The phenomenon of inflation is extremely diverse. Perhaps it would not be an overstatement to say that the effect of inflation and taxes on economic growth is the most important and interesting economic problem. And although inflation–free development is not possible in modem economies (on a practical level, the national statistics of almost every country in the world indicate this; one version of a theoretical proof of this fact is given in [1]) – nevertheless, inflation is still a serious brake on the natural expansion of the economic system’s production activity. We can talk about various manifestations of the “braking” effect of inflation in relation to economic growth. Thus, for example, for resource–intensive production processes with high output elasticity of costs (greater than one) a price rise acts as a factor leading to a drop in the profit margin and curtailment of the enterprises’ economic activity [1, 2]. The specific organization of the budget process, primarily the Oliver–Tancy effect, has a strong negative action on the economy’s development [3]. And there are other examples.

Typically, in conditions of inflation the connecting link between price dynamics and output is taxes, and they always take the form of inflation taxes. In other words, inflation taxes are a distinctive transmission mechanism in the “inflation–economic growth” chain. In this article, it will be shown that by means of these taxes inflation “eats away” enterprises’ financial resources, thereby contributing to economic collapse. Each of the inflation brakes named above sets up its own quantitative barriers in the way of expansion of business activity. Thus, for example, calculations carried out by the author for the Russian economy indicate that the Oliver–Tancy effect allows 3 percent annual economic growth in conditions of stabilization of the relative level of the budget deficit with approximately 10 percent monthly inflation. In connection with this, it is interesting to know the “resolution” of inflation taxes. It is clear that for a specific economic situation, as a rule, the inflation brake that produces the lowest maximum permissible inflation rate proves to be the active one, that is, the one that limits economic growth. The quantitative evaluation and comparison of threshold values of inflation in a cross section of various brakes make it possible to identify the basic groups of factors that provoke recessionary tendencies in the economy. In subsequent sections of the article, it will be shown that inflationary shifts can “come up against” the natural limits of enterprises’ capital turnover, thus causing permanent “impoverishment” of economic agents.

Varieties of inflation taxes

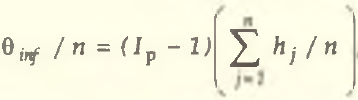

At present, along with the traditional understanding of the inflation tax, there are a number of varieties of it, which creates terminological collisions. According to orthodox economic theory, the inflation tax θinf is understood as the following macroeconomic quantity: θinf=(Ip–1)U, where Ip is the price–rise index (inflation rate); and U is the amount of base money in the economy (the monetary base) [4]. Substantively, θinf shows the losses of economic subjects’ wealth as a result of the devaluation of money. Along with the nominal inflation tax θinf, a large role is played by the real inflation tax θinf/P, where P is the average price level [4].

In addition to the macroeconomic form of the inflation tax, microeconomic analogs of it are used in a number of cases. Thus, for example, in [5] the inflation tax that an enterprise pays is determined as θinf=(Ip–1)h, where h is the company’s financial assets. The averaged inflation tax per enterprise is also used in [5]:

where j is the number of the company; and n is the total number of companies.

In [6], the macroeconomic amount of the inflation tax is calculated according to an “expanded” formula: θinf=N(Ip–1)+S(Ip–1–r), where N is cash; S is deposits; and r is the interest on deposits. This understanding of inflation income takes into account the total devaluation of enterprises’ and households’ funds.

Generally speaking, in its original interpretation, the very term “inflation tax” has no relation to taxes as such (much less to tax rates). This concept is based on the understanding that any short–fall of budgetary funds can be covered by issuing money, which leads to the devaluation of economic agents’ income. In other words, the phenomenon of the inflation tax is based on the possibility of “initiating” inflation as a substitute for tax revenues.

The concept of the inflation tax is given an entirely different meaning in [7]. The author of [7] analyzes the situation in which a price rise leads to an inflationary increase in taxable profit. In this case, the inflation tax is understood as the amount of tax payments from the inflation part of the enterprises’ profit (for more details about this, see below). Consequently, in conditions of a rise in production costs, a situation occurs whereby the part of the funds that should be classified as expenditures in the absence of inflation is taxed. It is clear that in this understanding the inflation tax is directly linked with the tax rates. Without a doubt, it is correct to call enterprises’ tax payments formed as a result of inflation an inflation tax, which, in our view, is etymologically even more appropriate than its traditional interpretation. An inflation tax of this kind has enormous significance in economic practice, since it will lead to purely inflationary “eating away” of enterprises’ current assets, which are replenished, as a rule, by net profit. In this case, the longer the enterprise’s production cycle is, the larger the inflation tax will be. This effect hits businesses in the investment sphere that have long periods of capital turnover particularly hard.

All of this indicates that, at present, the inflation tax is interpreted differently and, in the general case, should be perceived in the broadest possible sense. In this article, we will use the interpretation developed in [7].

Technique for financial calculations and inflation erosion of enterprises’ current assets

The problem of inflation taxes for corporations stems from the present accounting system. According to this system, each economic transaction is taxed (as a rule, the difference between proceeds and expenditures for any economic transaction). The strict linkage of taxes to the cost appraisal of economic transactions is supported by a system of corresponding bookkeeping income and expense accounts. If there is a time lag between when the expenditures are disbursed and the financial results are received (as always happens in practice), then in conditions of inflation this fact will lead to an artificial overstatement of the profitability of each economic transaction, on account of the inflationary rise in expenses, which is not taken into account in taxation. This time lag is the cycle of realization of an economic transaction. In the general case, this cycle is made up of two phases of an enterprise’s economic life: the technological cycle, during which expenditures are “processed” into results (this phase has enormous significance for actual discrete production operations that produce a finished product) and the trade cycle, during which the finished product is sold and fully paid for by the consumer (this phase is particularly important for dealers). Of course, all of this is also true of companies in the nonproduction sphere that offer services.

Depending on a company’s distinctive features, each phase of the realization cycle has different significance for it. For technology–intensive production facilities, as a rule, the production cycle is more important; for sales organizations, the main problem is marketing the product, and consequently, the key role is played by how fast the goods are sold. Here and hereinafter, the production and trade cycle (also known as the realization cycle) will be understood in precisely such an expanded, “two–phase” meaning. It is obvious that the realization cycle under consideration is short–term in contrast to investment cycles, which are connected with turnover of fixed capital.

Thus, although the system of primary accounting does not deal with the concept of the production and trade cycle as such, it still has a constant and direct connection with this cycle [1]. Thanks to the loss of part of its financial assets to inflation, the enterprise is constantly short of funds for restoring its current assets, which have become more expensive. The problem is aggravated by the need to hold money in reserve for wages, the value of which is diminishing, while the cycle is being realized. The enterprise is forced to make up for the operational shortage of current assets that arises in relation to the prior period from its net profit, which severely “undermines” its viability in the case of appreciable inflation. Decreased viability is manifested in curtailment of the enterprise’s possibilities for further expansion of production and capital replacement, due to erosion of its net profit by inflation. It is clear that if inflation is too high there comes a time when the company will not only be unable to expand its activity, but even to maintain it at the former level. At this point, the economic collapse of the production facility begins. If there are enough of these enterprises in the country, then the collapse grips the entire economic system. This mechanism is extremely important and indicates how the microeconomic problems of individual companies can “spill over” into the traditional macroproblem of economic growth.

We should note the universality of the effect of inflation taxes: it takes place in all countries of the world with any system of government. The general way in which these inflation taxes are formed differs only in certain technical details. Thus, for example, at present three systems of accounting for materials (inventories and equipment) are used: FIFO (first–in, first–out), LIFO (last–in, first–out), and accounting by weighted average prices. While the third system is the most common, none of these systems prevents the appearance of inflation taxes. Depending on the specific nature of the business, one system or another is more advantageous, as a rule, but this advantage is relative.

In spite of its mathematical simplicity, the problem to be solved in this article about the effect of inflation taxes on the rate of economic growth is quite beneficial, since it has a broad range of applied and theoretical consequences, which is especially important for developing macroeconomic estimation. In particular, distortions of nominal estimates of the efficiency of enterprises’ and industries’ functioning in Russia under the influence of inflation are analyzed in [7]. The importance of many of the methodological problems that inflation produces is shown in the same study.

Base model. The role of the production and trade cycle

The suggested model analysis is based on the methodology developed in [9]. The distinctive feature of the specific mathematical–economic constructions is consideration of the distribution of the enterprise’s proceeds in various income and expense items. In this case, in contrast to the traditional system used in [9–11], which calls for synchronization of the company’s results and expenditures, we will consider the effect of production and trade lags, which is of fundamental significance in conditions of high inflation.

The point of the situation being modeled is as follows. The net profit received by an enterprise (after paying all taxes) goes to maintain and expand production by means of reproduction of current assets and the payroll fund. The ultimate purpose of the analysis is to derive a clear functional relationship between the index of production growth, the inflation rate, the level of taxes in effect, and the length of the enterprise’s production cycle. The relationship that is sought is supposed to make it possible to calculate one of these four variables if the other three are known.

Let α be the tax on the enterprise’s balance profit; β, the value–added tax; γ, payroll taxes and social–security charges; α, β, and γ are stable in time and act as fiscal parameters in the model; xt is the amount of products produced and sold, in physical terms; pt is the average price of the products produced by the enterprise; γt is the amount of the company’s current expenditures (current assets), in physical terms; ct is the average price of current assets; Lt is the number of the company’s employees; wt is the average wage of the enterprise’s workers; t is time (month); and  is the length of the cycle of production and sale of the enterprise’s products. Then, by analogy with [11], the company’s net profit

is the length of the cycle of production and sale of the enterprise’s products. Then, by analogy with [11], the company’s net profit  at the moment

at the moment  is equal to

is equal to

(1)

(1)

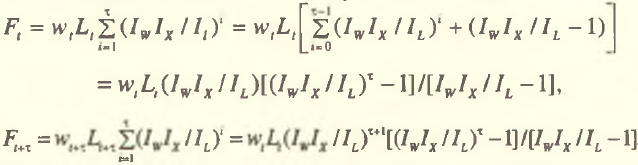

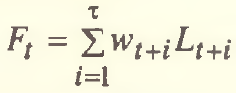

where Ft is the payroll fund for the period .png) , that is, Ft is a cumulative quantity determined as

, that is, Ft is a cumulative quantity determined as

(2)

(2)

Possessing profit .png) , at the moment

, at the moment .png) the enterprise repeats the production cycle, replacing and expanding its current assets and payroll fund in accordance with the structure of financial expenditures existing at that time, that is,

the enterprise repeats the production cycle, replacing and expanding its current assets and payroll fund in accordance with the structure of financial expenditures existing at that time, that is,

(3)

(3)

(4)

(4)

where  is the coefficient of profit distribution between material costs and payroll costs at the moment in time

is the coefficient of profit distribution between material costs and payroll costs at the moment in time .png) .

.

In essence, (1)–(4) is the desired microeconomic model, which makes it possible to derive a general formula for carrying out various macrocalculations.

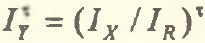

We will introduce into consideration the following average monthly growth indexes: for wages Iw = wt+1/wt; for the number of the company’s employees IN = Lt+1/Lt; for prices for raw material and intermediate materials (current assets) Ic = ct+1/ct; for the amount of current assets IY = yt+l/yt; for output IX= xt+1/xt; for prices for the company’s finished products and services Ip = pt+1/pt; for material return, which is the inverse of per–unit consumption of material, IR; and for the productivity of labor IL; All of the indexes are the same for any t, that is, they are supposed to be stable in time. Based on this assumption, we have  , which enables us to write the left side of (3) in the form

, which enables us to write the left side of (3) in the form

(5)

(5)

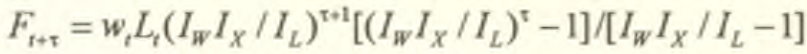

Taking into account IN = IX/IL and the notations that were introduced, the amounts of the payroll fund will take the form [2]

(6)

(6)

(7)

(7)

We will introduce the following structural indexes, which are more convenient for the subsequent macrocalculations: ζ = wtLt/ptxt is the portion of payroll expenses in the enterprise’s total proceeds (product wage); and σ = ctyt/ptxt is the relative portion of material costs in the total amount of the company’s proceeds (per-unit consumption of material in terms of cost). Then, using the notations A = (1 – α)(1 + γ), В = (1 – α)(1 – β), H = IWIX/IL – 1, and G = IcIX/IR – 1, relationships (1)–(4) are reduced to the equation

.png) (8)

(8)

The equation (8) that was derived is the desired one and establishes a strict functional relationship between enterprises’ production strategies, expressed in the specific growth rates of production, and the level of cost inflation. In this case, the realization cycle .png) , which is nonlinearly related to all of the other variables, plays an active role in the formation of the company’s economic policy.

, which is nonlinearly related to all of the other variables, plays an active role in the formation of the company’s economic policy.

In spite of the fact that equation (8) was derived on the basis of microeconomic considerations, it is entirely suitable for macroeconomic calculations. In this case, data are needed on structural inflation in the economy, that is, the indexes Ip, Ic and IW; for rougher calculations, we can set Ip = Ic = IW. The tax parameters are set by law; only the coefficient γ, as the sum of various charges, calls for certain averaging. The parameters ζ, and σ can be determined both for the entire economy as a whole and for individual industries according to data from the third quadrant of interindustry report balances. The average annual estimates obtained in this way can be considered fairly representative and used effectively in the calculations as the average monthly characteristics of ζ and σ.

Once we have these initial data, with the help of (8), using various numerical methods, it is not difficult to evaluate the maximum permissible realization cycle that makes it possible to reach an exogenous trajectory of economic growth IX. The results obtained can be compared with the actual values of .png) , and this will clarify the inflation reserves of the entire economy, as well as its individual industries and production facilities. In connection with this, the most interesting is the operational diagnosis of those industries that objectively “collapse” with a certain level of inflation.

, and this will clarify the inflation reserves of the entire economy, as well as its individual industries and production facilities. In connection with this, the most interesting is the operational diagnosis of those industries that objectively “collapse” with a certain level of inflation.

Other ways of using (8) are also possible. For example, if we have all of the information for (8) except for IX, can carry out predictive calculations to determine the maximum rate of economic growth for assigned technological characteristics of the economy and the prevailing inflationary environment. Equation (8) is also suitable for determining the maximum permissible inflation rate in relation to the desired growth rate of production and the realization cycle .png) that has been formed.

that has been formed.

More complex applications of (8) are associated with various calculations to reveal the economy’s reproduction structure (the structure of expenditures) and tax climate that allow for planned shifts in output with an exogenous inflation rate. In this case, several economic characteristics are sought simultaneously: for the reproduction structure, ζ, and σ, and for the tax system, α, β, and γ. In contrast to the basic descriptive strategy, this way of using (8) calls for a series of simulation experiments, on the one hand, and optimization calculations, on the other. In the latter case, for example, we can determine the optimum tax rates for the prevailing conditions, followed by estimation of the maximum growth rate of production. Comparison of the optimum values with their actual analogs makes it possible, first, to clarify the system’s economic reserves, and second, to obtain nontrivial results, according to which, in particular, local fiscal pressure must be increased to stimulate economic growth (i.e., for certain tax rates).

There are other statements of the problem in relation to (8), however, the first three modifications given here are the most realistic and substantive.

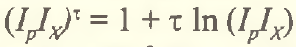

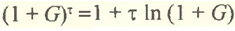

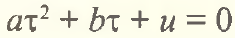

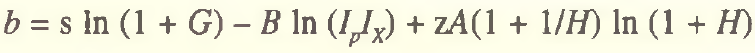

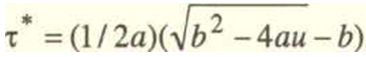

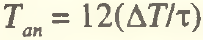

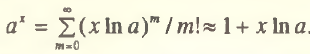

Despite the fact that the quantitative problem under consideration in this article, from a formal point of view, is represented by equation (8) in the general case, this equation is very inconvenient computationally, therefore we will transform (8) so as to obtain a ready formula for estimating the length of the cycle .png) x suitable for carrying out specific macro– and microcalculations. To do this, we will use the elementary theory of errors and approximate the exponential functions in (8) as follows:

x suitable for carrying out specific macro– and microcalculations. To do this, we will use the elementary theory of errors and approximate the exponential functions in (8) as follows:  ;

;  ;

;  [3]. Then, (8) is reduced to an ordinary quadratic equation:

[3]. Then, (8) is reduced to an ordinary quadratic equation:

(9)

(9)

where

(10)

(10)

(11)

(11)

(12)

(12)

Considering that, in most cases, the lower root of (9) is negative, we get the dependence [4]

(13)

(13)

Taking into account the notations that were introduced, (13) is a ready methodological tool for estimating the necessary turnover rate of capital (in the sense of current assets) in the economy. The main advantage of the suggested approach is its technical simplicity and the clarity of all of its economic interpretations. Although the linearization of the dependences that was done does lead to displacement of the desired estimates, it is unlikely that this will distort them significantly when carrying out aggregate macrocalculations.

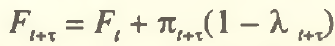

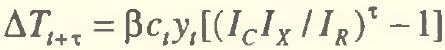

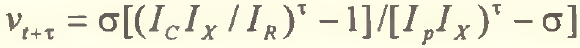

So far, we have considered the production consequences of inflation. Now we will turn to the analysis of inflation taxes as such. In connection with this, we will note that three inflation taxes are figured in our procedure: on profit, value added, and wages. To be definite and for the sake of brevity, we will consider only the value added tax below. The total sum of deductions from value added  at the moment

at the moment .png) is

is

(14)

(14)

At the same time, the amount of the “true” value added tax  that is, that which is obtained in the case of synchronization of the enterprise’s results and expenditures, is evaluated according to the formula

that is, that which is obtained in the case of synchronization of the enterprise’s results and expenditures, is evaluated according to the formula

(15)

(15)

Then the amount of the inflation tax on value added

can be expressed in an explicit index form:

(16)

(16)

and the portion of it in the actual amount of tax collections of this type  will be

will be

(17)

(17)

From (16), it follows that, in the overwhelming majority of cases, the company functions in conditions of nonzero inflation taxes. In this case, if the enterprise wants to reduce the amount of inflation taxes to zero or to a negative amount altogether, then it must adhere to a strategy in which the growth of production occurs at a more moderate rate than its efficiency (for (16), this is material return). It is precisely faster growth of the enterprise’s efficiency in comparison with its volume indexes that is the key principle for minimizing inflation payments.

Formula (17) can be used to evaluate the “natural” portion v* for assigned values of all of the economic variables. In this case, in (17)  . In a linearized form, (17) for v* will look like this:

. In a linearized form, (17) for v* will look like this:

(18)

(18)

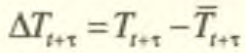

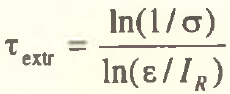

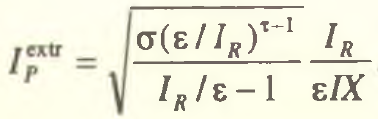

For economic analysis, only the relative amount of the inflation tax is of real interest, since its absolute value depends trivially on the tax rate, the inflation rate, and the length of the realization cycle (see (16)). In regard to the relative portion  , the dependence on the variables x and Ip is found to be ambiguous, with an extremum (at least theoretically). For example, by introducing the coefficient of structural inflation ε = Ic/Ip, from (17) it is easy to obtain the values of the stationary points for

, the dependence on the variables x and Ip is found to be ambiguous, with an extremum (at least theoretically). For example, by introducing the coefficient of structural inflation ε = Ic/Ip, from (17) it is easy to obtain the values of the stationary points for  and Ip:

and Ip:

(19)

(19)

(20)

(20)

Similar analytic computations can also be done for the inflation tax on profit and inflation payroll charges. Due to the awkwardness of all of the dependences, we will not discuss them here; however, we will note that the enterprise’s aggregate inflation tax is made up of all of the particular inflation taxes. In this case, the dependence of the portion of the aggregate tax on the inflation rate, tax rates (in this case, they do become significant), and the length of the production and trade cycle becomes even more complicated, taking on a highly nontrivial nature. Such a situation naturally leads to different optimization statements of the problem.

Results of experimental calculations

We will carry out calculations according to (13) and (17). To do this, we will form the initial statistical base so that it reflects as closely as possible the actual processes occurring in the Russian economy.

First, we will consider two scenarios of the tax climate. In accordance with the rules in effect at the beginning of 1996 the profit tax a is differentiated; 20 percent for small enterprises, and 35 percent for all other corporations. A similar situation is also characteristic of the value added tax β: 10 percent for food products, children’s goods, and the like, and 20 percent for services and other goods. The payroll charges γ are more unified. However, in order to obtain a total estimate of γ it is necessary to add up the following taxes and charges; social security–5.4 percent, medical insurance–3.6 percent, deductions to the unemployment fund–1.5 percent, deductions to the Pension Fund–28 percent, transportation tax–1 percent, and deductions for educational needs–1 percent. Altogether, we get γ = 40.5 percent. We arbitrarily separated possible differences in taxation conditions into “optimistic” (more favorable) and “pessimistic” (more severe) scenarios (see Table 1).

Table 1. Tax Parameters of Russia's Economy In 1996, %

|

Calculation scenario |

Rate |

||

|

profit tax |

Value added tax |

payroll charges |

|

|

Optimistic |

20.0 |

10.0 |

45.5 |

|

Pessimistic |

35.0 |

20.0 |

45.5 |

We will use indexes of the cost structure for 1993–1994 (Table 2) [1]. In this case, with respect to the sum of the cost percentages, 1993 can be classified as the optimistic version; and 1994, as the pessimistic one.

Table 2. Cost Structure of Gross Output for Russia's Economy, %

|

Calculation scenario |

Year |

Percentage of costs in gross social product |

|

|

material |

payroll |

||

|

Optimistic |

1993 |

51.0 |

13.8 |

|

Pessimistic |

1994 |

58.6 |

12.6 |

The rest of the prerequisites for the calculations are as follows. The enterprises realize simple reproduction of their current activity in the absence of scientific and technical changes, which is equivalent to the following condition: IL=IR=IX=1. We will ignore the structural aspect of inflation, setting IC=Ip=IW. In order to numerically “feel out” the requirements of inflation for turnover of the companies’ assets, we will conduct computational experiments for various turnover rates: Ip=5 percent and Ip=10 percent. The results of the calculations are given in Table 3.

Table 3. Calculated Maximum Permissible Parameters for Russia's Economy

|

Calculation scenario |

Inflation rate, % |

Length of production and trade cycle, months |

“Natural” relative portion of inflation VAT, % |

|

Optimistic |

5.0 |

1.6 |

7.2 |

|

10.0 |

1.5 |

12.2 |

|

|

Pessimistic |

5.0 |

0.9 |

5.7 |

|

10.0 |

0.8 |

9.4 |

From the data obtained, we can see that, generally speaking, the sensitivity of the turnover rate of current assets to a rise in the inflation rate is not as high as could be expected. However, such low sensitivity is compensated for by the enterprises’ financial sacrifices in the form of payments of inflation tax.

Estimates of  can be used for comparison with the actual values of the realization cycle

can be used for comparison with the actual values of the realization cycle  along the line of the “cut–off’ rate in [7]: businesses for which

along the line of the “cut–off’ rate in [7]: businesses for which  are not competitive and are automatically forced out of the market.

are not competitive and are automatically forced out of the market.

We need to comment on determination of the actual values .png) . The time

. The time .png) can be derived in two ways: empirically (directly from the companies’ practical activity), or by calculation (according to data on financial turnover). The former is applicable, as a rule, only for the microlevel (individual enterprises and organizations) and can only be used in rare cases. The latter is efficient at the enterprise level (the accounting procedure for the calculations is extremely simple in this case, see [8]), as well as at the industry level, and also at the macrolevel. However, macroestimation of

can be derived in two ways: empirically (directly from the companies’ practical activity), or by calculation (according to data on financial turnover). The former is applicable, as a rule, only for the microlevel (individual enterprises and organizations) and can only be used in rare cases. The latter is efficient at the enterprise level (the accounting procedure for the calculations is extremely simple in this case, see [8]), as well as at the industry level, and also at the macrolevel. However, macroestimation of .png) is an independent problem that goes beyond the bounds of this article. We will note only that the calculated values obtained for the turnover cycle of current assets do, in fact, impose very high requirements on manufacturers. It is sufficient to point out that in Russia’s economy there are industries for which the realization cycle is eight months or longer. As a rule, these are science–intensive plants specializing in the production of high–technology products.

is an independent problem that goes beyond the bounds of this article. We will note only that the calculated values obtained for the turnover cycle of current assets do, in fact, impose very high requirements on manufacturers. It is sufficient to point out that in Russia’s economy there are industries for which the realization cycle is eight months or longer. As a rule, these are science–intensive plants specializing in the production of high–technology products.

Active and passive inflation taxes

Considering that in this study we analyzed an effect of inflation taxation that differs somewhat from the traditional understanding of it, we will clarify in greater detail the relationship of these two synonymous concepts [6].

First of all, practically speaking, the traditional understanding of the inflation tax presumes the devaluation of enterprises’ and households’ financial resources. In this case, the main thing is that cash balances, that is, “passive” money, are subjected to devaluation. These funds are devalued by inflation only due to the fact that at a certain moment they are withdrawn from circulation, as it were, and frozen. Thus, what the traditional inflation tax hits is deferred demand. It is clear that this includes companies’ financial assets and cash hoarded by households. Consequently, the traditional inflation tax shows the opportunities missed by economic agents due to the need to have savings and reserves in an inflationary environment. In connection with the fact that, as was noted, the traditional inflation tax applies to passive financial resources and does not directly depend on the tax climate in the economy, we will call this type of inflation tax passive.

A completely different understanding of inflation taxation was used here, in contrast to the prevailing interpretation. Thus, for example, according to (16), the inflation tax applies to enterprises’ “active” financial resources, that is, those that have already been put to use and materialized in businesses’ current assets. In this case, the specific tax rates do play an active role in determining the amount of the inflation tax. This understanding of the phenomenon is directly linked with the fiscal effects, and, from the point of view of the economic mechanism, it is based on the actual confiscation of a certain part of the enterprises’ financial resources. Households are “freed” from such a tax squeeze. Accordingly, we will call the inflation taxes that apply to enterprises’ active financial resources active. It is precisely this type of inflation tax that is the most unhealthy for economic growth.

On the whole, the active and passive inflation taxes reflect completely opposite aspects of economic life and are fundamentally irreducible one to the other. Rather, they are two parts of one whole, showing how economic agents’ active, as well as passive financial resources are subjected to inflation corrosion. Hence, we can see that companies operating in the market in conditions of inflation are squeezed from both sides, in reality. For example, on the one hand, the concentrated involvement of an enterprise’s financial assets in turnover entails an increase in the amount of active inflation taxes, while on the other hand, any halt in economic activity automatically leads to a rise in passive inflation taxes. Therefore, in the practice of microanalysis it is advisable to figure the aggregate (total) inflation tax, which is the sum of the inflation bite taken from economic subjects’ financial assets and liabilities. Apparently, only this quantity can give a true estimate of the economic harm inflicted by inflation.

In connection with this, it is significant that, while it is fairly simple, as a rule, to get a unified macroeconomic estimate for passive inflation taxation [6], it is much harder to do this for active inflation taxes. This fact stems directly from the very understanding of the phenomenon under consideration.

In practice, the following problems have to be solved in macroestimation of active inflation taxation. First, due to the sharp differentiation in the tax climate for different corporations, some average tax rates must be determined. This is done by weighing the corresponding estimates, if the structure of output for different types of economic subjects is known (for example, the relative portion of small enterprises’ production is assigned, etc.). If such information is lacking, then some other averaging procedure that will not lead to quantitative distortions that are too large can be used. Second, it is necessary to determine the actual composition of inflation taxes, the sum of which will be the amount of the active inflation tax. Apparently, at the macrolevel it is advisable to limit the calculations to the inflation taxes on profit and value added. Third, the recurring nature of the turnover of enterprises’ financial assets must be taken into account. To do this, we first have to estimate its average time for the economy as a whole and then correct the annual amount of the inflation tax in accordance with the estimate that is obtained:  .

.

From what has been said, it is clear that, despite the fundamental possibility of obtaining a macroestimate of active inflation taxes, this quantity will be highly arbitrary in any case. Therefore, we should look at the figures thus obtained as ordinal indicators, rather than precise statistical indexes.

In light of the ideology that we have set forth on active and passive inflation taxes, it becomes clear that insignificant inflation is a stimulus for economic activity, and a sharp price rise is a brake on it.

Inflation and limitation of the capital turnover rate as factors of economic crises

In certain cases, the depletion of enterprises’ financial resources because of the constant payment of inflation taxes may lead to a global economic realization crisis, that is, in essence, to a modified form of a demand crisis. We would like to dwell on this aspect of the problem in greater detail, primarily because it is precisely the phenomenon of inflation taxes, being organically intertwined into the general cyclical mechanism, that makes it possible to see in a new way the destructive role of taxes in an inflationary environment.

We will briefly consider the “inflation–growth of production” chain. A certain inflation rate leads to the formation of an inflation tax, in accordance with the prevailing length of the turnover cycle of auxiliary (working) capital (see (16)). Upon reaching some critical level of inflation, the profit of an enterprise is no longer sufficient even for further simple reproduction of the economic cycle. In conditions of the imposition of cost inflation from outside in relation to a manufacturer, the latter can be “saved” in two ways. The first is the acceleration of scientific and technical progress expressed in a rise in the productivity of labor and a decrease in the per–unit consumption of material; the second way is a reduction in the length of the realization cycle. These two factors are the system stabilizers that prevent immediate economic collapse. It is clear that, in this case, positive changes in the indicated indexes occur under the influence of purely technological innovations, as well as the companies’ commercial successes [7].

So, inflation taxes objectively force enterprises to step up their efforts for survival, thus leading to global acceleration of the whole economic development. In this sense, we can state that moderate inflation is one of the engines of social progress. However, it is perfectly obvious that the reserves for increased efficiency of production and trade are quite limited and cannot neutralize a rate of price rise that is too high. Having reached the technical limit, enterprises are already not in a position to struggle with inflation and gradually begin to curtail their activity. In the initial phase of the process, this will lead to the bankruptcy of the less profitable enterprises. If the inflation rate climbs above the maximum permissible level even for successful businesses, the recession process will grip the whole economic system, and the first phase of a crisis will set in.

In relation to its subsequent phases, we can only make assumptions, which, nevertheless, seem fairly traditional and do not contradict reality. So, in a certain stage, a gradual production recession forces the government to reconsider its monetary and budget policy. Sooner or later, the government moves to financial restrictions, which holds down inflation. Moreover, the crisis curtailment of production puts people out of work and expands the scale of unemployment. In turn, this “weakens” aggregate demand and causes the Phillips–curve effect: the inflation rate begins to fall. This is the turning point in the development of the crisis, allowing some businesses to revive, taking into account the restructuring of effective demand that has occurred. Observations of various countries show that practically nowhere did an economic upturn begin in conditions of high inflation; the government first curbs the price rise. We can also see this general pattern on the example of Russia: perceptible stabilization and even a local upturn took place at the end of 1995 and beginning of 1996, then the monthly rate of price increase became close to the maximum permissible.

In the context of what has been said, we want to emphasize the “advantages” of the economy’s shadow sector in an inflationary environment. In fact, since it is not burdened by taxes at all, it does not have the problems of active inflation taxes (it comes under passive taxation on general bases). This allows it to function fairly stably, even with a sharp price rise. Hence, it logically follows that in crisis conditions the shadow sector of the economy is significantly less subject to recessionary tendencies and, as is noted in [13], is fully able to play the role of a stabilizing factor in the economy. Moreover, inflation by itself is a powerful source of development of shadow business, with its inherent tax–evasion phenomenon. This fact allows us to look at the problems of economic growth and fiscal collections in a new way.

In addition, we want to note the presence of stabilizing feedback in the crisis mechanism that has been described. Thus, the desire of companies to shorten the cycle .png) , as a rule, presumes that they are ready to make certain concessions in relation to terms of trade. In practice, a decrease in

, as a rule, presumes that they are ready to make certain concessions in relation to terms of trade. In practice, a decrease in .png) is possible only with a reduction in prices for the enterprise’s finished products. If this process encompasses all businesses, or an overwhelming majority of them, then it is capable of weakening inflationary tendencies in society by itself. An analogous situation is also observed in the case of scientific and technical progress. In fact, the latter, by increasing the efficiency of production, leads to a decrease in costs, thereby creating the prerequisites for a reduction in selling prices. Thus, not all inflationary impulses have a destructive action on the economic system. The economy slides into a state of crisis when inflation is superhigh. Insignificant price disturbances are damped by feedback and, on the whole, only increase the system’s stability.

is possible only with a reduction in prices for the enterprise’s finished products. If this process encompasses all businesses, or an overwhelming majority of them, then it is capable of weakening inflationary tendencies in society by itself. An analogous situation is also observed in the case of scientific and technical progress. In fact, the latter, by increasing the efficiency of production, leads to a decrease in costs, thereby creating the prerequisites for a reduction in selling prices. Thus, not all inflationary impulses have a destructive action on the economic system. The economy slides into a state of crisis when inflation is superhigh. Insignificant price disturbances are damped by feedback and, on the whole, only increase the system’s stability.

In conclusion, we will draw the following important ideological conclusion from the analysis that was carried out. The burden of inflation lies not only on the consumer, as it is customary to believe, but also on the producer. Moreover, in most cases, inflation hits a large property owner considerably harder, frequently leading to his complete ruin, than it does hired labor, which comes under the action of indexed wages.

Directions for expanding the boundaries of analysis

Strictly speaking, the model considered here (l)–(4) reproduces the functioning of the economy, on the one hand, without savings and, on the other, without the spending of net profit on consumption. In connection with this, all of the formulas derived above can be used efficiently to evaluate short–term economic effects. For longer time intervals, it is necessary to consider processes of retirement and renewal of fixed assets and the marginal propensity to consumption of new profit by the owner of an enterprise. Moreover, we assumed that the enterprise does not use credit resources in its activity. At the same time, the division of the enterprise’s funds into internal and borrowed may sharply alter its final production strategy [14].

In order to take these points into account, when figuring the balance profit it is also necessary to subtract depreciation [9] and the amount of credit, taking into account the official interest rate of the Central Bank of Russia. The remaining part of the credit debt is subtracted from net profit [14]. In this case, the profit–distribution scheme is expanded and includes an equation for the accumulation of fixed capital. The company’s property tax, the effect of enterprises’ reciprocal nonpayments, and the discreteness of reappraisal of corporations’ fixed assets on an inflationary trajectory of development, all of which we disregarded, are of particular interest in applied problems.

These directions for expanding the boundaries of analysis can be used for micro–, as well as macrocalculations.

In practice, at the macrolevel appropriate modification of the base model enables us to estimate the possible amounts of nonpayments for a specific economic situation. At the microlevel, the model can be used to calculate the amount of payment for intermediary marketing services, based on the anticipated savings of time on product sales.

In regard to theory, the following statement of the problem connected with accumulation of fixed capital is extremely valuable. Savings, as a rule, occur unevenly, which gives rise to cycles of renewal of fixed assets. The modeling of this process with consideration of inflation taxes makes it possible to investigate the dependence of “major” cycles (of renewal of fixed assets) on the inflation rate, tax rates, and “minor” cycles (realization cycles –.png) ). As far as we know, such research has not been done previously.

). As far as we know, such research has not been done previously.

One more interesting analytic section of the problem of inflation taxes is the effect of inflation on the size of production and trade units. Thus, for example, for large industrial facilities consisting of a large number of subdivisions (shops) interconnected by a rigid technological chain, the overall production cycle is made up of particular (shop) cycles. It is clear that the more stages current assets undergo while they are being processed into the finished product, the longer the realization cycle will be, and consequently, the higher the active inflation taxes will be. It is also clear that, in order to reduce the processing time for current assets, in certain conditions, it is advisable to split up the initial production conglomerate into a number of separate, formally independent subdivision companies, which nevertheless remain technologically complementary. Such division of a large business is equivalent to introducing distinctive, more frequent cost indexing. In fact, at the beginning of each subsequent technological stage the costs are revised, taking into account internal prices, that is, the prices at which transactions are made between the subdivision companies. However, it is perfectly obvious that, in the general case, the profitability of making individual technological sections autonomous in this way depends on a number of additional factors, among which the most important is the system that the conglomerate’s management selects for forming transfer (internal) prices. This problem is fairly critical even for a stable price environment; in conditions of inflation, the situation is still more intensified [15].

Strict analytic investigation of the effect of splitting up economic structures makes it possible to formulate a number of considerations that are interesting from the point of view of working out a company’s general economic strategy, as well as from the standpoint of the specific mechanism and calculation procedure for transfer prices. At the qualitative level, we can state only that inflation, by means of active inflation taxes, produces a tendency toward the subdivision of production complexes and their atomization into small, but flexible, independent companies. Apparently, it is precisely technological compactness that is a serious advantage of small business, for the latter proves to be less vulnerable during high inflationary pressure. Of course, as a rule, the enterprises that are subjected to subdivision during inflation are those that do not have control over prices; monopolists and monopsonists do not come under this process.

Conclusions and suggestions

From the standpoint of practical organization of the system of government regulation, the analysis that was conducted brings us to the conclusion that social imperatives in regard to tax incentives are hardly irreproachable from an economic point of view. Considering that there are always serious technological differences in the economy between enterprises in individual industries and, as was shown, it is precisely the technology-intensive businesses with long production and realization cycles that are subject to the strongest pressure from inflation taxes, in conditions of high inflation the tax system should be differentiated for different types of production. Otherwise, enterprises of the country’s vitally important industries (practically all pilot production processes and all types of development and mastering of complex technologies) may find themselves in conditions that are too unprofitable, which, with steady stable inflation, will lead to their gradual self–liquidation. In this case, the country may be left without advanced industries and, consequently, without serious prospects for escaping from the state of crisis. In essence, a standardized tax system is helping to transform Russia into a raw–material appendage of the world community.

The suggested concept of active inflation taxes can be used as a methodological tool to form the actual tax rates. The basic principle incorporated in a system of differentiated tax rates for economic subjects with different technological specializations can be as follows. With given inflation rates, the tax system should provide for approximately the same portion of active inflation taxes in the total sum of taxes paid for all enterprises of the economy’s real sector. In this case, it is simultaneously necessary to provide for a natural growth rate of production: approximately 2–3 percent per year.

The validity of such a measure in conditions of high inflation is obvious. In this case, it is clear that such a system may be of a selective nature, extending only to the economy’s “weakest” representatives. As the inflation rate drops, the number of enterprises receiving tax incentives should gradually be reduced. In conditions of inflationary equilibrium, the need for such a measure disappears completely.

The suggested approach for establishing differentiated tax rates in conditions of inflation calls for consideration of the objective capital turnover rate in different industries. Naturally, the specific regulations embodying this principle must be based on the precise expert review of the technological possibilities of the economy’s technology–intensive industries. Without dwelling on the organizational nuances of this measure, we should note that there has long been a need for it. In the transitional economy, when, in essence, it is being decided what technological path the country will follow, the whole set of questions connected with the preservation of domestic production has become extremely important and needs to be resolved as quickly as possible.

Final comments

In this article, we have considered only some of the economic problems of inflation taxes. For the most part, all of the questions were presented in a simplified outline form. However, this does not mean that it is not possible to “squeeze out” something of value from the base model (1)–(4) that was formulated without making it significantly more complicated. Thus, for example, the suggested procedure opens up interesting possibilities for investigating properties of the Laffer curve. To do this, it is necessary to express the growth rate of production from (8) IX in terms of the remaining variables and substitute it into equations for the amount of tax collections (for example, into (16)). But the implicit form and awkwardness of (8) do not permit this to be done in a compact form within the framework of this article; it needs independent investigation.

It is also possible to conduct a comprehensive analysis of the comparative statics of all of the variables in the model (l)–(4). This is elementary, if we consider that (8) is an implicit function. A functional relationship of this kind makes it possible to analyze all of the cross interactions of the variables entering into (8). But all of the desired equations will also be highly complex.

Computationally, it is of considerable interest to calculate the hyperinflation barrier, that is, the inflation rate at which production collapses even for a stabilized one–day realization cycle.

References

1. E.V. Balatskii. Perekhodnye protsessy v ekonomike (metody kachestvennogo analiza). Moscow: IMEI, 1995.

2. E.V. Balatskii. “Differentsial'nye svoistva krivykh sprosa i predlozheniia.” Mirovaia ekonomika i mezhdunarodnye otnosheniia, no. 12, 1995.

3. E.J. Dolan. “Ob ugroze giperinfliatsii v techenie perekhodnogo perioda.” Ekonomika i matematicheskie metody, vol. 27, no. 2, 1991.

4. R. Laird. Makroekonomika. Kurs lektsii dlia rossiiskikh chitatelei. Moscow: John Wiley, 1994.

5. J. Saks [J. Sachs]. “Stabilizatsiia rossiiskoi ekonomiki: kontseptsiia i deistvitel’ nost'.” Mirovaia ekonomika i mezhdunarodnye otnosheniia, no. 2, 1995.

6. Obzor ekonomiki Rossii. Osnovnye tendentsii razvitiia. Vol. 4. Moscow: Progress–Univers, 1995.

7. A.A. Vodianov. Investitsionnye protsessy v ekonomike perekhodnogo perioda (metody issledovaniia iprognozirovaniia). Moscow: IMEI, 1995.

8. 0.V. Efimov. “Analiz oborachivaemosti tekushchikh aktivov.” Bukh. uchet, no. 3, 1993.

9. L.E. Sokolovskii. “Nalog na dobavlennuiu stoimost’ i predpriiatie, maksimiziruiushchee pribyl'.” Ekonomika i matematicheskie metody, vol. 28, no. 4,1992.

10. S.M. Movshovich and L.E. Sokolovskii. “Vypusk, nalogi i krivaia Laffera.” Ekonomika i matematicheskie metody, vol. 30, no. 3, 1994.

11. E.V. Balatskii. “Fiskal'noe regulirovanie v infliatsionnoi srede.” Mirovaia ekonomika i mezhdunarodnye otnosheniia, no. 1, 1997.

12. I.N. Bronshtein and K.A. Semendiaev. Spravochnik po matematike dlia inzhenerov i uchashchikhsia vuzov. Moscow: Nauka, 1986.

13. M.I. Nikolaeva and A.Iu. Sheviakov. “Tenevaia ekonomika: metody analiza i otsenki (obzor rabot zapadnykh ekonomistov).” Ekonomika i matematicheskie metody, vol. 26, no. 5, 1990.

14. O.A. Kuznetsova and V.N. Livshits. “Struktura kapitala. Analiz metodov ее ucheta pri otsenke investitsionnykh proektov.” Ekonomika i matematicheskie metody, vol. 31, no. 4, 1995.

15. A.B. Vissarionov. Razvitie tsenovogo i finansovo–kreditnogo mekhanizma v Rossii. Moscow: NIEI, 1994.

[1] Analysis of economic activity uses indexes of the turnover rate and turnover time of current assets, which are important for developing an enterprise’s financial policy [8].

[3] These dependences stem from expansion of the exponential function αx into a power series with accuracy to within its second term [12]:

[4] If both roots of (9), , and

, and  , turn out to be positive, then the desired estimate of the realization cycle is determined as

, turn out to be positive, then the desired estimate of the realization cycle is determined as  .

.

[5] The author sincerely thanks L.A. Strizhkova for the information that she graciously provided on estimated interindustry balances, which was needed to calculate Table 2.

[6] This question was raised in the course of discussing the results of this study with Professor S.M. Movshovich, for whose comments the author is sincerely grateful.

[7] Companies have certain organizational reserves. Thus, for example, a skillful financial policy that optimizes the structure of an enterprise’s financial assets also makes it possible to reduce payments of the inflation tax. However, for a company that is operating optimally this factor is completely “spent,” as a rule.

Official link to the article:

Balatskii E.V. Inflation Taxes and Economic Growth// Matekon, vol. 33, no. 4, Summer 1997, pp. 23–48.