1. Introduction

The turbulent state of the global economy and the increasing process of globalization have seriously impacted the activities of international and multinational corporations (MNCs) (Alon, 2020; Peretz and Morley, 2021). In post–communist countries, especially those not associated with the EU, these developments are often associated with the opportunity and, sometimes, necessity to develop their own domestic production and gradually squeeze foreign companies' out of local markets. However, the current economic situation is not conducive to abundant investment in R&D or the launching of expensive and innovative products. Meanwhile, enterprises with foreign ownership retain their role as the main drivers of technological development in the vast majority of post–communist countries.

The key benefit local markets can derive from the entry and operation of international and multinational corporations is knowledge and technology transfer, which increases local firms’ overall productivity (Garcia et al., 2013). In addition, the presence of foreign firms boosts competition (Berger and Diez, 2008), provides learning opportunities for both local suppliers of goods and services (Altenburg, 2000) and local consumers (Berger and Diez, 2008), demonstrates the effects of advanced technology and management practices (Berger and Diez, 2008; Girma et al., 2008), and stimulates investment in employee training (Blomstrom and Kokko, 2002; Berger and Diez, 2008). On the other hand, it can result in brain drains to local businesses (Altenburg, 2000). In addition, negative externalities are also sometimes observed, particularly the displacement of local companies from the market due to their inability to compete with MNC affiliates with technological and other support from well–organized headquarters (Smeets and de Vaal, 2016). However, the institutional environment has proven significant in balancing the benefits and detriments of MNC affiliates for local firms (Meyer and Sinani, 2009).

The predominantly symbiotic nature of the interaction between foreign–owned companies and local firms, including R&D activities, is associated with profound differences in the factors and determinants of research activity between both types of enterprises. First, for MNCs, R&D activity tends to be less costly in the case of contributions from the head office and other affiliates (Un and Cuervo–Cazurra, 2008). In addition, MNCs have, on average, significantly better opportunities to attract the best talent, including that from the local market, which is particularly important for internal R&D. These and other competitive advantages of foreign–owned companies often push local firms into an imitative development path in which they borrow and adapt to advanced technologies (Liu et al., 2010). The research activity patterns of local firms also play a role in determining the location of an MNC affiliate (Cantwell and Piscitello, 2002).

This study focuses on post–communist countries for several reasons. After the collapse of the Soviet Union in 1991, its former members, as well as several other states with a command economy model, launched the process of market institution transfer. Relying on the successful experience of the world’s technological leaders, post–communist economies opened the door to foreign capital and lured MNCs in hopes of commercializing the accumulated scientific potential by creating modern channels of technological transfer. However, despite considerable efforts, none of the communist countries have ranked among the technologically advanced countries in terms of their innovation climate.

In particular, Mali (1998) notes that the rigid separation of the different components of the R&D system supports a vicious circle in which a lack of demand for knowledge and technology is entwined with the detachment of supply from the needs of the real economy. Simultaneously, these countries increasingly lag behind leaders in various measures of innovation input and output (Jurajda et al., 2017; Aslund, 2018). Moreover, the accumulated scientific potential yields negligible economic returns with an extensive lag due to stalled R&D commercialization mechanisms (Kovac et al., 2018).

The state of the innovation environment varies significantly from one group of post–communist countries to another. In particular, countries that joined the EU have gained access to a common R&D space, financial resources, and technology transfer channels (Papava, 2018).

Nevertheless, foreign direct investment flows are supposed to boost innovation development in host countries without leading to large–scale technological modernization. Studies show that, in post–communist countries, foreign capital predominantly saturates medium– and low–tech industries (Perugini et al., 2008). In the case of high–tech MNCs opening production facilities, the intellectual property of parent offices is strictly protected, thereby relegating local units to the role of assemblers and packers (Rapacki et al., 2020).

The main problem with the development of innovation in these countries is that until an enabling environment and knowledge spillover channels are established, all efforts to create high–tech industries, including state and foreign investment, do not yield significant results. At the same time, the institutional legacy of communism, even after more than 30 years, can inhibit the introduction of a mature innovation culture and the proliferation of market–oriented R&D companies.

This study consists of five parts. Section 1 provides a review of the extant literature on the impact of foreign–owned companies on local markets, the relationship between foreign ownership and firm R&D intensity, and other topics. Section 2 describes the input data and estimated models. Section 3 describes the methodology and Section 4 discusses the regression results. Finally, Section 5 presents the conclusions.

2. Literature review

MNCs have traditionally conducted R&D in their home countries, occasionally extending into technologically developed countries (the U.S., Japan, and Western Europe) (Reddy, 2000; Belderbos et al., 2017). In the last few decades, R&D has begun to be organized in emerging markets (Egan, 2018). Originally, these initiatives focused primarily on adapting products and processes to local conditions. In recent years, key R&D activities have moved to MNC affiliates in emerging markets, particularly in the enormous markets of China and India (Yip and McKern, 2014), motivated by the desire to cut costs and an interest in entering into partnerships with local research institutes and universities or to develop products immediately in accordance with local market requirements (Grosse, 2019).

However, empirical studies offer ambiguous results when testing R&D intensity in enterprises with foreign ownership or MNC affiliates and local firms (Table 1). In the CEE sample for 2005–2012, foreign ownership had no effect on the propensity to conduct research (Mannasoo and Meriküll, 2020). Similar results were obtained for a wider sample of post–Soviet states (Berulava and Gogokhia, 2016). Based on a sample of Indian firms, Kumar and Aggarwal (2005) found similar R&D intensities for foreign–owned companies and local firms. David et al. (2006) found a positive relationship between foreign ownership and R&D intensity in Japanese firms.

Table 1. Studies of R&D intensity in foreign–owned companies.

|

N° |

Results |

Sample |

Methodology |

Outputs |

|

1 |

Approximately the same R&D intensity for foreign–owned and local companies |

India |

Generalized Least Square |

Kumar and Aggarwal (2005) |

|

2 |

Foreign ownership is positively related to R&D intensity only when there are growth prospects for companies |

Japan |

General Method of Moments |

|

|

3 |

Weak positive correlation between R&D intensity and foreign ownership |

Korea |

Generalized Least Square |

Kim et al. (2008) |

|

4 |

MNC affiliates spend less on R&D than local firms |

Spain |

Tobit |

Un and Cuervo–Cazurra (2008) |

|

5 |

Purchases of local firms by foreign firms increase R&D expenditure |

France |

Difference–in–difference |

Bertrand (2009) |

|

6 |

Negative correlation between foreign ownership and R&D intensity |

Turkey |

Tobit |

Kalayci and Pamukçu (2011) |

|

7 |

Negative correlation between company affiliation with MNCs and R&D intensity |

India |

Probit |

Sasidharan and Kathuria (2011) |

|

8 |

Positive correlation between affiliation to MNCs and R&D intensity |

Indonesia |

Ordinary Least Squares, Two Stage Least Squares |

Kuncoro (2012) |

|

9 |

Majority foreign ownership is controversially linked to different types of R&D |

29 transition economies from Europe and Central Asia |

Probit |

Berulava and Gogokhia (2016) |

|

10 |

Affiliates of MNCs from G7 countries are less R&D intensive than local firms |

Japan |

Tobit, Quantile |

Kwon and Park (2018) |

|

11 |

Foreign–owned companies are less likely to conduct internal R&D but more likely to outsource |

India |

Generalized Least Square |

Aggarwal (2018) |

|

12 |

No relationship found between R&D intensity and foreign ownership |

10 CEE countries |

Probit |

Mannasoo, Merikull (2020) |

In addition to the different perspectives on the relationship between foreign ownership and R&D intensity, there is active debate on the influence of various factors on the choice of different R&D regimes in foreign firms. Numerous empirical studies have examined the determinants of enterprises’ foreign ownership engagement in R&D, including outsourcing. According to Veugelers (1997), foreign firms are less likely to establish R&D links with local firms than their parent country firms. Belderbos et al. (2004) found that foreign ownership was correlated with a lower propensity to engage in horizontal cooperation (inter–firm) than to engage in vertical cooperation (with universities and research institutes). Foreign ownership was also found to negatively affect R&D cooperation between foreign and local firms in a sample of Belgian (Veugelers and Cassiman, 2004, 2005) and Czech (Knell and Srholec, 2005) companies. In contrast, in the case of Spanish firms, affiliation with an MNC increased the likelihood of local innovation cooperation (Holl and Rama, 2014; Garcia Sanchez et al., 2016). Guimon and Salazar–Elena (2015) assessed the likelihood of MNC units cooperating with local universities and found that foreign subsidiaries had a lower propensity to cooperate with Spanish universities than with local holdings. Both were more likely to cooperate with universities than unaffiliated (independent) local firms.

In addition, the type of knowledge and technology required by foreign–owned companies plays an important role in determining whether R&D outsourcing is appropriate. In the case of a need for applied research (tacit knowledge), spatial proximity and personal contact between producers and developers are often indispensable (Grillitsch et al., 2017 Plum and Hassink;, 2011). Consequently, an enterprise with majority foreign ownership can either establish cooperation with local research centers or set up its own units. The dispersion of MNC units around the world and exchange of research results among them can be a highly relevant business structure for generating and sharing analytical knowledge (Castellani and Lavoratori, 2020).

Clearly, the possibility of outsourcing or R&D collaboration for enterprises with majority foreign ownership strongly depends on the skills of local high–tech firms and research centers (Cozza et al., 2021). Thus, a series of empirical studies have demonstrated that in sectors where the host economy demonstrates an identified technological advantage, companies are willing to invest in long–term collaboration with local firms and research institutions (Le Bas and Sierra, 2002; Cantwell and Mudambi, 2011). The choice of research mode is also related to the potential size of the spillover effects observed in the affiliate operating market (Ito and Wakasugi, 2007). The quality of institutions and the overall level of innovation and research activity of local firms in the host country play important roles (Davis and Meyer, 2004; Santangelo et al., 2016). Notably, it is not the absolute level of institutional quality that matters to enterprises with majority foreign ownership but rather the gap between them and enterprises at the same level in the host country, which research shows has a decisive impact on R&D outsourcing decisions (Athreye et al., 2016; Awate et al., 2015).

Hence, we propose the following hypotheses:

H1. Firms with majority foreign ownership have higher R&D intensity.

H2. Higher R&D intensity in firms with majority foreign ownership is positively related to higher R&D intensity in local firms.

According to Table 1, most studies discuss research activities in foreign–owned enterprises at the micro–level on a single or a small sample country example, while only a few papers cover groups of countries. With a few exceptions, there has been little focus on post–communist countries. This group of countries is of particular interest in terms of identifying the links between the Soviet institutional legacy (underdeveloped innovation environment, inertia of market institutions, transformational state of the science and a technology sector with a focus on transposing the Western model). This lingering legacy still influences the market behavior of local enterprises and the intensity of MNC research activities in these countries. Several studies have examined the impact of foreign–owned companies in boosting R&D activity; for example, in Central and Eastern Europe (Narula and Guimon, 2010). However, the link between R&D intensity in enterprises with majority foreign ownership and the institutional legacy of the communist economic model has yet to be clarified. Therefore, the following hypothesis is proposed:

H3. The R&D intensity of enterprises with majority foreign ownership is determined by the quality of the host economy’s institutional environment.

Most of the aforementioned studies suggest that foreign–owned firms play an important role in the development of the host economy, particularly through establishing higher levels of innovation and research activity than local companies. However, conducting R&D in collaboration with foreign–owned companies is hindered by a number of constraints; therefore, enterprises with majority foreign ownership often opt for vertical rather than horizontal partnerships. Regarding the impact of local firms’ R&D activity and the quality of the institutional environment on similar foreign–owned companies’ activities, neither of these issues has received much attention in previous studies or there is a complete contradiction in some of the empirical results obtained. This study is ideologically related to disruptive innovation theory, which has been discussed and explored many times in Chinese literature (Hang and Chen, 2021). The postulates of this theory are fully consistent with models of innovation sector development in post–communist countries.

3. Data

The dataset on the performance of local firms and foreign companies in post–communist countries was obtained from the BEEPS (Business Environment and Enterprise Performance Survey) conducted by the European Bank for Reconstruction and Development, European Investment Bank, and the World Bank Group (The EBRD–EIB–WBG Enterprise Surveys). To cover as many countries as possible, our sample includes observations from 2018, 2019, and 2020. (The questionnaire collects data on the previous year’s performance of firms.) As a result, we collected information on 26 post–communist countries and divided them into four territorial groups: 1) EU member state Eastern European (EE) countries (11 countries, EU_m); 2) non–EU countries of EE (five countries, non_EU), countries of the Caucasus region + Russia, Ukraine, Moldova (five countries, C_RUM), and Central Asia + Mongolia (five countries). This selection is similar to that of Ruziev and Webber (2019). Appendix A presents the list and country groups.

The BEEPS database allows us to measure R&D intensity and distinguish between three components: internal research, external knowledge acquisition (purchase or licensing of patents and unpatented inventions, know–how, and other types of knowledge from other organizations), and R&D outsourcing (via contracts with other companies). As control variables, we included the following: number of employees, presence of export sales, main market of operations (national or international), and subjective assessment of skill shortages. In addition, we controlled for industry specificity and utilized information about the main industry sector of operations according to the first two digits of the ISIC (The International Standard Industrial Classification) classifier for each firm. Additional data for each country were obtained from the Global Innovation Index to assess the impact of the institutional environment and other business conditions. We include five sub–indices: institutions, human capital and research, infrastructure, market sophistication, and business sophistication. Additionally, many studies point to the critical importance of intellectual property protection in countries when foreign firms select their innovation strategy. The Intellectual Property Rights subindex values from the International Property Rights Index were taken for each country to verify this thesis. All national–level variables correspond to the year of the BEEPS company survey, or as close to it as possible in the case of missing data. A detailed description of all the variables is provided in Table 2.

Table 2. Description of variables.

|

Description/question from BEEPS |

Source |

Mean |

S.D. |

Min |

Max |

|

|

Over the last three years, did this establishment spend money on R&D activities within the establishment? |

BEEPS |

0.204 |

0.403 |

0 |

1 |

|

|

Over the last three years, did this establishment spend money on the acquisition of external knowledge? This includes the purchase or licensing of patents and non–patented inventions, know–how, and other types of knowledge from other businesses or organizations. |

BEEPS |

0.136 |

0.343 |

0 |

1 |

|

|

Over the last three years, did this establishment spend money on R&D activities contracted with other companies? (This question refers to R&D spending contracted with other companies, institutions (e.g., universities or private or government R&D institutes), or other establishments of the same firm). |

BEEPS |

0.094 |

0.292 |

0 |

1 |

|

|

Small size (19 employees and less) |

BEEPS |

0.458 |

0.498 |

0 |

1 |

|

|

Medium size (20–99 employees) |

BEEPS |

0.334 |

0.471 |

0 |

1 |

|

|

Large size (100 employees and more) |

BEEPS |

0.208 |

0.406 |

0 |

1 |

|

|

Presence of direct exports |

BEEPS |

0.229 |

0.420 |

0 |

1 |

|

|

In the fiscal year, which of the following was the main market in which this establishment sold its main product? National |

BEEPS |

0.446 |

0.497 |

0 |

1 |

|

|

In fiscal year, which of the following was the main market in which this establishment sold its main product? International |

BEEPS |

0.131 |

0.337 |

0 |

1 |

|

|

To what degree is an inadequately educated workforce an obstacle to the current operations of this establishment? (0 = no obstacle, 4 = severe obstacle) |

BEEPS |

1.473 |

1.352 |

0 |

4 |

|

|

Institutions subindex |

Global Innovation Index |

65.975 |

8.786 |

46 |

82.3 |

|

|

Human Capital and Research subindex |

Global Innovation Index |

34.649 |

7.264 |

17 |

48.4 |

|

|

Infrastructure subindex |

Global Innovation Index |

46.744 |

7.273 |

29.8 |

61.5 |

|

|

Market Sophistication subindex |

Global Innovation Index |

48.539 |

5.213 |

39.2 |

62.2 |

|

|

Business Sophistication subindex |

Global Innovation Index |

32.768 |

7.979 |

15.2 |

45.9 |

|

|

Intellectual Property Rights subindex |

The International Property Rights Index |

5.227 |

1.192 |

3.028 |

7.401 |

|

The final sample size includes 14,988 firms, which were split into four groups based on the presence and size of foreign ownership (similar to Aggarwal, 2018): 1) majority holding with a controlling stake or enterprises with majority foreign ownership: a firm with foreign ownership equal to or more than 50%; 2) dominant minority holding with a dominant influence: a firm with foreign ownership more or equal to 25% but less than 50%; 3) minority holding with minor influence: a firm with foreign ownership more or equal to 10% but less than 25%; and 4) minority holding with near zero influence: a firm with foreign ownership less than 10%.

To make this study results more realistic, it is important to examine the R&D activities of firms within national industry markets (the first two figures of ISIC) and test the hypothesis that there is a relationship between foreign–owned companies and local firms. The values of the variables for local firms (in this case, all firms with less than 50% foreign ownership) were taken as the national and industry averages for the corresponding ISIC ("local market” before naming the variables). In other words, for enterprises with majority foreign ownership operating in Russia in the hotel and restaurant sectors, all variables were constructed as an average of the performance of local firms operating in Russia in the hotel and restaurant sectors. With this limitation, it became necessary to determine the minimum size of an industry’s national markets. At thresholds of 5,10, or 15 firms, the ratio of enterprises with majority foreign ownership to local firms in a few markets is near parity, which might potentially bias the existence of external effects and inter–firm relations. When the threshold was increased to 20 firms, the potential for bias decreased significantly. Choosing a tighter threshold seems impractical due to the significant reduction in the initial sample of foreign firms. As a result, at the 20-firm threshold, the sample size is fewer than 12,000 firms, including 732 enterprises with majority foreign ownership. At the country level, the differences between the full and truncated samples appear minimal (see Table 3).

Table 3. Structure of samples.

|

|

FO > 50% |

25%=<FO<50% |

10%=<FO<25% |

FO<10% |

Total |

|

EU member EE countries |

9% (7%)a |

1% (1%) |

1% (0%) |

89% (92%) |

6327 (4782) |

|

Bulgaria |

4% (3%) |

1% (0%) |

1% (0%) |

94% (96%) |

739 (610) |

|

Croatia |

11% (9%) |

1% (0%) |

0% (0%) |

89% (90%) |

400 (267) |

|

Czech Republic |

14% (12%) |

0% (0%) |

0% (0%) |

85% (88%) |

495 (384) |

|

Estonia |

15% (5%) |

1% (1%) |

1% (1%) |

83% (94%) |

350(167) |

|

Hungary |

10% (7%) |

1% (1%) |

0% (0%) |

89% (92%) |

793 (669) |

|

Latvia |

18% (14%) |

1% (0%) |

1% (0%) |

80% (86%) |

336 (220) |

|

Lithuania |

11% (8%) |

1% (0%) |

1% (1%) |

88% (91%) |

350 (230) |

|

Poland |

2% (2%) |

1% (1%) |

1% (1%) |

96% (96%) |

1271(1143) |

|

Romania |

11% (11%) |

1% (1%) |

1% (1%) |

88% (88%) |

782 (591) |

|

Slovak Republic |

13% (10%) |

1% (1%) |

0% (0%) |

86% (89%) |

420 (266) |

|

Slovenia |

13% (11%) |

2% (2%) |

2% (0%) |

84% (86%) |

391 (235) |

|

non–EU countries of EE |

10% (9%) |

0% (1%) |

1% (1%) |

89% (90%) |

1513 (996) |

|

Albania |

8% (9%) |

0% (0%) |

1% (1%) |

90% (90%) |

367 (302) |

|

Bosnia and Herzegovina |

13% (13%) |

0% (0%) |

1% (0%) |

86% (87%) |

327 (215) |

|

Macedonia, FYR |

5% (3%) |

0% (0%) |

1% (1%) |

93% (95%) |

329 (225) |

|

Montenegro |

11% (6%) |

0% (0%) |

2% (0%) |

87% (94%) |

141 (54) |

|

Serbia |

13% (13%) |

1% (2%) |

0% (0%) |

86% (86%) |

349 (200) |

|

Central Asia + Mongolia |

5% (5%) |

2% (1%) |

1% (0%) |

93% (93%) |

3550 (3036) |

|

Kazakhstan |

3% (3%) |

1% (0%) |

0% (0%) |

96% (97%) |

1374(1260) |

|

Kyrgyz Republic |

13% (11%) |

3% (4%) |

2% (3%) |

82% (83%) |

346 (225) |

|

Mongolia |

3% (2%) |

1% (0%) |

1% (0%) |

96% (98%) |

355 (257) |

|

Tajikistan |

6% (6%) |

1% (0%) |

0% (0%) |

92% (93%) |

295 (210) |

|

Uzbekistan |

6% (6%) |

3% (3%) |

1% (0%) |

91% (91%) |

1180 (1084) |

|

countries of the Caucasus region + RUM |

6% (5%) |

1% (1%) |

0% (0%) |

93% (94%) |

3598 (3019) |

|

Azerbaijan |

6% (8%) |

0% (1%) |

0% (0%) |

93% (91%) |

202(113) |

|

Georgia |

10% (10%) |

1% (1%) |

1% (0%) |

88% (88%) |

565 (452) |

|

Moldova |

9% (7%) |

1% (0%) |

0% (0%) |

90% (93%) |

344 (242) |

|

Russian Federation |

3% (3%) |

0% (0%) |

0% (0%) |

96% (96%) |

1229(1093) |

|

Ukraine |

5% (5%) |

1% (1%) |

0% (0%) |

93% (94%) |

1258 (1119) |

|

Total number of firms |

1142 (732) |

142 (103) |

85 (51) |

13,619 (10,947) |

14,988 (11,833) |

a Reduced samples are shown in brackets.

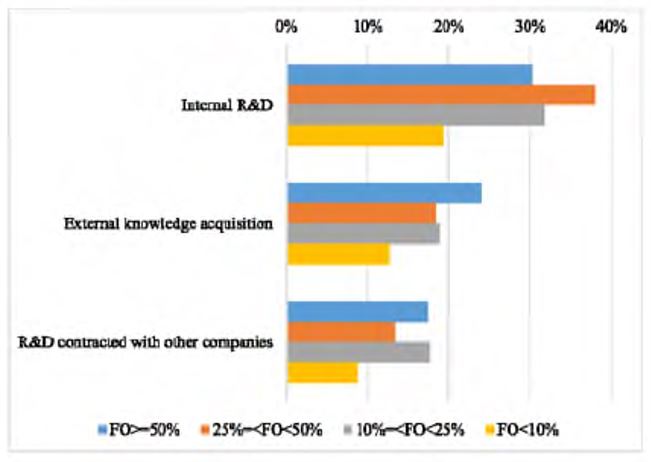

A comparison of the average values of the variables characterizing the performance of individual companies reveals that the presence of foreign ownership is important (see Fig. 1). Firms with significant foreign ownership (>10%) are more likely to conduct each of the aforementioned three types of R&D. However, the difference between enterprises with majority foreign ownership and firms with less substantial foreign ownership in R&D activity is less than 4–8 percentage points depending on the type of R&D.

Fig. 1. Average values of the variables by company type.

Regarding R&D intensity in different country groups, it should be noted that the highest R&D intensity is observed in the non–EU countries of EE. However, these companies also conduct R&D intensively in the countries of the Caucasus region + RUM (see Table 4). At the country level, enterprises with majority foreign ownership carry out internal R&D more often in Macedonia, Mongolia, and Azerbaijan. In the first two of these three countries, enterprises with majority foreign ownership were relatively more likely to acquire external knowledge and contract with other companies. Firms with majority foreign ownership were the least research intensive in Albania and Lithuania.

Table 4. Share of enterprises with majority foreign ownership performing each type of R&D by country and country group.

|

|

Full sample |

Reduced sample |

||||

|

Internal R&D |

External knowledge acquisition |

R&D contracted with other companies |

Internal R&D |

External knowledge acquisition |

R&D contracted with other companies |

|

|

EU member EE countries |

29% |

21% |

16% |

25% |

18% |

13% |

|

Bulgaria |

21% |

18% |

6% |

25% |

20% |

5% |

|

Croatia |

21% |

23% |

12% |

20% |

24% |

12% |

|

Czech Republic |

52% |

25% |

31% |

48% |

22% |

26% |

|

Estonia |

46% |

35% |

21% |

38% |

38% |

0% |

|

Hungary |

20% |

11% |

4% |

24% |

16% |

4% |

|

Latvia |

33% |

21% |

21% |

20% |

10% |

10% |

|

Lithuania |

3% |

16% |

0% |

0% |

16% |

0% |

|

Poland |

26% |

19% |

15% |

29% |

21% |

17% |

|

Romania |

22% |

13% |

17% |

22% |

14% |

21% |

|

Slovak Republic |

18% |

15% |

20% |

15% |

12% |

12% |

|

Slovenia |

42% |

38% |

16% |

26% |

26% |

11% |

|

Non–EU countries of EE |

34% |

39% |

28% |

30% |

37% |

23% |

|

Albania |

6% |

6% |

6% |

8% |

8% |

4% |

|

Bosnia and Herzegovina |

47% |

49% |

33% |

46% |

57% |

29% |

|

Macedonia, FYR |

56% |

72% |

44% |

57% |

71% |

43% |

|

Montenegro |

50% |

31% |

38% |

67% |

33% |

33% |

|

Serbia |

27% |

41% |

30% |

23% |

35% |

31% |

|

Central Asia + Mongolia |

23% |

21% |

11% |

21% |

18% |

10% |

|

Kazakhstan |

23% |

20% |

10% |

24% |

19% |

11% |

|

Kyrgyz Republic |

18% |

29% |

7% |

21% |

25% |

8% |

|

Mongolia |

55% |

55% |

55% |

40% |

40% |

40% |

|

Tajikistan |

26% |

26% |

21% |

23% |

31% |

23% |

|

Uzbekistan |

21% |

10% |

6% |

17% |

11% |

5% |

|

Countries of the Caucasus region + RUM |

39% |

26% |

20% |

40% |

27% |

19% |

|

Azerbaijan |

54% |

15% |

8% |

33% |

11% |

0% |

|

Georgia |

38% |

38% |

23% |

40% |

38% |

20% |

|

Moldova |

38% |

28% |

38% |

44% |

31% |

56% |

|

Russian Federation |

41% |

14% |

11% |

39% |

15% |

12% |

|

Ukraine |

37% |

24% |

16% |

40% |

26% |

16% |

|

Total for all countries |

30% |

24% |

17% |

28% |

22% |

15% |

As shown in Table 4, when we control for the minimum number of firms in the national market and reduce the sample, the average number of firms involved in different types of R&D changes only slightly at the country level; thus, we believe that it does not affect the representativeness of the sub–sample.

4. Methodology

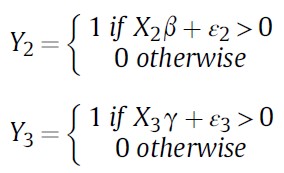

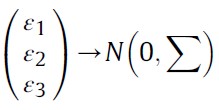

As noted in the survey section, the factors and determinants of the R&D activities of enterprises with majority foreign ownership vary considerably according to the type of R&D. Our dataset identifies three types of R&D: internal R&D, external knowledge acquisition, and R&D contracted with other companies. Thus, we considered three dependent variables in our empirical model: Y1, Y2, and Y3. We follow Berulava and Gogokhia (2016), Choi and Choi (2021) and Bernal et al. (2022) and model R&D activities by using multivariate probit regression. X is a vector of explanatory variables, including individual firm characteristics (headcount group, presence of export sales, main market of operation, national or international, and subjective assessment of skills shortage), GII scores on institutional environment quality, level of intellectual property protection, and binary variables reflecting membership in country groups. In addition to these variables, some models include repressors that reflect the research intensity in the market environment. To control for unobserved industry– and country–level effects, we introduce a set of binary variables. The model takes the following form.

.jpg)

(1)

where α, β, γ, is the vector parameters to be estimated and ε is a vector of the error term. In the multivariate model, the error terms jointly follow a multivariate normal distribution (MVN) with zero conditional mean and variance normalized to unity for identification of the parameters.

(2)

In this study, the multivariate probit model was analyzed using the Stata mvprobit command devised by Cappellari and Jenkins (2003).

5. Models and results

Table 5 presents the determinants of these three R&D activities. According to the results, enterprises with a majority of foreign ownership are more likely to acquire external knowledge, and firms with a high share of foreign ownership are more likely to conduct internal R&D. Therefore, Hypothesis 1 is only partially confirmed. After dividing the entire sample into two groups, we find that in companies from EU member EE countries, the choice of research mode is almost unrelated to the share of foreign ownership. In contrast, in non–EU countries, enterprises with a majority of foreign ownership are much more active in external knowledge acquisition and R&D contracted with other companies (Appendix B).

Table 5. Types of R&D and foreign ownership groups.

|

VARIABLES |

(1) |

(2) |

(3) |

|

Internal R&D |

External knowledge acquisition |

R&D contracted with other companies |

|

|

FO > 50% |

–0.0181 |

0.153*** |

0.0649 |

|

(0.0458) |

(0.0476) |

(0.0517) |

|

|

25%=<FO<50% |

0.203* |

–0.0301 |

–0.0415 |

|

(0.111) |

(0.128) |

(0.137) |

|

|

10%=<FO<25% |

0.0841 |

–0.0168 |

0.140 |

|

(0.152) |

(0.169) |

(0.162) |

|

|

Size medium |

0.229*** |

0.274*** |

0.307*** |

|

(0.0294) |

(0.0326) |

(0.0370) |

|

|

Size large |

0.446*** |

0.463*** |

0.580*** |

|

(0.0344) |

(0.0379) |

(0.0415) |

|

|

National market competition |

0.354*** |

0.288*** |

0.282*** |

|

(0.0300) |

(0.0331) |

(0.0373) |

|

|

International market competition |

0.368*** |

0.257*** |

0.349*** |

|

(0.0505) |

(0.0564) |

(0.0604) |

|

|

Inadequately educated workforce |

0.0982*** |

0.108*** |

0.0933*** |

|

(0.00944) |

(0.0102) |

(0.0112) |

|

|

Export |

0.355*** |

0.297*** |

0.236*** |

|

(0.0355) |

(0.0397) |

(0.0426) |

|

|

Institutions subindex |

0.0306*** |

0.0433*** |

0.0226*** |

|

(0.00362) |

(0.00379) |

(0.00422) |

|

|

Human Capital and Research subindex |

–0.0273*** |

0.00343 |

–0.00268 |

|

(0.00330) |

(0.00354) |

(0.00392) |

|

|

Infrastructure subindex |

–0.0522*** |

–0.0548*** |

–0.0305*** |

|

(0.00478) |

(0.00533) |

(0.00582) |

|

|

Market Sophistication subindex |

0.0199*** |

0.0155*** |

0.0174*** |

|

(0.00312) |

(0.00321) |

(0.00367) |

|

|

Business Sophistication subindex |

0.0482*** |

0.00997** |

0.0125** |

|

(0.00472) |

(0.00507) |

(0.00561) |

|

|

Intellectual Property Rights subindex |

0.0982*** |

0.0245 |

0.0329 |

|

(0.0214) |

(0.0226) |

(0.0251) |

|

|

Constant |

–2.711*** |

–3.167*** |

–3.173*** |

|

(0.232) |

(0.255) |

(0.277) |

|

|

Observations |

|

14,988 |

|

|

Chi–square statistic |

|

2805.96*** |

|

|

Log pseudolikelihood |

|

–14749.073 |

|

Industry and country group dummies are also included. Robust standard errors are indicated in parentheses. * - p < 0.1; ** - p < 0.05; *** - p < 0.01.

Regarding the set of control variables, it should be noted that we find a positive correlation between R&D intensity and firm size. Larger firms are more likely to conduct R&D because they usually have larger R&D budgets. The scale of the operating market (national and international) was significant for all specifications, which might confirm the positive impact of international competition on the propensity to conduct R&D. Export activity increases R&D, which may also be explained by the role of international competition as an R&D driver. The quality of institutions (institutions subindex) and business climate indicators are statistically significant in all cases and have a direct relationship with R&D intensity. However, the level of intellectual property protection is unrelated to R&D outsourcing (external knowledge acquisition and R&D contracted with other companies); in other words, companies fear intellectual property theft only when conducting internal R&D. The negative sign of the human capital and research subindex can be explained by the fact that with sufficient domestic R&D capacity, companies feel less pressured to organize internal R&D and can employ other channels of technology acquisition. However, the other two types of R&D were not explicitly linked to this index, which may be due to the low efficiency of technology transfer channels in post–communist economies, where accumulated scientific potential is not in demand by companies in the real economy (Blazek and Csank, 2016). A more controversial interpretation is that there is a negative relationship with the infrastructure subindex. It can be assumed that, in a developed infrastructure environment, companies are more inclined to use the available resources (including information and communications technology (ICT), logistics, etc.) rather than looking for knowledge–intensive solutions to emerging challenges. There literature provides evidence for the highly heterogeneous impact of infrastructure on firms’ innovation activities (Audretsch et al., 2015). The importance of infrastructure for innovative development is consistently confirmed when relatively lagging regions gain access to more advanced areas. In the absence of such neighbors, investment in transport infrastructure does not trigger innovative development (Chen and Vickerman, 2018). However, prioritizing funding for physical infrastructure projects can weaken the support for innovative development. Some evidence of this can be observed by splitting the sample into two groups (Appendix B). While the relationship between R&D intensity for two of the three types was found to be insignificant for EU members, a negative correlation was confirmed for non–EU members. Thus, the heritage of the Soviet economy can erode infrastructure improvements owing to a lack of entrepreneurial and innovative spirit (Medvedeva, 2012; Mussagulova, 2021). We can assume that in this case, there is a complex, non–linear effect of the institutional environment, which does not allow companies to take advantage of modern infrastructure, although this hypothesis requires further investigation.

Table 6. Intensity of different types of R&D activities for enterprises with majority foreign ownership depending on the overall research activity of the market environment.

|

VARIABLES |

(1) |

(2) |

(3) |

|

Internal R&D |

External knowledge acquisition |

R&D contracted with other companies |

|

|

Local market any type of R&D |

1.292*** |

0.718 |

1.669*** |

|

(0.483) |

(0.531) |

(0.551) |

|

|

Size medium |

0.241 |

0.234 |

0.349* |

|

(0.159) |

(0.171) |

(0.186) |

|

|

Size large |

0.576*** |

0.606*** |

0.733*** |

|

(0.165) |

(0.177) |

(0.195) |

|

|

National market competition |

0.160 |

0.282 |

0.00382 |

|

(0.165) |

(0.177) |

(0.181) |

|

|

International market competition |

0.266 |

0.214 |

–0.263 |

|

(0.209) |

(0.225) |

(0.240) |

|

|

Inadequately educated workforce |

0.101** |

0.170*** |

0.154*** |

|

(0.0415) |

(0.0444) |

(0.0481) |

|

|

Export |

0.236 |

0.261* |

0.163 |

|

(0.146) |

(0.153) |

(0.169) |

|

|

Institutions subindex |

0.0121 |

0.0364** |

–0.00171 |

|

(0.0166) |

(0.0182) |

(0.0189) |

|

|

Human Capital and Research subindex |

–0.00110 |

0.0127 |

–0.0166 |

|

(0.0153) |

(0.0161) |

(0.0172) |

|

|

Infrastructure subindex |

–0.0181 |

–0.0614** |

–0.00176 |

|

(0.0244) |

(0.0253) |

(0.0271) |

|

|

Market Sophistication subindex |

–0.00889 |

–0.0230 |

–0.0150 |

|

(0.0143) |

(0.0149) |

(0.0163) |

|

|

Business Sophistication subindex |

0.00588 |

–0.0163 |

0.0131 |

|

(0.0225) |

(0.0248) |

(0.0242) |

|

|

Intellectual Property Rights subindex |

0.00763 |

–0.0165 |

–0.0989 |

|

(0.0919) |

(0.0967) |

(0.0983) |

|

|

Constant |

–1.522 |

–0.411 |

–0.811 |

|

(0.946) |

(1.043) |

(1.089) |

|

|

Observations |

|

732 |

|

|

Chi–square statistic |

|

202.36*** |

|

|

Log pseudolikelihood |

|

–883.64 |

|

Industry and country group dummies are also included. Robust standard errors are indicated in parentheses. * - p < 0.1; ** - p < 0.05; *** - p < 0.01.

The research intensity in enterprises with majority foreign ownership is directly determined by the frequency of R&D in the market environment, which, as shown in Table 6, is predominantly represented by local firms. A similar relationship is observed for R&D contracts with other companies. Consequently, both types of firms enter markets with R&D backlogs that enable them to improve their production processes through various knowledge spillovers while competing. Alternatively, research–intensive enterprises, with a majority of foreign ownership, encourage local competitors to opt for technology-intensive business strategies. At the same time, skill shortages can be related to the participation of enterprises with majority foreign ownership in each of the three R&D regimes. It is a fairly common thesis that the more intensively a company engages in R&D and innovation, the more demanding it becomes in terms of the skills it requires of its employees (Mishra and Smyth, 2014). The presence of exports has proved to be positively related only to external knowledge acquisition.

The collaborative activities of enterprises with majority of foreign ownership are determined by the activities of local enterprises carrying out internal R&D (see Table 7). It can be assumed that enterprises with a majority of foreign ownership initiate such projects as no relationship between the collaborative activities of the local setting and these enterprises has yet been identified. However, the purchase of external knowledge by enterprises with majority foreign ownership has no link to the research regimes of the market environment other than the purchase of external knowledge itself. Enterprises with majority foreign ownership select this research mode by concentrating on the prevalence of R&D procurement in the operating market. Thus, there are convincing supporting arguments for Hypothesis 2.

Furthermore, the calculations prove the link between enterprises with majority of foreign ownership research activities and the market environment, thus leading to the following conclusions. First, the inclusion of geography in the models revealed no statistically significant relationship between the intensity of any type of R&D activity and membership in a particular country group. Second, the national innovation environment, which was considered by the GII sub–indices, is practically unconnected to the research intensity of enterprises with majority foreign ownership. Thus, Hypothesis 3 was completely rejected. On the one hand, this finding overlaps with other studies that did not find a linear relationship between institutional quality and R&D intensity in post–communist countries (e.g. Nazarov and Obydenkova, 2020). On the other hand, the analysis of the full sample of firms (see Table 5) suggests a fairly strong relationship between the quality of the institutional environment and the intensity of each of the three types of R&D. Enterprises with majority foreign ownership and those with less significant foreign ownership, as well as local firms, differ greatly in this respect. Numerous studies have proved that foreign companies consider the institutional climate of a country when deciding whether to locate research-active subsidiaries (Demirbag and Glaister, 2010; Falaster and Ferreira, 2020). However, the BEEPS database does not provide information on the duration of a company’s operations in a particular national market. Nevertheless, it is fair to assume that companies with dominant foreign ownership have already entered the market and choose their research strategy without adjusting it to the institutional state in the country.

Table 7. Intensity of different types of R&D performed by enterprises with majority foreign ownership depending on the activity of the market environment in performing internal R&D or outsourcing it.

|

VARIABLES |

(1) |

(2) |

(3) |

|

Internal R&D |

External knowledge acquisition |

R&D contracted with other companies |

|

|

Local market internal R&D |

1.730** |

1.230 |

2.278*** |

|

(0.779) |

(0.808) |

(0.854) |

|

|

Local market external knowledge acquisition |

0.863 |

2.014* |

0.936 |

|

(0.941) |

(1.062) |

(1.032) |

|

|

Local market R&D contracted with other companies |

–0.638 |

–1.863 |

–0.756 |

|

(1.157) |

(1.207) |

(1.212) |

|

|

Size medium |

0.243 |

0.238 |

0.360* |

|

(0.160) |

(0.174) |

(0.187) |

|

|

Size large |

0.570*** |

0.612*** |

0.735*** |

|

(0.167) |

(0.180) |

(0.195) |

|

|

National market competition |

0.160 |

0.281 |

0.00333 |

|

(0.165) |

(0.179) |

(0.181) |

|

|

International market competition |

0.257 |

0.197 |

–0.285 |

|

(0.210) |

(0.227) |

(0.242) |

|

|

Inadequately educated workforce |

0.104** |

0.182*** |

0.159*** |

|

(0.0422) |

(0.0456) |

(0.0494) |

|

|

Export |

0.236 |

0.273* |

0.159 |

|

(0.147) |

(0.155) |

(0.170) |

|

|

Institutions subindex |

0.0127 |

0.0329* |

–0.000512 |

|

(0.0161) |

(0.0179) |

(0.0184) |

|

|

Human Capital and Research subindex |

0.00471 |

0.0169 |

–0.00937 |

|

(0.0163) |

(0.0171) |

(0.0188) |

|

|

Infrastructure subindex |

–0.0110 |

– 0.0464* |

0.00632 |

|

(0.0246) |

(0.0253) |

(0.0273) |

|

|

Market Sophistication subindex |

–0.0133 |

–0.0308** |

–0.0206 |

|

(0.0145) |

(0.0153) |

(0.0165) |

|

|

Business Sophistication subindex |

–0.00422 |

–0.0299 |

0.000859 |

|

(0.0234) |

(0.0260) |

(0.0251) |

|

|

Intellectual Property Rights subindex |

0.0116 |

0.00420 |

–0.0928 |

|

(0.0964) |

(0.101) |

(0.104) |

|

|

Constant |

–1.677* |

–0.597 |

–1.032 |

|

(0.948) |

(1.053) |

(1.087) |

|

|

Observations |

|

732 |

|

|

Chi–square statistic |

|

197.47*** |

|

|

Log pseudolikelihood |

|

–878.58 |

|

Industry and country group dummies are also included. Robust standard errors are indicated in parentheses. * - p < 0.1; ** - p < 0.05; *** - p < 0.01.

In summary, the significance of the findings is primarily due to the introduction of the market environment factor of research activity in the analytical framework. In our view, the most significant finding is the evidence of the synchronization of R&D strategies of enterprises with a majority of foreign ownership and those of local firms. We find that enterprises with majority of foreign ownership and local firms determine each other’s R&D activity, particularly internal R&D and purchasing external knowledge. However, contract R&D occurs significantly more frequently if the local environment is actively researched.

Regarding recent empirical papers, our study complements a series of papers that examined the determinants of R&D intensity in a sample of BEEPS firms (Berulava and Gogokhia, 2016; Ashyrov and Masso, 2020; Gogokhia and Berulava, 2021). However, these studies have not been used previously in the context of modelling the impact of the market environment on the R&D activities of foreign–owned firms. We believe that our study contributes by providing an analysis of the factors determining the R&D intensity of enterprises with majority foreign ownership in post–communist countries while considering the market and institutional environments.

It should be noted that our results have several limitations that stem from the assumption of a minimum national industry market. It can be assumed that a different market configuration would likely yield different conclusions. Another limitation is that our data do not allow us to identify the head offices of enterprises with foreign ownership. As has been shown in previous studies (e.g., Kwon and Park, 2018), multinational corporations from global economic leaders rely more on intra–corporate knowledge and technology circulation, whereas companies from emerging or catching–up economies tend to establish research units, that is, conduct internal R&D in their countries of operation.

6. Conclusion

Our findings show that enterprises with majority of foreign ownership are more likely to acquire external knowledge. This is due, on the one hand, to the possession of comparatively large financial opportunities and, on the other, to having a greater degree of involvement in international markets (i.e., the availability of foreign partners, accessibility of information, etc.).

We find that the R&D intensity of enterprises with majority foreign ownership and that of local firms are interrelated. Based on this, we argue that these findings might be considered evidence of the synergistic effect between the R&D behavior of enterprises with majority foreign ownership and that of local firms. These results indicate the presence of knowledge spillover and cross–learning effects in both types of companies in post–communist countries. However, R&D contracts with other companies occur much more often if local firms conduct internal R&D. In terms of public policy implications, this implies the need to support the entry of foreign knowledge–intensive firms and foster R&D activity in local firms. Enterprises with foreign ownership promote innovative growth of the host economy only up to a certain limit because at some level of R&D activity, support of international firms is required. Accordingly, the synergy of the research activity of enterprises with majority foreign ownership and local companies might be seen as a mechanism that further promotes R&D and ultimately benefits the domestic market.

However, contradictory evidence was obtained concerning the relationship between human capital and the research intensity of enterprises with majority foreign ownership. An adequately educated workforce proved to be a significant barrier to R&D for all three types. At the same time, the human capital and research subindex at the national level turned out to be insignificant. That is to say, such companies mainly concentrate on the problems unique to their industry or market and do not pay much consideration to the national context. This supposition is confirmed by the rather low correlation between the research intensity of enterprises with majority foreign ownership and the rest of the national sub–indexes. Thus, enterprises with majority foreign ownership take considerably less account of countrywide research factors and are more influenced by internal factors or the research intensity of their immediate local environment.

To attract research–intensive foreign companies, a comfortable institutional environment is not necessarily needed owing to the presence of R&D–intensive local companies within the industry. Accordingly, if the involvement of foreign–owned companies is to be considered a factor for accelerating the development of certain national industries or the economy as a whole, it is advisable to attract international capital to areas with high concentrations of research– and innovation–intensive local enterprises (e.g., clusters). The links between enterprises with majority foreign ownership and local R&D firms point to the possibility of self–organization of innovation consortia within such science and innovation hub zones. Enterprises with majority of foreign ownership can act as both suppliers and purchasers of R&D results for local firms. However, bilateral technology transfer requires specific conditions and support mechanisms. For the government, this is a strategic opportunity to bet on one type of cooperation between foreign companies and local businesses.

Appendix A. List of countries by group

1. EU member EE countries (11 countries, EU_m): Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovak Republic, Slovenia

2. Non–EU countries of EE (five countries, non_EU): Albania, Bosnia and Herzegovina, Macedonia, Montenegro, Serbia;

3. Countries of the Caucasus region + RUM (five countries, C_RUM): Azerbaijan, Georgia, Russian Federation, Ukraine, Moldova

4. Central Asia + Mongolia (five countries): Kazakhstan, Kyrgyz Republic, Mongolia, Tajikistan, Uzbekistan

Appendix B. Types of R&D and foreign ownership groups in EU member countries and non–EU countries

|

VARIABLES |

EU member EE countries |

non–EU countries |

||||

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

RDINT |

ACQEXKN |

RDCONT |

RDINT |

ACQEXKN |

RDCONT |

|

|

10%=<FO<25% |

(0.188) |

(0.233) |

(0.247) |

(0.138) |

(0.158) |

(0.171) |

|

–0.0469 |

–0.243 |

0.0949 |

0.0861 |

–0.00963 |

–0.159 |

|

|

Size medium |

(0.208) |

(0.285) |

(0.229) |

(0.217) |

(0.222) |

(0.241) |

|

0.257*** |

0.259*** |

0.358*** |

0.196*** |

0.268*** |

0.248*** |

|

|

Size large |

(0.0504) |

(0.0535) |

(0.0637) |

(0.0370) |

(0.0417) |

(0.0464) |

|

0.562*** |

0.474*** |

0.672*** |

0.430*** |

0.464*** |

0.557*** |

|

|

National market competition |

(0.0574) |

(0.0628) |

(0.0696) |

(0.0443) |

(0.0490) |

(0.0527) |

|

0.257*** |

0.0896 |

0.243*** |

0.395*** |

0.364*** |

0.312*** |

|

|

International market competition |

(0.0578) |

(0.0570) |

(0.0737) |

(0.0356) |

(0.0400) |

(0.0445) |

|

0.374*** |

0.275*** |

0.374*** |

0.194*** |

0.0949 |

0.195** |

|

|

Inadequately educated workforce |

(0.0795) |

(0.0824) |

(0.0973) |

(0.0721) |

(0.0810) |

(0.0866) |

|

0.0665*** |

0.0698*** |

0.0890*** |

0.119*** |

0.136*** |

0.0950*** |

|

|

Export |

(0.0170) |

(0.0171) |

(0.0201) |

(0.0117) |

(0.0128) |

(0.0139) |

|

0.372*** |

0.254*** |

0.241*** |

0.296*** |

0.295*** |

0.190*** |

|

|

Institutions subindex |

(0.0524) |

(0.0582) |

(0.0645) |

(0.0497) |

(0.0546) |

(0.0607) |

|

0.0890*** |

0.0956*** |

0.111*** |

0.00718 |

0.0294*** |

–0.00145 |

|

|

Human Capital and Research subindex |

(0.00954) |

(0.00983) |

(0.0111) |

(0.00535) |

(0.00593) |

(0.00625) |

|

–0.0532*** |

–0.00970 |

–0.0530*** |

–0.0195*** |

0.00156 |

0.00556 |

|

|

Infrastructure subindex |

(0.00787) |

(0.00840) |

(0.00988) |

(0.00416) |

(0.00426) |

(0.00471) |

|

0.0106 |

–0.0278** |

–0.00701 |

–0.0344*** |

–0.0371*** |

–0.0153** |

|

|

Market Sophistication subindex |

(0.0111) |

(0.0110) |

(0.0127) |

(0.00612) |

(0.00664) |

(0.00721) |

|

–0.0411*** |

0.00262 |

–0.0341*** |

0.0178*** |

0.0114*** |

0.0182*** |

|

|

Business Sophistication subindex |

(0.00786) |

(0.00785) |

(0.00900) |

(0.00310) |

(0.00335) |

(0.00370) |

|

0.0451*** |

–0.0335*** |

–0.0106 |

0.0187*** |

–0.0105** |

–0.00691 |

|

|

Intellectual Property Rights subindex |

(0.00912) |

(0.0107) |

(0.0113) |

(0.00480) |

(0.00510) |

(0.00566) |

|

–0.0310 |

0.00163 |

0.0648 |

–0.0481 |

–0.000439 |

–0.112*** |

|

|

Constant |

(0.0447) |

(0.0466) |

(0.0542) |

(0.0298) |

(0.0333) |

(0.0353) |

|

–6.268*** |

–5.855*** |

–6.400*** |

–0.790** |

–2.278*** |

–1.465*** |

|

|

Observations |

(0.539) |

(0.550) |

(0.632) |

(0.333) |

(0.385) |

(0.409) |

|

6327 |

|

|

8661 |

|

|

|

|

Chi–square statistic |

904.963*** |

|

|

1836.98*** |

|

|

|

Log pseudolikelihood |

–5408.18 |

|

|

–9105.23 |

|

|

The industry dummy variable is included. Robust standard errors are indicated in parentheses. * - p < 0.1; ** - p < 0.05; *** - p < 0.01.

References

Aggarwal, A. (2018). The impact of foreign ownership on research and development intensity and technology acquisition in Indian industries: pre and post global financial crisis. Asian Dev. Rev. Stud. Asian Pac. Econ. Issues, 35(1), 1–26. https://doi.org/10.1162/adev_a_00103

Alon, I. (2020). COVID–19 and international business: a viewpoint. FIIB Bus. Rev., 9(2), 15–11. https://doi.org/10.1177/2319714520923579

Altenburg, T. (2000). Linkages and Spill–Overs between Transnational Corporations and Small and Medium–Sized Enterprises in Developing Countries: Opportunities and Policies. Reports and Working Papers of. German Development Institute https://www.files.ethz.ch/isn/28039/2000–05.pdf.

Ashyrov, G., & Masso,J. (2020). Does corruption affect local and foreign–owned companies differently? Evidence from the BEEPS survey. Post Commun. Econ., 32(3), 306–329.

Aslund, A. (2018). What happened to the economic convergence of Central and Eastern Europe after the global financial crisis? Comp. Econ. Stud., 60(2), 254–270. https://doi.org/10.1057/s41294–018–0060–x

Athreye, S., Batsakis, G., & Singh, S. (2016). Local, global, and internal knowledge sourcing: the trilemma of foreign–based R&D subsidiaries. J. Bus. Res., 69(12), 5694–5702. https://doi.org/10.1016/jJbusres.2016.02.043

Audretsch, D.B., Heger, D., & Veith, T. (2015). Infrastructure and entrepreneurship. Small Bus. Econ., 44(2), 219–230.

Awate, S., Larsen, M. M., & Mudambi, R. (2015). Accessing vs sourcing knowledge: a comparative study of R&D internationalization between emerging and advanced economy firms. J. Int. Bus. Stud., 46(1), 63–86. https://doi.org/10.1057/jibs.2014.46

Belderbos, R., Carree, M., Diederen, B., Lokshin, B., & Veugelers, R. (2004). Heterogeneity in R&D cooperation strategies. Int. J. Ind. Organ., 22(8–9), 1237–1263. https://doi.org/10.1016/j.ijindorg.2004.08.001

Belderbos, R., Du, H. S., & Goerzen, A. (2017). Global cities, connectivity, and the location choice of MNC regional headquarters. J. Manag. Stud., 54(8), 1271–1302. https://doi.org/10.1111/joms.12290

Berger, M., & Diez, J. R. (2008). Can host innovation systems in late industrializing countries benefit from the presence of transnational corporations? Insights from Thailand’s manufacturing industry. Eur. Plann. Stud., 16(8), 1047–1074. https://doi.org/10.1080/09654310802315708

Bernal, P., Carree, M., & Lokshin, B. (2022). Knowledge spillovers, R&D partnerships and innovation performance. Technovation, 115, Article 102456.

Bertrand, O. (2009). Effects of foreign acquisitions on R&D activity: evidence from firm–level data for France. Res. Pol., 38(6), 1021–1031. https://doi.org/10.1016/j.respol.2009.03.001

Berulava, G., & Gogokhia, T. (2016). On the role of in–house R&D and external knowledge acquisition in firm’s choice for innovation strategy: evidence from transition economies. Bull. Georg. Nat. Acad. Sci., 10(3).

Blažek, J., & Csank, P. (2016). Can emerging regional innovation strategies in less developed European regions bridge the main gaps in the innovation process? Environ. Plann. C Govern. Pol., 34(6), 1095–1114. https://doi.org/10.1177/0263774X15601680

Blomström, M., & Kokko, A. (2002). FDI and human capital: a research agenda. In OECD Working Paper No. 195. https://www.researchgate.net/profile/Ari–Kokko/publication/5204378_FDI_and_Human_Capital_A_Research_Agenda/links/0fcfd509287b97bc3a000000/FDI–and–Human–Capital–A–Research–Agenda.pdf.

Cantwell, J. A., & Mudambi, R. (2011). Physical attraction and the geography of knowledge sourcing in multinational enterprises. Global Strat. J., 1(3–4), 206–232. https://doi.org/10.1002/gsj.24

Cantwell, J., & Piscitello, L. (2002). The location of technological activities of MNCs in European regions: the role of spillovers and local competencies. J. Int. Manag., 8(1), 69–96. https://doi.org/10.1016/S1075–4253(01)00056–4

Cappellari, L., & Jenkins, S. P. (2003). Multivariate probit regression using simulated maximum likelihood. STATA J., 3(3), 278–294.

Castellani, D., & Lavoratori, K. (2020). The lab and the plant: offshore R&D and co–locationwith production activities. J. Int. Bus. Stud., 51(1), 121–137. https://doi.org/10.1057/s41267–019–00255–3

Chen, C. L., & Vickerman, R. (2018). Can transport infrastructure change regions’ economic fortunes? Some evidence from Europe and China. In Transitions in Regional Economic Development (pp. 257–286). Routledge.

Choi, J., & Choi, J. Y. (2021). The effects of R&D cooperation on innovation performance in the knowledge–intensive business services industry: focusing on the moderating effect of the R&D–dedicated labor ratio. Technol. Anal. Strat. Manag., 33(4), 396–413.

Cozza, C., Franco, C., Perani, G., & Zanfei, A. (2021). Foreign vs. domestic multinationals in R&D linkage strategies. Ind. Innovat., 1–24. https://doi.org/10.1080/13662716.2020.1865133

David, P., Yoshikawa, T., Chari, M. D., & Rasheed, A. A. (2006). Strategic investments in Japanese corporations: do foreign portfolio owners foster underinvestment or appropriate investment? Strat. Manag. J., 27(6), 591–600. https://doi.org/10.1002/smj.523

Davis, L. N., & Meyer, K. E. (2004). Subsidiary research and development, and the local environment. Int. Bus. Rev., 13(3), 359–382. https://doi.org/10.1016/j.ibusrev.2003.06.003

Demirbag, M., & Glaister, K. W. (2010). Factors determining offshore location choice for R&D projects: a comparative study of developed and emerging regions. J. Manag. Stud., 47(8), 1534–1560. https://doi.org/10.1111/j.1467–6486.2010.00948.x

Egan, P. J. (2018). Globalizing Innovation: State Institutions and Foreign Direct Investment in Emerging Economies. MIT Press.

Falaster, C., & Ferreira, M. P. (2020). Institutional factors and subnational location choice for multinationals' R&D subsidiaries. Innovat. Manag. Rev., 17(4), 351–367. https://doi.org/10.1108/INMR–08–2019–0102

Garcia Sánchez, A., Molero, J., & Rama, R. (2016). Are ‘the best’ foreign subsidiaries cooperating for innovation with local partners? The case of an intermediate country. Sci. Publ. Pol., 43(4), 532–545. https://doi.org/10.1093/scipol/scv057

Garcia, F., Jin, B., & Salomon, R. (2013). Does inward foreign direct investment improve the innovative performance oflocal firms? Res. Pol., 42(1), 231–244.

https://doi.org/10.1016/j.respol.2012.06.005

Girma, S., Gong, Y., & Görg, H. (2008). Foreign direct investment, access to finance, and innovation activity in Chinese enterprises. World Bank Econ. Rev., 22(2), 367–382. https://doi.org/10.1093/wber/lhn009

Grillitsch, M., Martin, R., & Srholec, M. (2017). Knowledge base combinations and innovation performance in Swedish regions. Econ. Geogr., 93(5), 458–479. https://doi.org/10.1080/00130095.2016.1154442

Gogokhia, T., & Berulava, G. (2021). Business environment reforms, innovation and firm productivity in transition economies. Eurasian Bus. Rev., 11(2), 221–245.

Grosse, R. (2019). Innovation by MNEs in emerging markets. Transnatl. Corp., 26(3), 1–32. https://unctad.org/system/files/official–document/diaeia2019d3a1_en.pdf.

Guimoan, J., & Salazar–Elena, J. C. (2015). Collaboration in innovation between foreign subsidiaries and local universities: evidence from Spain. Ind. Innovat., 22(6), 445–466. https://doi.org/10.1080/13662716.2015.1089034

Hang, C. C., & Chen, J. (2021). Innovation management research in the context of developing countries: analyzing the disruptive innovation framework. Int.J. Innovat. Stud., 5(4), 145–147. https://doi.org/10.1016/j.ijis.2021.09.001

Holl, A., & Rama, R. (2014). Foreign subsidiaries and technology sourcing in Spain. Ind. Innovat., 21(1), 43–64. https://doi.org/10.1080/13662716.2014.879254

Ito, B., & Wakasugi, R. (2007). What factors determine the mode of overseas R&D by multinationals? Empirical evidence. Res. Pol., 36(8), 1275–1287. https://doi.org/10.1016/j.respol.2007.04.011

Jurajda, S., Kozubek, S., Munich, D., & Skoda, S. (2017). Scientific publication performance in post–communist countries: still lagging far behind. Sciento–metrics, 112(1), 315–328. https://doi.org/10.1007/s11192–017–2389–8

Kalayci, E., & Pamukçu, M. T. (2011). Analysis of foreign ownership, R&D and spillovers in developing countries: evidence from Turkey. In Economic Research Forum for the Arab Countries. Iran and Turkey (ERF). Working Paper Series (No. 642) http://erf.org.eg/wp–content/uploads/2014/08/642.pdf.

Kim, H., Kim, H., & Lee, P. M. (2008). Ownership structure and the relationship between financial slack and R&D investments: evidence from Korean firms. Organ. Sci., 19(3), 404–418. https://doi.org/10.1287/orsc.1080.0360

Knell, M., & Srholec, M. (2005). Innovation Cooperation and Foreign Ownership in the Czech Republic. Norwegian Institute for Studies in Innovation, Research and Education (NIFU–STEP) https://www.fm–kp.si/Files/File/Konference/EIIE 2006/Knell.pdf.

Kovac, D., Scrbec, N., & Podobnik, B. (2018). Does it payoff to research economics–a tale of citation, knowledge and economic growth in transition countries. Phys. Stat. Mech. Appl., 505, 293–305. https://doi.org/10.1016/j.physa.2018.02.171

Kumar, N., & Aggarwal, A. (2005). Liberalization, outward orientation and R&D behaviour of local firms and MNE affiliates: a quantitative exploration. Res. Pol., 34(4), 441–460. https://doi.org/10.1016Zj.respol.2005.01.010

Kuncoro, A. (2012). Globalization and innovation in Indonesia: Evidence from micro–data on medium and large manufacturing establishments. In ERIA Discussion Paper, (2012–09).

Kwon, H. U., & Park, J. (2018). R&D, foreign ownership, and corporate groups: evidence from Japanese firms. Res. Pol., 47(2), 428–439. https://doi.org/10.1016/j.respol.2017.11.010

Le Bas, C., & Sierra, C. (2002). ‘Location versus home country advantages’ in R&D activities: some further results on multinationals’ locational strategies. Res. Pol., 31(4), 589–609. https://doi.org/10.1016/S0048–7333(01)00128–7

Liu, X., Lu, J., Filatotchev, I., Buck, T., & Wright, M. (2010). Returnee entrepreneurs, knowledge spillovers and innovation in high–tech firms in emerging economies. J. Int. Bus. Stud., 41(7), 1183–1197. https://doi.org/10.1057/jibs.2009.50

Mali, F. (1998). The eastern European transition: barriers to cooperation between university and industry in post–communist countries. Ind. High. Educ., 12(6), 347–356. https://doi.org/10.1177/095042229801200604

Männasoo, K., & Meriküll, J. (2020). Credit constraints and R&D over the boom and bust: firm–level evidence from central and eastern Europe. Econ. Syst., 44(2), Article 100747. https://doi.org/10.1016/j.ecosys.2020.100747

Medvedeva, T. A. (2012). Developing an innovative style of thinking and innovative behavior. Syst. Pract. Action Res., 25(3), 261–272. https://doi.org/10.1007/s11213–011–9221–9

Meyer, K. E., & Sinani, E. (2009). When and where does foreign direct investment generate positive spillovers? A meta–analysis. J. Int. Bus. Stud., 40(7), 1075–1094. https://doi.org/10.1057/jibs.2008.111

Mishra, V., & Smyth, R. (2014). Technological change and wages in China: evidence from matched employer–employee data. Rev. Dev. Econ., 18(1), 123–138. https://doi.org/10.1111/rode.12073

Mussagulova, A. (2021). Newly independent, path dependent: the impact of the Soviet past on innovation in post–Soviet states. Asia Pac.J. Publ. Adm., 43(2), 87–105. https://doi.org/10.1080/23276665.2020.1805338

Narula, R., & Guimon, J. (2010). The R&D activity of multinational enterprises in peripheral economies: evidence from the EU new member states. In UNU– MERIT Working Papers. https://www.researchgate.net/publication/46433655_The_RD_activity_of_multinational_enterprises_in_peripheral_economies_

evidence_from_the_EU_new_member_states/link/09e4150d83c8f868ee000000/download.

Nazarov, Z., & Obydenkova, A. V. (2020). Democratization and firm innovation: evidence from European and Central Asian post–communist states. Post Commun. Econ., 32(7), 833–859. https://doi.org/10.1080/14631377.2020.1745565

Papava, V. (2018). Catching up and catch–up effect: economic growth in post–communist Europe (lessons from the European union and the eastern partnership states). Eur. J. Econ. Stud., 7(2), 109–125. https://doi.org/10.2139/ssrn.3253236

Peretz, H., & Morley, M. J. (2021). A preliminary test of the impact of de–globalization on MNC performance. Manag. Organ. Rev., 17(2), 412–428. https://doi.org/10.1017/mor.2021.20

Perugini, C., Pompei, F., & Signorelli, M. (2008). FDI, R&D and human capital in Central and Eastern European countries. Post Commun. Econ., 20(3), 317–345. https://doi.org/10.1080/14631370802281431

Plum, O., & Hassink, R. (2011). Comparing knowledge networking in different knowledge bases in Germany. Pap. Reg. Sci., 90(2), 355–371. https://doi.org/10.1111/j.1435–5957. https://doi.org/10.1111/j.1435–5957.2011.00362.x

Rapacki, R., Gardawski, J., Czerniak, A., Horbaczewska, B., Karbowski, A., Maszczyk, P., & Prochniak, M. (2020). Emerging varieties of post–communist capitalism in Central and Eastern Europe: where do we stand? Eur. Asia Stud., 72(4), 565–592. https://doi.org/10.1080/09668136.2019.1704222

Reddy, P. (2000). The Globalization of Corporate R&D: Implications for Innovation Systems in Host Countries. Routledge. https://doi.org/10.4324/ 9780203160534

Ruziev, K., & Webber, D. J. (2019). Does connectedness improve SMEs’ access to formal finance? Evidence from post–communist economies. Post Commun. Econ., 31(2), 258–278. https://doi.org/10.1080/14631377.2018.1470855

Santangelo, G. D., Meyer, K. E., & Jindra, B. (2016). MNE subsidiaries’ outsourcing and insourcing of R&D: the role of local institutions. Global Strat.J., 6(4), 247–268. https://doi.org/10.1002/gsj.1137

Sasidharan, S., & Kathuria, V. (2011). Foreign direct investment and R&D: substitutes or complements–a case of Indian manufacturing after 1991 reforms. World Dev., 39(7), 1226–1239. https://doi.org/10.1016/j.worlddev.2010.05.012

Smeets, R., & de Vaal, A. (2016). Intellectual Property Rights and the productivity effects of MNE affiliates on host–country firms. Int. Bus. Rev., 25(1), 419–434. https://doi.org/10.1016/j.ibusrev.2015.08.004

Un, C. A., & Cuervo–Cazurra, A. (2008). Do subsidiaries of foreign MNEs invest more in R&D than domestic firms? Res. Pol., 37(10), 1812–1828. https://doi.org/10.1016/j.respol.2008.07.006

Veugelers, R. (1997). Internal R D expenditures and external technology sourcing. Res. Pol., 26(3), 303–315. https://doi.org/10.1016/S0048–7333(97)00019–X

Veugelers, R., & Cassiman, B. (2004). Foreign subsidiaries as a channel of international technology diffusion: some direct firm level evidence from Belgium. Eur. Econ. Rev., 48(2), 455–476. https://doi.org/10.1016/S0014–2921(02)00327–6

Veugelers, R., & Cassiman, B. (2005). R&D cooperation between firms and universities. Some empirical evidence from Belgian manufacturing. Int. J. Ind. Organ., 23(5–6), 355–379.

Yip, G., & McKern, B. (2014). Innovation in emerging markets–the case of China. Int.J. Emerg. Mark., 9(1), 2–10. https://doi.org/10.1108/IJoEM–11–2013–0182

Official link to the article:

Yurevich M.A., Simachev Yu.V., Kuzyk M.G., Fedyunina A.A. R&D synergy between local and foreign-owned enterprises in post-communist economies // «International Journal of Innovation Studies», 2023, No. 7, Pp. 101–114.