The theory of institutional traps is popular now in Russian economics. In the past ten years the analytical framework of this field has been considerably expanded and deepened. The very term “institutional trap” has become a professional euphemism that is used increasingly often by broad strata of the population, from journalists to average citizens. Meanwhile, because of its excessive popularity, the term is interpreted too broadly and has lost its initial rigor.

All of this indicates the need for a thorough survey of this relatively new direction in economics and for a demonstration of the whole range of the palette of ideas expressed in this field. However, we will immediately point out that it is impossible to mention in this survey the already vast number of publications on this subject. A survey of Western studies touching upon questions of the theory of institutional traps has already been in given in [17], so we concentrate here only on the Russian segment of studies, with an emphasis on original studies.

Emerging theories of institutional traps

Historically, the theory of institutional traps traces its roots back to V.M.Polterovich’s 1999 publication [17], which presents its most important concepts: an institutional trap, transformation costs, transition rent, and so on. An institutional trap is understood as an inefficient but stable institution (norm). In other words, an institutional trap is a Nash equilibrium that is not Pareto optimal.

In addition, the author revealed the role of three groups of factors in the origin of traps. The fundamental factors are a system’s resource and technological capabilities and macroeconomic characteristics; the organizational factors are laws and instructions in effect that facilitate the “collision” of supply and demand in the market; and the societal factors are those that reflect the expectations and stereotypes of social interaction.

In parallel, Polterovich revealed the effects of establishing institutional traps. These include the learning effect, which leads to a reduction in costs and an increase in the efficiency of measures taken as their participants accumulate experience in such matters. This effect is analogous to the scale effect in the theory of the firm. Another mechanism, the linkage effect, occurs when an existing norm is linked with other norms. Tightly interwoven with each other, norms and institutions begin to support each other’s existence. The third mechanism, the coordination effect, refers to the fact that the more consistently a norm is observed in a society, the greater the cost incurred by each individual deviating from it. A trap is further cemented by cultural inertia, which means agents’ reluctance to alter behavioral stereotypes that have already proved to be viable in the past.

It must be said that [17] had everything needed to become popular. First of all, it revealed the theory of institutional traps in the most general verbal form and simple language. There were no formal constructs (the model in the appendix is illustrative) or complex diagrams in it. Second, the author found an extremely apt term for the phenomenon he was studying: institutional trap. The figurativeness and sonorousness of this phrase, it seems to me, played a decisive role in the success of the new theory. “Lock-in,” the previously existing equivalent of “trap,” was less graceful and more ambiguous. Third, in addition to everything else, the article described extremely attractive and exotic mechanisms: hysteresis, institutional conflict, dissipation of rent, mutant firms, and so on. Almost all of them were interdisciplinary, which favored the penetration of the theory of institutional traps into various spheres of knowledge, all the way down to the awareness of ordinary citizens. Fourth, the article was full of real examples from the life of Russia that not only brilliantly demonstrated the trap phenomenon itself but also showed the analytical possibilities of the new analytical tools.

The institution market and institutional traps

The next step in comprehending the trap phenomenon was another landmark article by Polterovich [21]. While in his previous one he had studied institutional traps that seemingly appeared as by-products of institutional decisions, in the new article he examined traps that occur as a result of purposeful “transplanting” of progressive Western institutions into the economy of developing countries. This process of borrowing of institutions that had developed in different institutional environments was called transplantation.

Understanding the specific nature of the institution market in comparison with the technology market was an important point in the new round of analysis. For instance, in the international technology market, sellers (patent holders and development consultants) try to make a profit, and purchasers have to pay, while in the institution market the situation is completely different. Institutional innovations are not patented, and they have no owners, so the right to copy them is free. Furthermore, developed countries are frequently willing to pay the costs of transplantation, competing for the right to cultivate precisely their own institutional product in new soil. It is not surprising that such copies often prove to be inefficient. In these cases it is said that dysfunction of the transplanted institution occurs. The mechanism of dysfunction is determined by the same mechanisms that underlie the formation of institutional traps.

Polterovich distinguishes four types of dysfunctions. Atrophy and metamorphosis of the institution occurs when the transplant turns out to be uncalled for and its use is incompatible with the cultural traditions and institutional structure of the recipient country. In this case, it may gradually atrophy and disappear, or sometimes, while formally preserving its identity, it metamorphoses into a tool for shadow activity. Activation of alternative institutions and rejection of transplants are also possible. The institutional conflict that was already mentioned sometimes occurs because of a difference in institutional conditions in the donor and recipient countries, which leads to copying of formal rules and the appearance of an institution that is viable but significantly different from the original one and, as a rule, inefficient. A transfer paradox sometimes occurs, when, as a result of free transfer of a more efficient institution, the donor country can benefit at the expense of the recipient country.

Thus, generalized ways in which institutional traps are created in the construction and cultivation of progressive institutions were examined in [17], while in [21] it was shown how and why “good” (efficient) borrowed institutions may turn into “bad” (inefficient) ones.

Institutional trajectories as a preventive measure against institutional traps

Awareness of the danger of existence of things such as institutional traps in the economy led to an understanding of how to avoid them. This was the subject of Polterovich’s articles [19, 20], in which he proposed the idea that it is necessary to purposefully construct institutional trajectories that describe the aggregate of institutions in time. In the author’s opinion, a reformer sets the task of constructing a certain institutional trajectory, that is, a sequence of intermediate institutions leading to the intended goal. The intermediate institutions “connect” existing institutions with the most progressive ones [22, p. 424].

The strategy of intermediate institutions includes managed cultivation of the institutions, their design and transplantation, and also institutional experimentation. All four of these elements can be combined to construct a chain of institutions leading to the intended goal. Auxiliary institutions specially created for conducting reforms are a particular case of intermediate institutions.

The philosophy of intermediate institutions is extremely fruitful; however, its purpose is not to combat institutional traps that have already appeared, but managerial mistakes that could give rise to them. So this concept is a set of preventive measures to avoid institutional traps.

Intensity of reforms as a factor in the occurrence of traps

An important thesis of reform theory is that reforms should be carried out not only in the proper direction but also at the proper pace [17]. Progressive transformations that are too slow sometimes lead to repudiation of the transformations themselves and are equivalent to institutional failure. The reforms should not take too long to produce results, or broad strata of the population may lose confidence. However, an additional requirement has been suggested in the literature: reforms should not be too quick. We should dwell on this point in greater detail.

Among recent studies, we should mention O.S.Sukharev’s work, which examines a refined and, at the same time, indicative example that we will arbitrarily call the “chess syndrome.” According to this speculative model, a grandmaster and a second-rate opponent play chess. In the usual conditions, when the rules of the game are clear and known, there is a very high probability that the grandmaster will win, since he has more professional capital. However, if the rules of the game start to change during the match, then the outcome will become less obvious. If the rules change frequently and repeatedly, most likely the grandmaster will lose sooner or later to the second-rate player, who obviously has less intellectual capital. This analogy well explains the genesis of the Russian financial oligarchy, when obviously second-rate economic agents (merchants, bandits, security officials, etc.) won and grandmasters (engineers, scientists, doctors, etc.) lost [28].

However paradoxical it may seem, this phenomenon was described back in 1896 by Robert Louis Stevenson, who gave an almost exhaustive explanation of it. In particular, he observed the strange phenomenon that the population of southern islands in the Pacific Ocean was dying off under the impact of European civilization. His verdict regarding the degradation of those native communities was this: “Where there have been fewest changes, important or unimportant, salutary or hurtful, there the race survives. Where there have been most, important or unimportant, salutary or hurtful, there it perishes. Each change, however small, augments the sum of new conditions to which the race has to become inured” [27, p. 45]. As a paradoxical example of the effect of institutional changes, Stevenson cites the elimination of local wars between the natives and the cannibalism associated with them, which were enormously significant for their vitality: without such wars they sank into depression and ceased to enjoy life, which resulted in a decline in all social life and economic activity. Even the simplest changes in the natives’ dress caused serious psychological conflicts for them [27, p. 44].

Sukharev’s chess syndrome and Stevenson’s depopulation effect supplement each other. In this case, a cascade of institutional transformations by itself leads to the occurrence of an institutional trap. While in the case of the chess syndrome an institutional trap occurs due to ill-considered, improper reforms, with the depopulation effect a trap is formed as a result of the introduction of quite reasonable and progressive social norms. Reform triggers mechanisms leading to dysfunction of the new institution. In this case, it is not even the new institution that suffers—in the final analysis it is introduced nevertheless—but the whole economic system, which falls into an inefficient regime.

The explanation of such effects suggests two channels of cause-and-effect relationships. We start by considering the depopulation effect, as the simpler of the two. The first explanation presumes the destruction of human capital. The general logic of the process is as follows. The efficiency (including economic efficiency) of a social system depends (linearly, in the simplest case) on the human capital accumulated by each person and the society as a whole. Institutional innovation devalues some of the population’s old traditions, know-how, and motivation, which leads to the evaporation of accumulated human capital. This is automatically followed by a decrease in the community’s social and economic efficiency. In this case, the greater the density of institutional changes, that is, their number per unit of time and the longer the period during which they occur, the more actively the native people’s human capital is destroyed and the more primitive their socioeconomic life becomes.

The second explanation is based on the concept of adaptation costs. In this case, it is assumed that the community’s efficiency depends on the existing institutions. If an institutional innovation takes place and the original institutions change, then people need time and resources (efforts, money, technologies) to adapt to the changes that have occurred in order to maintain the system’s former economic efficiency. Consequently, the greater the density of institutional changes and the longer the period during which they occur, the greater the adaptation costs will be for the native population and the more difficult it will be for them to maintain the former level of efficiency of the social system. Note that adaptation costs are a type of transformation costs [17, p. 8]; however, the distinctive characteristic of this case is that these costs are imposed in the sense that they are forced upon the local population and cannot be refused. This is the theoretical significance of the depopulation effect.

If we assume that adaptation costs go to restoring human capital (accumulating a new type of capital), then the two versions of the explanation can easily be combined into one.

Analogous logic is used in explaining the chess syndrome, with the only difference being that it is applicable to two agents that are not affected by institutional changes in the same way. Formalization of both mechanisms is almost trivial.

Types of traps and their classification

Since the 2000s, the research literature has been continuously augmented with the analysis of various types of institutional traps. E.V.Popov and V.V.Lesnykh estimate that by 2006, there were more than twenty of them, which created a need to classify them [25]. The so-called Classification of Institutional Traps was based on their significance in society, that is, their rank. Some of them are universal in nature and determine distinctive characteristics of economic development in general; others have only a local effect on certain segments of society. On this basis, Popov and Lesnykh distinguish institutional traps of systemic rank (inherent in society as a whole and macroeconomic in scale), structural rank (inherent only in individual fragments of society and therefore mesoeconomic), and financial rank (those that occur due to misalignments in the financial system and are generally microeconomic) [25, p. 163].

In addition to this, a matrix for studying institutional traps was suggested in [25], which is a kind of methodological template that can be used to dissect various traps with an eye to expeditiously determining their distinctive features.

Meanwhile, the classification of institutional traps that was introduced seems to be incomplete. In our opinion, this is because of an article that came out in 2006 [1], which introduced the concept of a global institutional trap. As such, the phenomenon of corporatocracy was considered, which was understood as an amalgamation of American multinational corporations, international lending institutions, and national governments for the purpose of extracting natural resources from less developed countries. Considering that global institutional traps encompass many national economies and, thus, are spread throughout the global system (megasystem), they can be called institutional megatraps [1]. Because of this, another important gradation should be added to the Classification of Institutional Traps proposed by Popov and Lesnykh: institutional traps of global rank (those that encompass the whole global economy).

In addition to corporatocracy, several more examples of global institutional traps are now known. For example, offshore tax havens and international organized crime (Mafia) can be classified as such. For instance, Jeffrey Robinson reveals the genesis of the offshore phenomenon, including all the factors in the origin of institutional traps and how they are fortified [26].

Adopting the concept of global institutional traps and examining undying institutions such as the Mafia, offshore tax havens, and corporatocracy lead to a controversial but very important conclusion: some institutional traps can exist indefinitely. Thus, the economic system can function, develop, and even generate progressive innovations while having in its institutional environment chronically defective elements in the form of global institutional traps. In our opinion, this thesis needs further verification.

To continue the thought about the indestructibility of some institutional traps, we can assume that such traps are even necessary for normal functioning of the economic system. This thesis can be illustrated by the phenomenon of institutional symbiosis, which was identified in [12]. Thus, drawing an analogy between economics and biology, we can distinguish three mechanisms of evolution of trap institutions: mutation, recombination of individual elements, and symbiosis.

The most interesting of the three elements is the process of institutional symbiosis. Broadly, it is the manifestation of a linkage effect; however, there is a rather fine difference between them. The point is that the linkage effect is understood as a process of incorporating an institution into a system of other norms that assist in maintaining the institution’s viability. However, in essence, the linkage effect is an interaction with some externalities, that is, outside institutions that do not directly conflict with the first institution. In other words, a trap institution enters into such interaction with other, outside institutions, and this interaction strengthens its position in comparison with an institution alternative to it. For example, linkage of the barter institution with tax evasion mechanisms leads to the strengthening of barter and the weakening of its competitor institution: the system of monetary settlements. In contrast to the linkage effect, the symbiosis mechanism presumes cooperation not with “friendly” outside institutions, but directly with a “hostile” alternative institution. The trap institution and its competitor institution form a unified system that does not make sense without one of these institutions. Consequently, even the competitor institution cannot be interpreted as a full-fledged externality, since it is, in a manner of speaking, inside the institutional trap that has been formed. The linkage effect between a trap institution and a competitor one is the essence of the mechanism of institutional symbiosis.

The “dissertation trap” can serve as an interesting example of institutional symbiosis. For a shadow producer of dissertations, the following dilemma is significant: preparation of a dissertation at an agreed upon shadow-market price or official work at established rates (filling research orders and grants or teaching in higher educational institutions). Preference of the alternative norm by the consumer and the producer of the shadow good with the same success destroys the dissertation market, and the dissertation trap along with it. Consequently, it is not possible to determine which of the trap institution’s two alternatives is more important, from the demand side or the supply side of the shadow market. And if this is so, then institutional analysis should include examination of two types of alternative institutions, from the side of the consumer (market demand) and the producer (market supply).

The division of alternative institutions that has been introduced is very important for understanding the mechanisms of evolution of institutional traps. For example, the price increase that has occurred in the shadow market for dissertation services cannot be explained just in terms of market demand. Fuller exposure of this phenomenon entails the following dialectic of the concepts that have been introduced. In the initial stage of economic reforms, scientific personnel found themselves in an extremely severe financial situation, which forced them to participate in writing dissertations at dumping prices. However, over time, the potential supply of dissertation preparation services decreased because many researchers emigrated or went into other occupations. At the same time, many of the remaining specialists went to work in higher educational institutions, which revived their status over the course of time. In parallel, thanks to the government and some private organizations, a system of scientific grants and commercial orders was set up in the country, which gave researchers additional income. The growth of teachers’ income with the appearance of opportunities for extra earnings from lectures at other higher educational institutions and from filling commercial and academic grants reduced the incentives to participate in work in the shadow dissertation market. To preserve these incentives it was necessary to raise the price for preparing dissertations. This circumstance was accepted by the consumers of dissertation services, and the price of these services rose accordingly. The financial basis for reaching a compromise between supply and demand was a rapid rise in the incomes of highly placed officials and businessmen. Because this happened over and over again, the market price in the shadow dissertation market rose dramatically, which predetermined the preservation and evolution of the dissertation trap phenomenon itself.

As a result of this example of synchronous growth of prices in the official and shadow markets for scientific services, preservation of the shadow market fostered improvement of the situation in the official market. Consequently, in some sense, the dissertation trap was necessary for the preservation of the collapsing scientific research market.

Formation of the corporatocracy trap also entails a complex symbiosis of four types of economic agents: American government services (generally the U.S. Central Intelligence Agency and National Security Agency), American private companies that have interests outside of the United States, international organizations (the World Trade Organization, the International Monetary Fund, and the International Bank for Reconstruction and Development), and government services and highly placed officials of developing countries [1]. As it turns out, a similar model of corporatocracy based on institutional symbiosis was also reproduced in Russia, which confirms the universality of this global institutional trap [1]. In the 2000s, the Russian model of corporatocracy was strengthened by the inclusion of representatives of the country’s intelligence services in it [30]. Moreover, analysts note that similar phenomena have become almost ubiquitous and encompass many developed countries [29].

Adding global institutional traps to the analysis raises another crucial question: how are culture and economic efficiency related? The point is that global institutional traps lead to the expansion of market institutions, irrevocably destroying the culture of less developed peoples and countries. The recent “Arab Spring” in Egypt, Tunisia, Libya, and Syria is yet another reminder of this. In this regard, it is relevant to recall Douglass North’s analysis of the development of North and South America, which followed Anglo-Saxon and Spanish/Portuguese models, respectively. His ultimate conclusion was simple: the difference in the dynamism of the two Americas is explained by the fact that the Anglo-Saxon legal system, taking root in North America, ensured a greater degree of political stability and use of the potential of modern technologies [16, p. 150]. However, there is also another side to this question: which legal system was more progressive, considering that the local Indian population has been preserved to this day in the Spanish and Portuguese colonies, while in the English colonies the indigenous peoples were completely destroyed or segregated on reservations? As we know, destruction of the culture of conquered countries is typical of primitive, not highly developed, peoples. And in this regard the following question is valid: was not the Anglo-Saxon culture less developed than the Spanish/Portuguese one?

This question becomes particularly crucial if we consider the fact that in his day Hernando Cortez developed a theory of creolization of the Indian population of Mexico, based on mixing of the races [15, p. 72]. The Spanish conquistador’s idea consisted in transplanting a Spanish root to the cultural soil of the Aztec Empire in order to create a mixed Creole society. Cortez decreed that teaching in local schools be done in two languages: Nahuatl (the “official” local language) and Latin. And he attributed no less importance to the Indians’ ideographic writing [15, p. 150]. According to Cortez, the mixing of cultures occurs through the mixing of blood. It was his intention to blend into the cultural landscape of Central America, and the way to do this was through polygamy. Therefore, he himself had an Indian wife and “married” his assistants to Indians. Cortez treated his numerous common-law wives with honor and respect, and all children from mixed common-law marriages were given Spanish names, baptized, and officially recognized. In addition, the conversion of Indians to Christianity by means of a complex combination with the local peoples’ pagan past was an important element of the creolization of Mexico. Cortez selected specially trained priests capable of shrewdly carrying out their patron’s policy [15, p. 158]. Against this background, the Spanish/Portuguese system’s historical loss is highly ambiguous.

Ways of overcoming traps

The next important milestone in development of the theory of institutional traps was [11], which investigated ways in which a system gets out of trap states. Here an attempt was made to answer a sacramental question: why does a system get out of an inefficient state sometimes and sometimes not?

A very simple and, at the same time, universal analytical scheme was developed along this line, the essence of which is as follows.

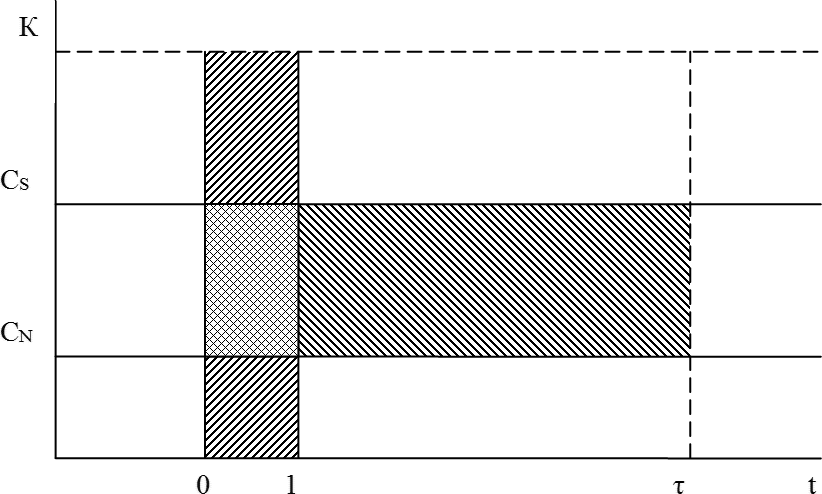

Suppose there are two possible institutional states for a system: an old one that the system is already in and a new one to which the system can make a transition. In this case, the second state is more efficient than the old one. Then the system’s behavior will be described by the following variables: CS and CN — the old and new current transaction costs, which correspond to the old and new institutions; K0 — the transformation costs that occur when the new institution is introduced; τ — the period of time (planning horizon) during which a company expects to recoup its actual transformation costs; r — the efficiency (interest rate) of investments in institutional innovation over the whole period in question τ; and t — time (e.g., a year).

Then the condition of institutional equilibrium is described by the following basic equation:

The integral form of equilibrium is determined by the difference between the transaction and transformation costs: while the former are in the category of current nonproduction costs, the latter are in the category of one-time (capital) expenses. This means that transaction costs are permanent, and their burden weighs upon the company all the time, while transformation losses occur only periodically, at times of change in the institutional pattern of the firm’s interaction with the outside world.

Equation (1) defines the simple logic of an economic agent’s behavior, which is illustrated in Figure 1. According to this logic, transition from the old norm (institution) to the new one means that the savings on transaction costs (the area of the horizontal band in Figure 1) must be greater than the transformation costs (the area of the vertical column in Figure 1). In this case, a strategically important conclusion already follows from Equation (1): the longer the economic agent’s planning horizon (τ) is, the more likely that the transition to a new, progressive norm will be made.

According to Figure 1, the old institution is less efficient, and therefore a long stay of the system in it is interpreted as falling into an institutional trap. Transition to a new institution means getting out of the trap, overcoming it. Accordingly, the longer the economic agent’s planning horizon (τ) is, the greater the probability it will get out of the institutional trap.

If we put into consideration x(t)—the total amount of the firm’s transactions (production); cS — per unit transaction costs with the old institution; and cN —per unit transaction costs with the new institution, then Equation (1) is rewritten in the form:

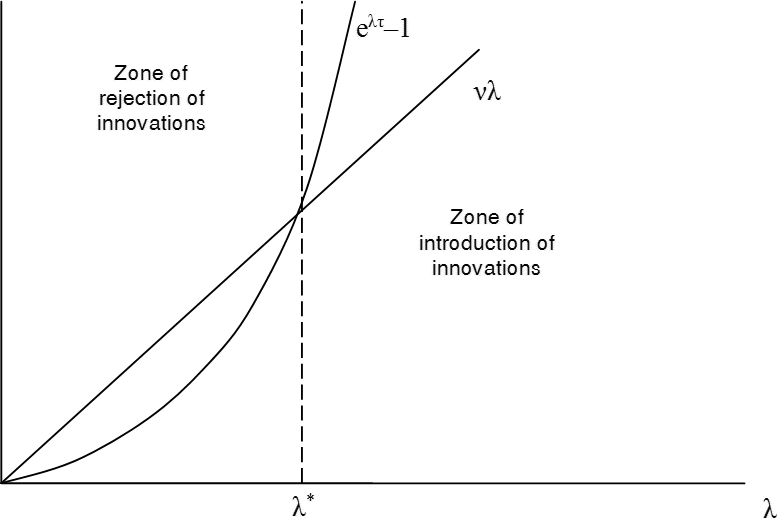

If, in addition, we assume that the growth rate of the firm’s sales is constant in time and equal to λ, then

If the notation

Equation (4) has a clear-cut geometric interpretation, which is presented in Figure 2: the critical growth rate of the firm’s production λ* is the point of intersection of the exponential curve (the left side of Equation [4]) with the straight line (the right side of Equation [4]). Substantively this means that, if the firm follows a sufficiently active expansionist strategy to win a sales market (λ > λ*), then it will most likely be interested in getting out of the institutional trap; if the company follows a depressive line of development or a not too active production program (λ < λ*), then it will prefer to remain in the old, inefficient system of doing business.

Thus, any stimulation of high activity on the part of businesses helps to break down an institutional trap. At the same time, institutional traps are not automatically eliminated by any spike in business activity. Only sufficiently intensive economic growth triggers the ratchet mechanism by which a company “takes off” to a qualitatively new level of development, and it is fundamentally impossible to attain such a result in the old institutional environment.

The theory that has been constructed accentuates two largely unexpected factors of development: the planning horizon and the economic growth rate. Considering that progress in the institutional environment opens the way for economic growth, a curious paradox emerges, which is well noted by Polterovich: “The most important factor in economic growth is economic growth itself” [18]. Thus, for positive institutional evolution it is necessary to set the flywheel of economic growth in motion in one way or another. Simultaneously with this it is necessary to extend the planning horizon, which is done, in many cases, with the use of an indicative planning system that makes it possible to outline the long-term prospects for a country’s development and to include businessmen in these plans.

So, the theory embodied in Equation (1) enables us to directly arrive at managerial solutions in relation to institutions and institutional traps.

Universality of investment logic and technological traps

There is a peculiar thesis in physics: “Formulas are smarter than the people who create them.” The same can be said of of the relationships shown in Equations (1)–(4) in the theory of institutional traps: it was only some time after they were derived that it became clear that the equations reflect a considerably broader class of transition processes than was initially assumed (the first results of (1)–(4) were obtained as long ago as 2000 in [5]). In connection with this, a study came out in 2003 [13] that examined production technologies instead of institutions. To do this, it turned out to be sufficient to give just a few of the variables in Equation (1) a different meaning. The following variables were used in the new concept: CS and CN — old and new current production costs, which correspond to the old and new technological systems (production technologies); K0 — capital costs (capital investments) that occur with the introduction of a technological innovation (this is actually the cost of new equipment); and the rest of the notations keep their original content.

The logic of Equation (1) is investment logic, when the agent determines whether or not it is worthwhile to invest in something new. It is precisely on this universal mechanism of rational choice that the unity of institutional and technological processes is based.

A more general equation for technological equilibrium was obtained in [13]:

where some additional parameters are used: the elasticity of per unit production costs — m=(x/cS)(dcS/dx) и n=(x/cN)(dcN/dx); r – discount.

Introducing parameters of the elasticity of per unit costs makes it possible to take into account the so-called learning effect for institutions and the scale effect for technologies, which is equivalent to the inequalities m < 0 and n < 0. The parameter r serves as a discounting coefficient for the conversion of current and capital costs in time to take into account the interest rate. In a particular case, the discount r can be interpreted as the interest rate on minimum-risk bank deposits. This makes it possible to take into account the intertemporal effect of the two types of costs, which can be used as investment resources for obtaining interest income.

Equation (5) entails some additional generalization; however, it is nevertheless a fundamental economic construct. This is because it links together very important economic aggregates such as current transaction (production) costs, transformation (capital) costs, economic growth rate, interest rate (discount), and planning horizon; and the learning (scale) effect. In addition to this, the starting conditions (initial output) figure in Equation (5) in an explicit form. As a rule, such characteristics are rarely joined together in the framework of a single, simple analytical construct.

As in the case of an institutional trap, a technological trap occurs when a company that has an opportunity to make the transition to a newer production technology prefers to remain in an old, less efficient one. This additional interpretation made it possible to explain some important economic phenomena. For example, how can the low technological and institutional receptivity of underdeveloped countries be explained?

Since developing and transitional economies are characterized by political, economic, and legal instability, the planning horizon for production companies in them is generally not very long. This fact largely predetermines the dominance of firms’ short-term interests over long-term ones and fosters technological stagnation of national production. This leads to the unambiguous conclusion that economic agents’ lack of trust in the government and its policy can be a direct cause of a country’s technological backwardness. If the overall political situation is not turned around, the economic system may remain in a technological trap indefinitely.

It must be said that for developing countries the “leap effect” embodied in Equation (5) holds an element of “chronic pain.” For instance, their technological lag impedes potential rapid economic growth, while the absence of the latter is conductive to the preservation of the existing technological lag. What they have is a closed cycle that is responsible, to a significant extent, for the practical difficulties of equalizing the economic parameters of developed and developing economies.

Additional study of Equation (5) shows that as the discount r increases, the system has fewer and fewer chances to get out of a technological trap, not only in the stage of a production recession but also in the economic growth phase. The restraining role of the interest rate in relation to the process of making the transition to a new technological paradigm is manifested here. In other words, the higher the interest rate is, the higher the economic growth rate in a country must be in order to make a technological breakthrough (i.e., to make the transition to a new technological level). This effect is also very significant for explaining the mechanism of developing countries’ technological stagnation. In particular, excessively high interest rates are established in the local markets of third-world and transitional economies. In turn, higher interest rates on loans and bank deposits in these countries automatically impair the general economic conditions for replacing obsolete technologies. Thus, the interest rate mechanism currently acts in favor of developed economies, giving them an innovation advantage in going through cycles of upgrading technologies.

Meanwhile, the theory of technological traps enables us to explain not only failures in the development of third-world countries but also their successes. For example, economic reforms in China went through stages in complete conformance with the theory of technological traps. In the first stage, the country emphasized increasing production. As we know, this goal was achieved, although the quality of the output was not very high. Cheap, but low-quality, Chinese goods flooded not only China itself but also many other countries. For example, Chinese feather beds became common in Russia, but they were low quality and did not last long: after a while, all of the down began coming out of them, and they were no good anymore. However, this strategy gave the Chinese economy a powerful impetus for development and built up the necessary growth rate, which enabled the country to make the transition to the second stage of development: gradual technological retooling of national production and improvement of the quality of its output. This pattern was subsequently repeated many times over. For example, by 2005, cheap, but not very high-quality, Chinese cars appeared in Russia. Once again, this was the first stage of development of the country’s automobile industry, the expansion stage. It was followed by a stage of bringing Chinese automobiles up to appropriate international standards by improving their production technology.

Objective and subjective factors in institutional and technological innovations: Which are more important?

It is very important to understand that getting out of traps is determined by two factors: the economic growth rate and the planning horizon. Here we have to pay attention to the difference between these parameters. For instance, while the rate of market expansion (λ) is an objective parameter of the external environment characterizing the possibilities of the market and a company, the planning horizon (τ) is an internal, subjective parameter that is established in the investor’s head and depends exclusively on his worldview and mood. At the same time, external and internal factors are multiplied by each other and thereby produce an integral result.

The direction of cause-and-effect relationships is an important point in this scheme, that is, a new economic reality emerges as a result of business expansion. At first glance, it may seem that the situation is exactly opposite: more efficient companies establish markets with increased capacity. However, this is not so. It is precisely the expansion of activity, or the need to expand it, that creates the basic impetus for new decisions and strategies. And it seems that this rule is universal. The need for, or the possibility of, rapid development of high-capacity markets pushes new problems to the forefront, which generally cannot be solved using old production and management technologies. This gives rise to the need for innovations [4].

With an understanding of the role of expansion in forming innovation movements, another question needs to be answered: which of the two factors is more important?

The answer to this question was obtained based on Model (1) in [3]. There it was shown, in particular, that the following simple inequality is valid:

Condition (6) means that a contraction of the planning horizon leads not to an equivalent increase in the economic growth rate, but to an accelerated one. Theoretically, if the planning horizon is cut in half, then the economic growth rate should increase by more than twofold. We can say that the time factor, which is expressed by the planning horizon τ, is stronger than the market factor proper, which is expressed by the growth rate λ. This is the first argument indicating that the subjective factor (τ) is more important than the objective one (λ).

A spatial and temporal interpretation of the two determinants of evolution is interesting. For example, the growth rate of production is a characteristic of the process of winning a market, which is always spatially definite. In fact, a market is always a space, and therefore the parameter λ can be seen as a measure of utilization of the market space. As for the planning horizon parameter τ, it expresses mental expansion in relation to time. That is precisely how the construction of long-term business plans should be perceived by an economic agent. Figuratively speaking, the planning horizon sets the part of the timescale that is captured and utilized by an agent scanning his future. Consequently, the expansion of business activity, which is manifested in its spatial and temporal expansion, initiates all kinds of innovations [4].

The next step in understanding the two factors involves the premise that the market’s growth rate is equal to zero (λ = 0), that is, output remains constant in time. Then, instead of Equation (4), we get a more compact and simpler relationship [4]:

Equation (7) shows that getting out of a trap state is directly determined by the quantity τ. When the spatial factor of innovation decisions collapses, the temporal factor still remains, and it is what determines the direction of further development. Consequently, we can say that the planning horizon is the leading factor in technological and institutional evolution.

The conclusion reached can be considered a general one in trap theory. Based on it, a number of interesting phenomena can be explained in a new way. For example, in spite of their enviable demographic parameters, India and China demonstrated innovation passivity for many years. The situation changed radically with the transition to state planning with a long horizon. And, on the other hand, European countries, without having high birthrates, demonstrate high innovation activity, thanks to the highly strategic life of their populations. In other words, in these examples we see the leading role of the planning horizon factor.

Identifying the planning horizon

Up to now, we have mainly discussed theoretical questions of how an economic system functions. And one very important, but absolutely speculative, parameter was used in doing so: the planning horizon. On the one hand, this mental tool undoubtedly exists; on the other hand, it is not found in official statistics, which makes it hard to verify. Apparently, this explains the fact that the first estimate of this parameter was not made until 2009, in [8].

The planning horizon is a virtual parameter that is established in the heads of economic agents and is not reflected in any company reports or documents. Because of this, its estimate can be based only on data from sociological surveys. Such surveys were conducted in 33 regions of Russia in 2008 by the business organization Opora Rossii and the Web site Kapital strany. The sample size was 200 respondents, and the sampling error was 6.2 percent [8]. The respondents were company leaders: owners and hired managers. The overall results of the survey are given in Table 1.

Averaging of the data in Table 1 through a weighting procedure made it possible to get a rough estimate of the planning horizon of small and medium-size businesses in Russia: 2.3 years. Analysis of this figure shows that it is not sufficient for creating an economy receptive to innovations. Moreover, short-lived business plans can explain the constant failures in regard to Russian economic modernization.

It has been noted in the literature that the planning horizon is a form of social confidence and an element of social capital conforming to the hysteresis effect. At the same time, of course, there is no question of homogeneity of the planning horizon: various segments of the economy and various groups of agents have their own planning horizons (Tables 2 and 3).

Thus, the verification of a parameter such as the planning horizon enables us to make the whole trap theory more operational and opens up various directions of applied research.

Technological leaps, monopoly power, and the structural cycle

Model (1), which describes the process of a system getting out of a technological trap, has a number of substantive analytical continuations. For example, analysis of an innovator firm and the market as a whole enables us to formulate a theorem of monopolization of conservative markets: the introduction of innovations in firms that operate in conservative markets is accompanied by a tendency toward monopolization of these markets on the part of the innovator firm. The introduction of innovations at firms operating in developing markets leads either to the preservation or tightening of competition in these markets [2].

| Planning horizon | Percent of respondents, % |

|---|---|

| No more than 3 months | 7,5 |

| No more than 6 months | 16,5 |

| No more than 1 year | 36,0 |

| No more than 2 years | 12,0 |

| No more than 3 years | 9,5 |

| No more than 5 years | 7,0 |

| No more than 10 years | 1,5 |

| More than 10 years | 5,5 |

| Operations are not planned at all | 4,5 |

| Average planning horizon, years | 2,3 |

| Number of employees | Planning horizon, years |

|---|---|

| Individual businessman | 1,39 |

| Up to 15 employees | 2,21 |

| From 16 to 100 employees | 2,56 |

| From 101 to 250 employees | 1,82 |

| Sector | Planning horizon, years |

|---|---|

| Manufacturing | 2,54 |

| Construction | 1,46 |

| Trade | 2,62 |

| Transportation and communications | 1,44 |

| Real estate | 3,88 |

| Services | 1,37 |

By conservative markets, we mean markets in which demand is stabilized to a significant extent and its growth rate is close to zero. Markets in which demand is far from stabilization and is growing at a very high rate are called developing markets.

The main result of the theorem regarding the monopolization of conservative markets is that it shows the role of a technological leap in getting out of the technological trap of formation of monopoly advantage in the market. To a certain extent, this fact is unexpected and interesting.

Another important pattern in the life of a technological trap is the generalized theorem of the effect of the discount on investment decisions. In the case of implementing a state of rapid economic growth, when i < λ (i is the amount of the discount), an investor decides to implement a project only if the discount values are small enough, not exceeding the company’s economic growth rate (i < i * < λ); If economic growth is sluggish, when i > λ, a positive decision to invest is made only when the discount values are higher than the company’s economic growth rate (i ** > i > λ) [6].

One interpretation of the theorem that was formulated is that for innovative and rapidly developing markets with an expectation of a high growth rate, low interest rates are preferable, while conservative markets with modest prospects for expansion have to maintain relatively high discount rates. This pattern makes some points in international development understandable. For instance, Japanese monetary authorities maintained traditionally low interest rates for many years. And it is precisely Japan that accomplished the so-called economic miracle, actively introducing various innovations for several decades.

The next stage in comprehending the role of a technological trap was L.A.Dedov’s study of the mechanism by which structural cycles take place [14]. According to his concept, this mechanism can be represented in the following way. The initial impetus for activating structural cycles is a company’s sprint to achieve a technological leap, that is, technological innovation. Increased dynamism of the firm’s development leads to the growth of its market share, the introduction of the innovation, and increased efficiency (profitability). This does not go unnoticed in the market, and other economic agents start to pour capital into this company (sector). To prevent the flow of resources that has begun, other companies (sectors) are forced to respond by making their own technological leap, which leads to the formation of a distinctive innovation cluster that may even encompass the whole economy. Because the introduction of innovations is uneven in this period, the role of sectors changes, and is manifested in a change in their market shares. This is the active phase of a structural cycle, which is understood to be the dynamics of the economy’s structural activity (i.e., the activity of a change in the shares of sectors’ outputs). Then the economy’s structural activity weakens due to an attenuation of innovation activity. The repetition of this cycle leads to a fluctuation in the intensity of structural shifts and the formation of a structural cycle. In this way, the technological leap described in Equation (5), based on which the system gets out of the technological trap, is the foundation of the mechanism that forms a global economic phenomenon such as the structural cycle.

Coexistence of institutions and technologies

Another unexpected pattern in the way systems function consists in the effect of the presence of several institutions (technologies) on economic growth. Studies have been done showing that the “rule of small shares” operates here — that is, an insignificant share of business activity within the framework of one of the institutions (technologies) does not disturb the trajectory of economic growth: if approximately equitable participation of institutions (technologies) in the creation of products is observed, then this is conducive to a production recession. Such strange behavior of the system is based on the complex intertwining of learning effects for institutions and scale effects for technologies [11]. Production strategies in which a company’s activity occurs within the framework of just one institution (technology) are called pure; if several institutions (technologies) are used simultaneously, then we talk about mixed strategies. Consequently, mixed strategies harbor nontrivial effects that need to be taken into account in conducting institutional and technological transformations.

In practice, the rule of small shares means that many companies can function completely normally using old institutions and technologies in insignificant shares. For example, a firm can operate on the basis of an up-to-date system of monetary settlements, but at the same time some of its operations are carried out through barter. Many large foreign companies do this without any detrimental consequences for the economy. Analogously, a company may have old, inefficient equipment that accounts for an insignificant share of its production. This does not involve big problems either. However, roughly speaking, if half of production is done on new equipment and the other half on old, it may have a depressive effect or cause a drop in profit.

Such a theoretical result was obtained in 2002 for the case of an invariant proportion between institutions (technologies) [11]. In 2005, this result was generalized for the case of variable proportions [9]. Thus, the effect that was found can be considered general enough to use it to explain many real phenomena.

In 2001, the rule of small shares was extended to the exotic phenomenon of legal pluralism (polycentric law), which describes a situation in which two or more legal systems coexist in one social field [10]. The North Caucasus is a typical example of legal pluralism in Russia. In many regions there, at least three legal systems coexist: adat (the customary law of indigenous peoples), Sharia (the legal code of Islam), and Russian law (the country’s official legal system). In a number of cases, these legal systems can conflict with each other, which greatly complicates the region’s normal socioeconomic development.

A similar situation, but with an informal slant, is seen in Saudi Arabia, where there are serious restrictions on women’s rights, which are expressed in the prohibition of women from engaging in many types of business or driving a car. In spite of this, many Saudi women successfully run a business, resorting to various tricks to do so. They manage their own offices, communicating with clients and personnel by telephone, fax, and e-mail, and delegating a man to sign contracts for them. All of this, together with the prohibition on driving a car, makes it very hard to conduct business and, in the final analysis, leads to an increase in transaction costs and irrational waste of national resources, impeding the country’s economic development.

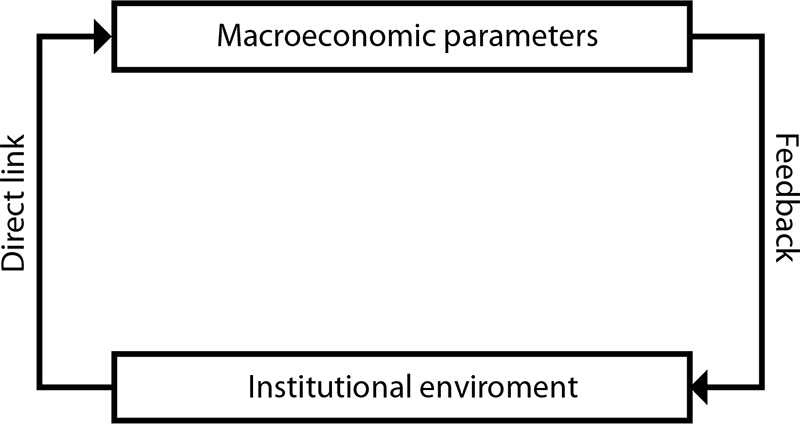

The rule of small shares has big theoretical significance. In particular, it establishes the nature of the effect of institutional (technological) conditions on the macroeconomic climate (the direct link in Figure 3): proportions in the distribution of products produced in the context of various business norms (technologies) predetermine the possibility (or impossibility) of economic growth. On the other hand, a sudden change in the growth rate reveals the pattern of the effect of macroeconomic conditions on the formation of a society’s institutional environment (the feedback in Figure 3): the economic growth rate predetermines the “choice” of one or another type of business relationships. Thus, trap theory is intended to study the two-way interaction between macroeconomic parameters and the institutional (technological) environment in an explicit form.

The role of trap theory in the everyday life of individuals

An important criterion for the fruitfulness of a theory is its universality, that is, its applicability to various situations. Trap theory satisfies this criterion. For instance, people’s decision making in regard to new undertakings in their lives can be examined in terms of trap theory. The essence of this approach can be reduced to the following.

Any undertaking requires increased expenditures of a person’s vital resources (efforts, money, time, and knowledge), which raises an entirely justified question: Will these expenditures be repaid? For example, is it worth studying a foreign language at age fifty?

Many people will answer this question in the negative, and the new undertaking will be blocked. However, the answer to the question that is posed depends on what the person’s planning horizon is. If the individual plans to have an extremely long life, this gives him a basis for a longer planning horizon, and this, in turn, leads to an affirmative decision in regard to the new undertaking. In reality, the person may not live that long, and his program will not be realized. but that is not important. What is important is that now he will begin a new project in his life, increasing the efficiency of his activity. In this way, a positive remote future generates productivity in the present.

This leads us to something we can call the principle of a long planning horizon. We now have numerous clear examples of the viability of this principle [4]. Forming a life philosophy based on this principle may be the most important real application of trap theory.

* * *

Trap theory today has already been created in its elementary form and has even put on a fair amount of weight. Nevertheless, its developmental process is ongoing. However, this development seems to be going mostly in the direction of accumulating examples of institutional and technological traps, which can hardly change what we already know. It seems that a much more intriguing direction would be to incorporate trap theory into more general scientific lines of inquiry: economic theory of reforms [22], economic theory of institutions [23, 24], and the general theory of innovations [4, 7]. In our opinion, it is precisely trap theory that should become the central link in these scientific lines of inquiry.

References

- Balatskii [Balatsky], E.V. “Gobal’nye institutsional’nye lovushki: sushchnost’ I spetsifika.” Mirovaia ekonomiki i mezhdunarodnye otnosheniia, 2006, no. 9.

- Balatskii [Balatsky], E.V. “Innovatsionnye strategii kompanii na razvivaiushchikhsia rynkakh.” Obshchestvo i ekonomiki, 2004, no. 4.

- Balatskii, E.V. “Mekhanizm vzaimoobuslovlennosti innovatsii i ekonomicheskogo rosta.” Nauka. Innovatsii. Obrazovanie [Almanac]. Iazyki slavianskoi kul’tury, 2007, no. 2.

- Balatskii [Balatsky], E.V. “Model’ ekonomicheskoi evoliutsii.” Obshchestvo i ekonomiki, 2009, no. 8–9.

- Balatskii [Balatsky], E.V. “Neproizvodstvennye izderzhki v teorii institutsional’nykh lovushek.” In Aktual’nye problemy gosudarstvennogo stroitel’stva i upravleniia: sbornik. Moscow: GUU, 2000.

- Balatskii [Balatsky], E.V. “Rol’ diskonta v investitsionnykh resheniiakh.” Obshchestvo i ekonomiki, 2004, no. 5–6.

- Balatskii [Balatsky], E.V. “Rol’ optimizma v innovatsionnom razvitii ekonomiki.” Obshchestvo i ekonomiki, 2010, no. 1.

- Balatskii [Balatsky], E.V. “Rynok doveriia i natsional’nye modeli korporativnogo sektora ekonomiki.” Obshchestvo i ekonomiki, 2009, no. 2.

- Balatskii [Balatsky], E.V. “Smeshannye khoziaistvennye strategii kompanii i ekonomicheskii rost.” In Vzaimosviaz’ institutsional’nykh izmenenii i sotsial’noekonomicheskoi dinamiki v sovremennoi Rossii. Moscow: Zhurnal EMM, RGNF, TsEMI, 2005.

- Balatskii [Balatsky], E.V. “Teoriia institutsional’nykh lovushek i pravovoi pliuralizm.” Obshchestvo i ekonomiki, 2001, no. 10.

- Balatskii [Balatsky], E.V. “Funktsional’nye svoistva institutsional’nykh lovushek.” Ekonomika i matematicheskie metody, 2002, no. 3.

- Balatskii [Balatsky], E.V. “Tsenovye mekhanizmy evoliutsii institutsional’nykh lovushek.” Obshchestvo i ekonomiki, 2005, no. 10–11.

- Balatskii [Balatsky], E.V. “Ekonomicheskii rost i tekhnologicheskie lovushki.” Obshchestvo i ekonomiki, 2003, no. 11.

- Dedov, L.A. “Stroenie produktovogo strukturno-tsiklicheskogo protsessa v ekonomiki.” Obshchestvo i ekonomiki, 2001, no. 7.

- K. Diuverzhe, K. (Duverger, C.). Kortes [Cortйs]. Moscow: Molodaia gvardiia, 2005.

- Nort [North], D. Instituty, institutsional’nye izmenenii i funktsionirovanie ekonomiki [Institutions, Institutional Change and Economic Performance]. Moscow: Fond ekonomicheskoi knigi Nachala, 1997.

- Polterovich, V.M. “Institutsional’nye lovushki i ekonomicheskie reform.” Ekonomika i matematicheskie metody, 1999, vol. 35, no. 2.

- Polterovich, V.M. “Politicheskaia kul’tura i transformatsionnyi spad (kommentarii k stat’e A. Khillmana ‘V puti k Zemle Obetovannoi’).” Ekonomika i matematicheskie metody, 2002, no. 4.

- Polterovich, V.M. “Strategiia institutsional’nykh reform. Kita ii Rossiia.” Ekonomika i matematicheskie metody, 2006, vol. 42, no. 2.

- Polterovich, V.M. “Strategiia institutsional’nykh reform. Perspektivnye traektorii.” Ekonomika i matematicheskie metody, 2006, vol. 42, no. 1.

- Polterovich, V.M. “Transplantatsiia ekonomicheskikh institutov.” Ekonomicheskaia nauka sovremennoi Rossii, 2001, no. 3.

- Polterovich, V.M. Elementy teorii reform. Moscow: Ekonomika, 2007.

- Popov, E.V. Transaktsii. Ekaterinburg: UrO RAN, 2011.

- Popov, E.V. Evoliutsiia institutov miniekonomiki. Moscow: Nauka, 2007.

- Popov, E.V., and V.V. Lesnykh. Institutsional’nye lovushki Polterovicha i transaktsionnye izderzhki. Ekaterinburg: Institut Ekonomiki UrO RAN, 2006.

- Robinson, Dzh. [J.]. Vsemirnaia prachechnaia. Terror, prestupleniia i griaznye den’gi v ofshornom mire [The Sink. Terror, Crime, and Dirty Money in the Offshore World]. Moscow: Al’pina Biznes Buks, 2004.

- Stivenson [Stevenson], R.L. V iuzhnykh moriakh [In the South Seas]. St. Petersburg: Propaganda, 2005.

- Sukharev, O.S. “Institutsiona’nye izmeneniia i ierarkhicheskie struktury—III.” Kapital strany.

- Iashina, G.A. “Razvedka i ekonomiki: smena prioritetov.” Kapital strany, January 26, 2012.

- Iashina, A.A. “Spetssluzhby v rossiiskoi ekonomike i politike.” Kapital strany, January 25, 2012.