a political and economic form and dogmatized the impossibility of Russia’s technological leadership. Hereinafter, with a certain convention, we will call these provisions D. Sorokin’s concept. These political economic considerations are expressed verbally and are not supported by formal and empirical tools. Therefore, the study aims to build a model of public administration that would allow to strictly mathematically illustrate the concept of D. Sorokin and to test its validity about the impossibility of Russia’s technological leadership.

The relevance of the work is determined by the fact that the theory of D. Sorokin basically puts an end to the large–scale technological modernization of the Russian economy and proposes just a slight improvement in the existing bureaucratic model of country management and its adaptation to the current situation. However, this unassuming scenario for Russia’s development seems extremely undesirable. The proposed model aims at determining the features of the governing system that allow the country to overcome the “centralization syndrome” and to claim global technological leadership.

PRINCIPLES OF THE MODERN CONTROL THEORY

A cornerstone achievement of the control theory (cybernetics) is Ashby’s law of requisite variety and Sedov’s law of hierarchical compensation formulated in the 1950s. According to the first, the complexity (variety) of the control subsystem should be no less than the complexity (variety) of the controlled subsystem. According to W. Ashby’s law, the development of the economy should be accompanied by an outrunning complexity of the management system, which entails an accelerated increase in the load on the public administration system. If the public administration system is not able to adequately improve (increase its variety), then according to E. Sedov’s law, it must reduce the variety of the controlled system — the economy [2]. These views were anticipated by Aleksandr Bogdanov (Malinovskii) back in 1913–1929 in his tektology, where the Ashby’s law function is realized by ingression mechanisms (unification of the activities of system elements) and egression (centralization and coordination of the activities of system elements), the E. Sedov’s law function is realized by disingression (separation of the activities of system elements) [3].

Being the result of an abstract generalization of long–term observations of various systems, the laws by W. Ashby and E. Sedov make it possible to interpret the dynamics and development of any complex formations. Thus, the role of E. Sedov’s law is shown on the example of the standardization of markets and institutions, when the excessive complexity of the economy leads to a simplifying management effect on the part of the regulator [4, 5]. Market regulation creates certain frameworks (constraints) and thereby eliminates the increased complexity of the economy.

One of the Ashby’s law manifestations was the global increase in the share of government expenditure in all countries (with no exception) over the past 150 years. German economist Adolph Wagner was the first to notice this pattern. In 1892, he formulated the law of increasing state activities: in countries with developed industry, the increase in government expenditure is faster than the output and national income. This is due to the complexity of socio–economic relations and the strengthening of the regulatory function of the state against this background. Over 150 years, this law has been empirically confirmed for different countries (Table 1), and therefore it has long been considered one of the most inviolable economic laws [6].

Wagner’s law is no longer valid in many countries. This is due to the fact that the share of government expenditure in GDP in some states exceeded 50% by the end of the last century, which, most likely, became the marginal financial burden, requiring the search for other approaches to complicating the management system. One of the simplest consequences of the fact that Wagner’s law is exhausted was the decline in development of advanced (democratic) countries and globally growing authoritarian regimes of various severity as the most economically and socially effective, based on Sedov’s law [8]. The most prominent examples are China, Turkey and Iran. Less pronounced success is in Belarus, Vietnam and North Korea. Russia steadily follows this global trend, but with much less economic dynamism. The events of 2020 associated with the COVID–19 pandemic clearly showed the lack of central government power in the United States, which did not timely prevent election riots and law violations. In some European countries, on the contrary, signs of authoritarianism appeared in the form of an overly strict regime of self–isolation of the population.

Table 1. Share of government expenditure in GDP in developed countries

|

Countries |

Share of government expenditure in GDP,% |

|||

|

1870 |

1960 |

1996 |

2019 |

|

|

Austria |

10.0 |

35.7 |

52.0 |

48.2 |

|

France |

13.0 |

34.6 |

55.0 |

55.6 |

|

Germany |

10.0 |

32.4 |

49.0 |

45.7 |

|

Italy |

14.0 |

30.1 |

53.0 |

48.7 |

|

Japan |

9.0 |

17.5 |

36.0 |

38.9 |

|

Norway |

6.0 |

29.9 |

49.0 |

51.8 |

|

Sweden |

6.0 |

31.0 |

64.0 |

49.3 |

|

Switzerland |

16.0 |

17.2 |

39.0 |

32.7 |

|

Great Britain |

9.0 |

32.2 |

43.0 |

39.3 |

|

USA |

7.0 |

27.0 |

32.0 |

37.8 |

Source: Bainev V., Komar I. [7]; Trading Economics. URL: https://ru.tradingeconomics.com/country-list/government-spending-to-gdp (accessed on 05.11.2020).

Italian political scientist Danilo Zolo explains that the main threat to democratic traditions is the increasing complexity of modern society [9]. The excessive complexity of society due to democratic freedoms (freedom of the media, the activities of public organizations, the political activity of the population at rallies and demonstrations, force majeure such as the COVID–19 pandemic, etc.) leads to increasing social risks and generates a response from the authorities. Rigid regulation of social life in the form of prohibitions leads to blocking its centrifugal tendencies, which is equivalent to its simplification. This anti–democratic method of government is a natural manifestation of Sedov’s law, when the governing system does not try to develop to the governed one and to surpass it, but simplifies the latter to its own level, thereby causing stagnation in the development of society. Democratic regimes are more progressive and tolerant of all kinds of freedoms, but their maintenance becomes too expensive.

As a rule, the development of any society is an alternating action of Sedov’s and Ashby’s laws, which manifests itself in the cyclical nature of authoritarian (Sedov’s law) and democratic (Ashby’s law) regimes. This alternation of different methods of government is typical even for Russia, where over the course of many centuries the institutions of authoritarian power were replaced by their democratic antipodes (city veche, Boyar Duma, noble meetings, State Duma, etc.) [4].

Ashby’s and Sedov’s laws are supplemented by Arnold Toynbee’s concept stating that the development of civilization is affected by external disturbances of the “challenge–response” model. This means that the complexity of social systems as a global trend of evolutionary development constantly challenges the system of public administration. If the latter accepts the challenge and adequately responds to it, it continues to exist and develop. Otherwise, society degrades to the point of complete destruction along with an incapacitated system of power [10].

The foregoing unambiguously indicates that if earlier the increasing complexity of society “spilled over” into the growth of government spending, today we must search for new management mechanisms and new forms of interaction between the system of power and economic entities. There are opportunities for this, especially in the context of total digitalization.

One of the traditional and universal tools for increasing the efficiency of the public administration system is the dosed decentralization of power, including administrative, aimed at redistributing powers, responsibility and financial resources between different levels of the management system [11, 12]. The analysis of the relationship between administrative decentralization and economic growth in China on the example of implementing the China’s counties power expansion reform in 2002, showed that transferring powers to the lower (county) level of government contributed to GDP growth per capita by 3.3%, which was mainly due to the expansion of the local administration’s ability to attract investment (an increase of 18.8% from 2000 to 2008). The positive effect weakened in the regions under less government supervision [13]. In the context of interaction between the control and controlled subsystems, this experience demonstrates at least two important points. On the one hand, at the level of interaction between local authorities and their subordinate territories, there is a clear complexity of the control system due to the delegation of new functions and additional resources. On the other hand, the management system at the level of the central government has become more complicated due to creating an extensive network of subordinate bodies, which made it possible not only to redistribute resources, but also to increase the efficiency of the central government management. The analysis showed that the weakening of the supervisory function “simplified” the control subsystem of the center and made it less complex relative to the control subsystem of counties, which significantly reduced the efficiency of public administration in the regions [13].

Decentralization of power has proven its efficiency not only at the state level, but also in the management of large organizations, when the management system becomes more complex due to a complex of lower management subsystems. Thus, the introduction of a three-level corporate project management system at Gazprom Dobycha Yamburg, which looped all stages of the project development from its inception to full implementation, made it possible to reduce the complexity of the overall enterprise management, free up the management resource of top management and thereby increase the manageability of the entire organization [14]. The complexity of the corporate management apparatus implies the introduction of advanced management technologies, and not just the attraction of additional human resources and the expansion of the administrative staff [15].

The main reserve for the management system efficiency is improving personnel management aimed at increasing the professionalism and competence of personnel. A lot of work is being done in this direction in the public sector. In particular, on the development of competence models, which in many countries are a key tool in human resource management systems [16]; creating a personnel reserve has become widespread in Russia [17]; aimed at recruiting professional staff in government bodies, Indonesian multilevel model of human capital management NUSANTARA has a good history [18].

Modern development is a multifaceted cyclical process with a permanent complexity of the controlled subsystem, challenging the control subsystem, whose response should increase its complexity. If this does not happen, either the entire system starts degrading, which may lead to its complete collapse, or it will move to authoritarian regimes of power with their inherent ineffective “manual control” of the economy, indicating a managerial crisis of the central government.

INTERACTION MODEL OF POWER, MARKET AND COMPLEXITY OF THE SOCIAL SYSTEM

We will illustrate the above logic of the evolution and functioning of socio–economic systems on the corresponding model of economic growth.

This model serves mainly as an illustration of the described mechanism, but it indirectly proves the thesis about the dependence of the Russian economy on its spatial and climatic features. This dependence is by no means unambiguous and not fatal that may justify all subsequent constructions.

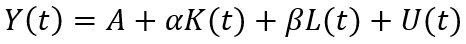

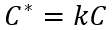

The model is based on a standard macroeconomic production function where for simplicity we will use a linear relationship:

(1)

(1)

where Y is the level of production in the country (GDP); K is the amount of fixed capital in the national economy (production technologies); L is the number of employees in the national economy (human capital); U is the macroeconomic organizational potential of the state (variety of institutions and regulatory instruments); A, a and p are the parameters of function (1), determined statistically by constructing the corresponding econometric dependence; all parameters are positive by default.

In the literature, an established standard usually considers three participants at the macro level: the state (management by maintaining certain institutions and their efficiency), the employer (investments in fixed assets through the purchase of new technologies) and employees (the number of employees able to work with modern technology). Here, function (1) can be considered an absolutely traditional analytical construction.

By function (1), we describe the economic growth of a certain conditional country, since the described mechanism is universal and typical of all countries.

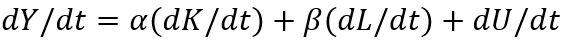

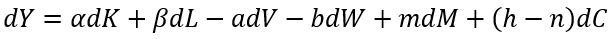

Function (1) can be written in a dynamic form (by time differentiation):

(2)

(2)

where t is time, and the derivatives show the increments of the corresponding quantities. For simplicity we will assume that dt = 1 and will operate simply with absolute increments.

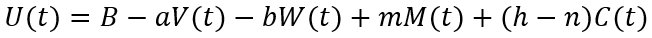

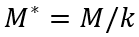

The next step in modeling the public administration is the most important and interesting aspect of the study. We assume that the very managerial potential of state U depends on several groups of factors: the effect of assembling all the country’s resources for purposeful use, provided by the central authorities; the effect of market self–regulation of the system of economic resources; the effect of diverting part of the managerial potential to non–economic tasks – maintaining the country’s internal integrity and ensuring its external security. It is legitimate to introduce the following institutional function (for simplicity we will also write it in linear form):

(3)

(3)

where V is management costs for maintaining the internal integrity of the country; W is management costs for maintaining the country’s external security; C is the managerial potential of the central government (the “strength” of the vertical of power); M is the potential of market selfgovernment (market “strength”); B, α, b, h, m and n are the parameters of function (3); like in function (1), all the parameters are positive.

Function (3) requires some commenting. The macroeconomic potential of management depends on the diverting effect due to the maintenance costs of the country’s internal integrity and external security. This effect is described in function (3) by component (–αV–bW). In this case, it is assumed that the larger the territory of the country and the more severe its climate are, the higher these two types of costs are, “subtracted” from the general management potential. This fact determines the minus sign in front of corresponding parameters a and b. However, the values of these two parameters show the managerial efficiency of the state in solving the problems of internal integrity and external security. This means that even with a large country and cold climate, skillful management can reduce the diverting effect.

The main component of function (3) is the assembling effect (hC), which depends both on the strength of the vertical of power (C) [2] and on the art of using it to solve national economic problems (h). The assembling effect is complemented by the effect of market selfregulation (mM–nC). It depends on the power (capacity) of the market (M) and its ability to self–regulation (m), as well as on government intervention in this process (–nC). We assume that this intervention depends on the strength of the vertical of power (C) and is generally destructive in nature, which determines the negative sign of parameter n, as well as on the activity of the intervention itself (n). Thus, the efficiency of market self–regulation negatively depends on the strength and activity of the central government. Theoretically, one could assume that the intervention of the central government eliminates the so–called market failures and thereby improves its functioning.

We will not consider this option, assuming that any outside interference disrupts natural market mechanisms and reduces their ability to self–regulation.

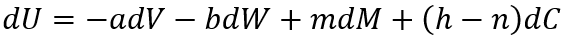

By analogy with function (1), function (3) can be represented in a dynamic form:

(4)

(4)

where, as already mentioned, the differentials denote the increments of the corresponding variables for the year.

The equation for the dynamics of economic growth will take its final form:

(5)

(5)

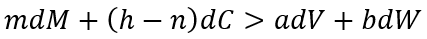

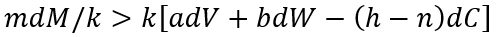

Equations (4) and (5) show that institutional dynamics will stimulate economic growth only if dU> 0. Equation (4) implies that fulfilling the inequality is a necessary condition for this development:

(6)

(6)

Violating condition (6) means the following: the managerial potential of the central government and market self–regulation are insufficient for effective management of the economy, because their resource is completely depleted by an extensive increase in maintenance costs of internal order and external sovereignty and a not very productive management system for these two geopolitical directions. The positive effect of increasing power takes place only if h>n. This means that the efficiency of general central regulation is quite high, and direct government intervention in the economy is not too great. Otherwise, the strengthening of power will only worsen the situation and hold back economic growth.

Generally, we have got a result showing the power possesses the feature of managerial ambivalence, already considered in the literature [20]: with sufficient flexibility and efficiency, a strong central government is capable of accelerating economic growth; otherwise, it has a restraining effect on the development of the economy.

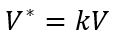

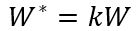

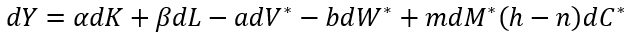

Let us suppose that the model describes an “ordinary” country, i. e. with an average size of the territory, a temperate climate and a relatively democratic form of political government. For a state like Russia, which is many times larger than an “ordinary” country and has worse climatic conditions, as well as an immeasurably stronger central government, the following ratios can be written:

(7)

(7)

(8)

(8)

(9)

(9)

(10)

(10)

where the asterisk marks the indicators of the Russian economy.

The coefficient of the relative strength of the central government of Russia in relation to the “ordinary” country k>1 in dependencies (7)–(10) is determined by the above reasons, which determine the costs of internal and external security. This, in turn, requires a stronger vertical of power, while the market potential, on the contrary, is cut down by this power. Expression (10) is fundamental. In contrast to formulas (7)–(9), it sets an inverse dependence of the structural variable with the relative strength of the central government. This ratio fixes the confrontation between power and the market: the more power is, the weaker the market mechanisms are and the larger the segment of the market that is under the direct patronage of the government.

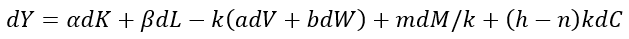

Generally, the proportionality coefficients in (7)–(10) are different. However, for simplicity of calculations, we will assume that they have the same value – k. If we assume that the dynamics of capital and labor in Russia coincides with their dynamics in an “ordinary” country, then equation (5) can be rewritten for Russia as follows:

(11)

(11)

Considering equations (7)–(10), the assumption of the invariability of coefficient k in time and the equality of the parameters in the functions of both countries, equation (11) will be as follows:

(12)

(12)

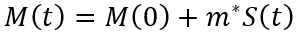

Then the impact of the managerial factor will stimulate economic growth both with an analogue of condition (6) and considering ratios (7)–(10):

(13)

(13)

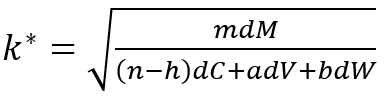

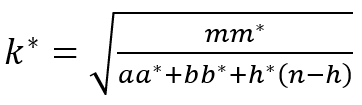

Condition (13) sets the upper limit (k*) of the relative strength of the vertical of power in Russia:

(14)

(14)

where the critical value k* is determined by formula:

(15)

(15)

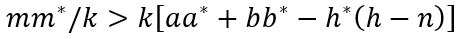

If n>h, the upper limit k* certainly exists; if h slightly exceeds n, this limit also takes place. Thus, with excessive pressure from the vertical of central government on the market, the state management system cannot cope with its responsibilities and has a negative impact on economic growth.

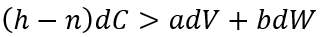

For all their simplicity, the formulas demonstrate the nontriviality of the role of the central government and a large territory of the country. For example, if

(16)

(16)

then any strengthening of power (k growth) will positively affect the economic developmentof the country; otherwise, the power of the central government should be limited to some reasonable level (15).

We will now get back to the idea of complexity. Growing complexity of the socioeconomic system determines the growing costs for its internal and external protection, the growth of the market “volume” and, ultimately, the maximum strengthening of the central government. Thus, the main initial and completely impersonal factor of the dynamics of the control system (power of authority) is the complexity of the controlled system (economy).

Therefore, we will get back to Danilo Zolo’s concept, which sees the complexity of the system as equivalent to the increasing freedom of its elements and leads to the need for government response in the form of increasing all restrictions. To ensure these restrictions, it is necessary to maximally concentrate and strengthen the power itself. Due to increasing complexity is in the modern world, the logic of D. Zolo leads him to the conclusion about the coming domination of authoritarian regimes.

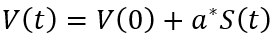

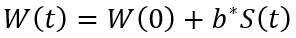

Developing D. Zolo’s idea, we will consider the auxiliary linear dependences of the structure variables of the control function on the complexity of the controlled system:

(17)

(17)

(18)

(18)

(19)

(19)

(20)

(20)

where S is the complexity of the socioeconomic system of an ordinary country; the asterisk marks new parameters in the presented dependencies. As before, all parameters are positive. We leave aside the question of how to measure the complexity of a social system in practice. This is due to two circumstances. First, as will be shown below, this aggregate will not be included in the final conclusions on the model. Second, there is no doubt the very possibility of assessing the complexity of a social system, but assessment methods can be arbitrarily diverse and nontrivial; this is a discussion for a separate study.

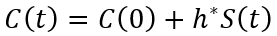

The condition for the efficiency of the control system will then take on a more compact form (due to the fact that, in accordance with dependencies (17)–(20), all changes in structural variables depend on the increase in complexity dS, reduced in subsequent calculations):

(21)

(21)

Condition (16) is specified by the following equation:

(22)

(22)

If equation (22) is satisfied then the built power vertical is highly effective and its strengthening will only streamline the socioeconomic system and has a beneficial effect on all aspects of public life. If condition (22) is not satisfied and the central government is not very effective, then its upper limit is calculated quite simply:

(23)

(23)

Thus, the need for power is completely determined by the configuration of parameters (23), where the parameters reflect the efficiency of the public administration system’s response to external disturbances.

Let us summarize the models.

Table 2. Initial and calculated parameters of the model

|

Model parameters |

Calculation scenarios |

|||||

|

No. 1 |

No. 2 |

No. 3 |

No. 4 |

No. 5 |

No. 6 |

|

|

a |

0.80 |

0.60 |

0.60 |

0.60 |

0.50 |

0.45 |

|

a* |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

|

b |

0.80 |

0.60 |

0.60 |

0.60 |

0.50 |

0.50 |

|

b* |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

|

m |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

0.90 |

|

m* |

1.20 |

1.20 |

1.20 |

1.20 |

1.20 |

1.20 |

|

h |

0.50 |

0.80 |

0.80 |

0.80 |

0.80 |

0.80 |

|

h* |

1.20 |

1.30 |

1.30 |

1.30 |

1.30 |

1.30 |

|

n |

0.00 |

0.00 |

0.05 |

0.15 |

0.15 |

0.15 |

|

k* |

1.13 |

5.20 |

3.21 |

2.14 |

4.43 |

10.39 |

Source: the authors’ calculations.

First, we considered a three–level system of economic growth formation. The first level is associated with a challenge that comes in the form of an increase in the complexity of the social system. Four subsystems of public administration respond to this challenge with various adequacy and efficiency: management costs for maintaining the country’s internal integrity; management costs for maintaining the country’s external security; the administrative potential of the central government (“strength” of the vertical of power); the potential of market selfgovernment (market “strength”). At this level, we consider the efficiency of the subsystems of public administration. At the second level, these four subsystems are assembled into a common power potential to maintain the efficiency of the entire public administration system. At this level, we consider the efficiency of the public administration system in coordinating all subsystems and maintaining the capacity to perform other functions. The third level examines the direct impact of the government’s ability to maintain the efficiency of various institutions on the economic growth rate.

We consider the Russian geographic and geopolitical specifics through the decomposition of its influence on the economic development through different management channels. This approach makes it possible to identify the least effective management areas that lead to system failure, when ineffective government tries to compensate for its shortcomings by direct pressure on the situation, when it is necessary to build up the very potential of the power vertical.

Critical assessment (23) of the relative power of the central government has a simple interpretation: growing power of the center allows to positively affect economic growth only until limit k* is reached. Excessing the limit grows out of proportion and “cuts” the economic growth rate. Moreover, the higher the efficiency of the public administration system, the larger limit k* is. This is a very important thing, which we will dwell on in more detail below: only effective totalitarianism has the right to exist; the ineffective one just destroys everything.

All aggregates discussed above can obviously be expressed in monetary form, when the interpretation of all processes becomes as transparent as possible. In theory, we could use other units of measurement.

RESULTS OF EXPERIMENTAL CALCULATIONS

To understand the action mechanism of the model and the scale of all digital values, we will consider six scenarios that differ in the initial parameters specified in Model 9. Table 2 demonstrates the calculation results using formula (23) and the initial data.

When designing the scenarios, we used two principles. The first involves considering a sufficiently efficient control system: the overwhelming number of parameters is less than 1, i.e. management costs grow more slowly than the complexity of the corresponding managed subsystem occurs. The second principle assumes that h*Z m*, i.e. Ashby’s law is observed: the complexity of the control system (h*) must be no less than the complexity of the controlled system (m*). In all scenarios, the complexity of the market is not faster than the growth of power and the complexity of the state administration system.

We will consider the scenarios in Table 2 in more detail.

When comparing scenarios 1 and 2, it can be seen that even entire elimination of the state from influencing the market (n = 0) cannot justify a high level of the vertical of power. Non–interference in the market functioning gives an effect only if the state effectively copes with external and internal threats by complicating the management system.

Comparing scenarios No. 2, No. 3 and No. 4 shows that even the smallest interference in market processes sharply reduces tolerance for an authoritarian regime. As a rule, the dictatorship of the center and its legitimacy is based on an original model of mutually beneficial interaction between the state and the market. If, against the background of insignificant government intervention in the economy, there is a very modest increase in efficiency in response to challenges in the external and internal environment (scenario No. 5), then this power becomes acceptable again. If we add a very small increase in efficiency in the sphere of internal order in country (scenario No. 6), this justifies even a very high level of totalitarianism of the central government.

Paradoxical as it may seem, the calculations show that the despotism of the management system or the excessive strength of the vertical of power is not a serious constraint for the country’s economic development as might be expected. The conclusion is even more unexpected that legitimate totalitarianism, manifested in a tolerant attitude of the population, must still be earned. In other words, the full power of the state’s leader or the ruling elite can only be justified by its managerial efficiency. Otherwise, excessive centralization of power causes rejection by the masses and economic stagnation.

In such way the result explains the dreams of many peoples (including Russians) about a strong ruler. However, this strong ruler must, above all, be effective. Otherwise, the voluntarism of the authorities finds no justification, and the entire socio–economic system degrades.

DISCUSSION OF THE RESULTS

The built model made it possible to generalize and correct Professor Dmitry Sorokin’s thesis about the absence of political and economic prerequisites for Russia’s technological leadership. At first sight this thesis seems to be correct, but it is violated if we build a highly efficient public administration system. Organizational, technological and personnel reserves are used to increase the efficiency of the management system. This means that neither the gigantic area of Russia, nor its specific climate, nor the multinational and multi-confessional composition of the population, strictly speaking, are an insurmountable obstacle to the country’s transformation into a global technological leader. In practice, however, overcoming this growing complexity is a big challenge.

The historical record confirms this result. For example, the administrative despotism of Turkish leader Recep Tayyip Erdogan is not in great doubt, but the strength of his central government does not interfere with the country’s rapid economic growth for many years. This suggests that his government considers the interests of both national business and the common population. At the same time, R. Erdogan’s rigid vertical of power is quite successfully combined with the country’s market economy. Thus, the administrative apparatus of the ruler with unlimited power does not automatically lead to technological stagnation; on the contrary, Turkey today possesses advanced weapons, a robust economy and aspires to become a nuclear power.

A more striking example is provided by China, which has a large territory, a huge and heterogeneous population and extremely specific natural conditions, and, like in Russia, denies democratic forms of government. Xi Jinping’s lifelong supreme power is enshrined at the legislative level and no one doubts his almost unlimited powers, but this did not prevent the PRC from going through a technological rally in 35 years, which allowed it today to claim world leadership. Besides a powerful public sector, the Chinese economy also has a solid market component.

The history of the USSR provides no less convincing examples. During 40 years, under the absolute centralism of power in the form of the dictatorship of the proletariat, from an agrarian country it turned into a space superpower with unconditional priority in many scientific and technological fields. Various elements of the market and competition also existed in the USSR: for example, work organization of several design bureaus in the field of aircraft construction. There are multiple examples, and all of them contradict D. Sorokin’s thesis about the impossibility of Russia’s technological leadership. Summing up, this thesis basically assumes that highly centralized power does not allow building an effective management system for a huge economy. Apparently, it is true in most cases, but regular exceptions to this rule provide grounds for expanding the theoretical framework of the political economy of technological leadership, as well as for searching for original management models that will allow Russia to rejoin the states demonstrating an exception to the rule.

The model and its analysis confirm the thesis about the innovative ambivalence of power. Everything depends on the focus of the ruling elite: it will either improve the system of public administration, according to W. Ashby’s law, or, according to E. Sedov’s law, it will try to simplify the controlled system by introducing various restrictions.

CONCLUSIONS

To finish the conversation about Russian specifics, we will note that the complexity of the controlled system depends on the size of the country, its climate, population, etc. However, all these dependencies are usually nonlinear and ambiguous. Therefore, it is wrong to think that Russia is a completely unique country with insoluble governance problems. In this context, it would be appropriate to mention the example of Singapore, which literally performed a miracle, stepping over 40 years from the third world to the first one.

In a sense, for all its dissimilarity to Russia, Singapore sets the only possible model for us. We will consider this issue in a bit more detail. Today, it is out of the question that modern Singapore is the merit of its leader, Lee Kuan Yew, who served as the all–powerful Prime Minister of the country from 1959 to 1990, i.e. about 32 years. This long–term irremovability of power and strict observance of very strict laws have become the hallmark of Singapore. What is the secret of the Singapore miracle?

Lee Kuan Yew answered this question: “America and Great Britain will continue to prosper even with a mediocre government, but we will not” [21, p. 275]. “Singapore is a tiny country without any natural resources, and in the middle of a historically unstable region. To survive, we need an ingenious government” [21, p. 276]. “I am absolutely sure that if Singapore gets a dumb government, we are done for. The country will sink into nothingness” [21, p. 277]. This is why Singapore’s government is carefully selected, nurtured, and adequately paid. While in the USA, Great Britain and other developed countries the most talented people and the best graduates of universities work in private companies, in Singapore they find themselves in the public service. Today, no country in the world pays its ministers as generously as Singapore. This fact has led to the creation of a unique ecosystem in the country that minimizes corruption and attracts the best talent from around the world. People are appointed to the posts of ministers who have already demonstrated outstanding success in the corporate sector and have experience in managing complex social systems.

This can be perfectly applied to Russia. The complexity of the country as a managed system is really great, and therefore requires, as in Singapore, an ingenious government, i. e. no less complex and finely arranged control system. The country’s transition to the strategy of “super–competent power”, generating correct management decisions, will make it possible to “overcome” D. Sorokin’s logic of political economy of technological leadership and become another exception. Otherwise, any progressive technological innovation will have to be centrally and, as a rule, unsuccessfully “pressed” into the national economy by the administration.

REFERENCES

- Silaev D.P., Ganzhur M.A. The phenomenon of self-organization and the law of the need for diversity by U.R. Ashby. Problemy sovremennogo pedagogicheskogo obrazovaniya = Problems of Modern Pedagogical Education. 2018;(59–4):259–263. (In Russ.).

- Balatsky E. Concept of complexity and economic theory of democracy. Obshchestvo i ekonomika = Society and Economy. 2013;(5):5–24. (In Russ.).

- Bogdanov A.A. Tectology: General organizational science. Moscow: Lenand; 2019. 680 p. (In Russ.).

- Tzirel S.V. “Qwerty effects”, “path dependence” and the Sedov law, or is the creation of stable institutions in Russia possible? Ekonomicheskii vestnik Rostovskogo gosudarstvennogo universiteta = Economic Herald of Rostov State University. 2005;(3):44–56. (In Russ.).

- Tzirel S.V. “Qwerty effects”, “path dependence” and the law of hierarchical compensation. Voprosy Ekonomiki. 2005;(8):19–26. (In Russ.). DOI: 10.32609/0042-8736-2005-8-19-26

- Balatsky E. Wagner’s law, Armey–Rahn curve and wealth’s paradox. Obshchestvo i ekonomika = Society and Economy. 2010;(9):80–97. (In Russ.).

- Bainev V., Komar I. Government spending and Wagner’s law. Finansy, uchet, audit. 2009;(12):30–33. (In Russ.).

- Zizek S. The year of dreaming dangerously. London, New York: Verso Books; 2012. 142 p. (Russ. ed.: Zizek S. God nevozmozhnogo. Iskusstvo mechtat’ opasno. Moscow: Evropa; 2012. 272 p.).

- Zolo D. Democracy and complexity: A realist approach. University Park, PA: Penn State University Press; 1992. 202 p. (Russ. ed.: Zolo D. Demokratiya i slozhnost’: realisticheskiy podkhod. Moscow: HSE Publ.; 2010. 320 p.).

- Toynbee A.J. Civilization on trial. New York, London: Oxford University Press; 1948. 255 p.; Toynbee A. J. The world and the West. New York, London: Oxford University Press; 1952. 99 p. (Russ. ed.: Toynbee A. J. Tsivilizatsiya pered sudom istorii. Mir i Zapad. Moscow: AST; Astrel; 2011. 318 p.).Bardhan P., Mookherjee D., eds. Decentralization and local governance in developing countries: A comparative perspective. Cambridge, MA: The MIT Press; 2006. 363 p.

- Grindle M.S. Going local: Decentralization, democratization, and the promise of good governance. Princeton, NJ: Princeton University Press; 2007. 256 p.

- Gong O., Liu Ch., Wu M. Does administrative decentralization enhance economic growth? Evidence from a quasi-natural experiment in China. Economic Modelling. 2021; 94:945–952. DOI: 10.1016/j. econmod.2020.02.035.

- Andreev O., Arabsky A., Kramar V. On the problems of transition to modern management systems. Standarty i kachestvo = Standards and Quality. 2012;(8):56–59. (In Russ.).

- Khomyakov V.N. Cybernetics, law of requisite variety, and development of economic indicator forecasts. Izvestiya Tul’skogo gosudarstvennogo universiteta. Ekonomicheskie i yuridicheskie nauki = News of the Tula State University. Economic and Legal Sciences. 2014;(1–1):128–141. (In Russ.).

- Skorkova Z. Competency models in public sector. Procedia — Social and Behavioral Sciences. 2016;230:226–234. DOI: 10.1016/j.sbspro.2016.09.029

- Sheburakov I.B. Reserves of managerial personnel in the Russian Federation as a tool for the development of personnel in the field of public administration. Vestnik Rossiiskogo universiteta druzhby narodov. Seriya: gosudarstvennoe i munitsipal’noe upravlenie = RUDN Journal of Public Administration. 2019;6(2):148–157. (In Russ.). DOI: 10.22363/2312-8313-2019-6-2-148-157

- Cahyaningsih E., Sensuse D.I., Arymurthy A.M., Wibowo W.C. NUSANTARA: A new model of knowledge management in government human capital management. Procedia Computer Science. 2017; 124:61–68. DOI: 10.1016/j.procs.2017.12.130.

- Balatsky E.V., Yurevich M.A. Central government, market competition and technological progress: Model experiments and stylized examples. Journal of Economic Regulation. 2020;11(3):2137. (In Russ.). DOI: 10.17835/2078-5429.2020.11.3.021-037.

- Balatsky E.V., Ekimova N.A. Alternative model for managing innovation and high-tech sector of the Russian economy. Upravlenets = The Manager. 2020;11(5):2–16. (In Russ.). DOI: 10.29141/2218-5003-2020-11-5-1

- Yew Lee Kuan. One man’s view of the world. Singapore: Straits Times Press Pte Ltd.; 2013. 348 p. (Russ. ed.: Yew Lee Kuan. Moi vzglyad na budushchee mira. Moscow: Alpina Non–Fiction; 2017. 446 p.).

[1] The political economy of technological leadership. Report at VI International Congress “Production, Science and Education” (PNO-2019). TV–Info, December 5. URL: https://www.youtube.com/watch?v=gpZvP60W6rY (accessed on 05.11.2020).

[2] The strength of the vertical of power can be measured in different ways. In particular, in work [19], Centralization index V was calculated by subtracting the values of this index for the USA (7.96) and Russia (3.11) from the maximum value of the Democracy Index D (10 points); as a result, for the USA V = 10 — D = 2.04, and for Russia — V = 10 — D = 6,89. Economist Intelligence Unit: The Democracy Index 2019. URL: https://www.eiu.com/public/topical_report.aspx?campaignid=democracyindex2019; https://gtmarket.ru/ratings/democracy-index/info) (accessed on 11/05/2020). In this case, a simple principle was used: the stronger and tougher the central government is, the less democratic foundations and freedoms in the country are.

Official link to the article:

Balatsky E.V., Ekimova N.A. Power, market and social system complexity: theoretical model of financial and management mechanism // «Finance: Theory and Practice», 2021, Vol. 25, No. 1, pp. 70–83.