Introduction

The modern world economy is experiencing a slowdown in its pace of economic growth, as production growth rate is declining dramatically in comparison with previous decades. Recent global events related to the coronavirus pandemic, the fall in oil prices, and the shutdown of enterprises are threatening to exacerbate this trend.

Such a situation is likely to have the gravest effect on the territories that lie outside economic activity hubs and whose catch–up development is the responsibility of regional authorities. More than half a century of international experience in various countries has shown that there exist certain effective tools to achieve rapid economic growth. Suffice it to recall the following examples: reconstruction of the economies of Germany, Austria, France, the USSR, and others that were destroyed during the war; economic development of the countries of Eastern and Central Europe after their accession to the EU; and the Asian economic miracle. Despite the differences these countries may have, their development strategies share common features related to the implementation of institutional reforms and regional development policies [1].

World practice has shown that to address issues related to economic development of territories in conditions of cultural, institutional and technological restrictions it is necessary to have a system of special institutions that can implement non–standard schemes for regional development projects. Thanks to this policy, growth points can be created in the regions that have a large economic multiplier and generate growth in related industries, thereby initiating significant economic activity. At present, Russia is in urgent need of effective mechanisms to launch regional economic growth. This need is caused, on the one hand, by a sluggish growth in previous years, on the other — by the necessity of equalizing development levels of the territories between which there already exists a huge gap that is increasing continuously. In this regard, the accumulated international experience in implementing progressive forms to boost regional economic growth can give Russia organizational benchmarks for establishing similar institutions on its territory, taking into account its national specifics. Obtaining these benchmarks involves taking a closer look into the available range of regional development institutions (RDIs) [1]. In this regard, the goal of our present paper is to search for and study modern literature on the experience of the most promising RDIs for their subsequent adaptation in Russia.

Regional development institutions: general overview

Various RDIs have become an integral part of the administration system in any developed country. Being a tool of state innovation policy, they represent the standards of interaction between economic agents, and their application leads to a change in the state of the system [2]. By accumulating financial resources and redistributing them to the most promising projects, RDIs not only promote the evolution of economic sectors and the implementation of national strategies, but also help raise investment attractiveness of regions and address interregional differentiation issues [3].

To date, there is a whole range of classifications of RDIs based on different characteristics. In terms of the “founding principle” we can distinguish federal development institutions, federal development institutions at the regional level, and regional development institutions [4].

In international practice, the following RDIs are distinguished according to their functional features: financial that are responsible for additional financing of the regional financial market, infrastructure–related that deal with the implementation of regional infrastructure projects, industrial (innovative) development corporations whose goals are to support the industry in regions and promote innovation, expansionist development institutions that attract foreign investment and promote exports to ensure internationalization of regions, and specialized social funds involved in the development of territories [3].

According to the level of development and maturity of RDIs, there are competitive market institutions (CMIs) and catch–up development institutions (CUDIs) [1]. The first type includes institutions that provide a high quality of competitive environment and are typical of developed countries with a high level of civic culture. CUDIs are intermediate institutions and serve as drivers of rapid economic growth in developing countries in conditions of low quality of CMIs.

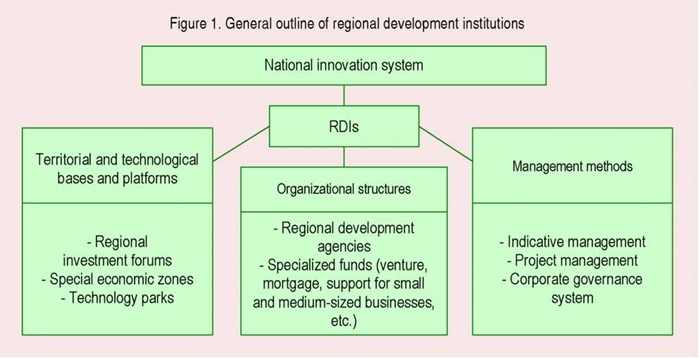

RDIs include elements such as organizational structures, various methods for managing socio–economic development of territories, and territorial and technological platforms and bases. The first of these three elements includes regional development agencies (corporations), regional mortgage and venture funds. The second one includes corporate management system, indicative planning, project management, etc. The third one includes regional investment forums (RIF), technology parks and special economic zones. The unifying feature of different RDIs is that they are all special institutions (rules for the interaction of market participants) created to accelerate economic development in individual regions of the country. The general outline of RDIs, which does not claim to be exhaustive, is shown in Figure 1.

Some of the abovementioned elements of RDIs are found more commonly in catch-up development institutions, due to this fact they have not been given due attention in the Western literature. In particular, we are talking about regional investment forums that have become widespread in Russia in recent decades. These structures are unique platforms where the demand for investment and its supply can easily meet from time to time. In developed countries, this mission is performed by financial institutions and stock exchange mechanisms; but as for developing countries, these institutions are not sufficiently mature there, leading to the necessity of searching for new forms of organizing the RIF–type investment market [5; 6].

We cannot say that such forums are a unique Russian innovation; similar events are regularly held in other countries, as well. For example, in 2020, a number of similar events were planned: the Global Investment Forum in Switzerland, the Alternative Investment Forum in Lithuania, the Responsible Investment Forum in the UK, the Selectusa Investment Summit in the U.S., the Private investment Forum Worldwide in Switzerland, etc. Russia did not just join the new institution, but became one of its first and most active operators.

To date, both positive and negative experience of RIF [2] activities in Russia has been noted. Thus, the most successful is the Saint Petersburg International Economic Forum, which since 2006 has been held under the patronage and with the personal participation of the President of the Russian Federation. According to the results of 2019, more than 19 thousand people from 145 countries attended the forum, more than 230 business events were held, and 745 investment agreements were signed for a total of 3.3 trillion rubles [3].

The success of RIF depends on many factors, including the support of federal and regional authorities, financial assistance from sponsors, coordination of dates, etc., this is why the “failure” of at least one of them can lead the forum to a fiasco. In Russia, examples of such unsuccessful initiatives include the Baikal Economic Forum, which was replaced by a more active Eastern Economic Forum, and the Tula Economic Forum held in 2006 and 2007. According to the results of the work of the Tula Economic Forum, 69 investment agreements were signed for a total of 275 billion rubles, which significantly exceeded the budget of the Tula Oblast for several years [7]; nevertheless, the forum ceased to exist in 2013 due to a decrease in investor activity [8]. However, these examples are not unique and are not typical only of Russia. For example, at the end of the past century, the government of the Republic of Bangladesh tried to attract foreign investment in the economy through investment forums and the attempts proved unsuccessful, because the exceedingly ambitious goals of the planned events and their extensive agendas raised distrust in investors and became the reasons why the initiative failed [9].

Another element of RDIs is indicative planning (IP). In the context of insufficiently developed institutional environment and a low level of culture and technology, IP is an institution that becomes the main driver of national economic modernization and promotes the improvement of competitive market institutions [1; 10].

The modern indicative planning system consists in the activity of state bodies aimed at drawing up medium– and long–term plans for the country’s territorial and industry–specific development; the plans are based on large–scale projects for modernizing its individual regions and industries [11]. IP was widely used in the post–war period in Japan, France, South Korea, and the United States; today, it is successfully used in Ireland, India, Saudi Arabia, Malaysia and China, where it carries out macroeconomic planning while maintaining the independence of enterprises and the dominance of the public sector in the economy [1; 11; 12]. The use of IP in the Republic of Tatarstan allowed the region to become one of the leading Russian regions in terms of economic development and investment attractiveness [13; 14].

It should be noted that the RDI management institutions provide methodological support for planned projects. For example, a set of analytical tools that helps adequately evaluate comprehensive projects for the purpose of their subsequent selection and preparation of regional development plans is one of relevant issues in this regard. However, it is a topic for a separate study and lies beyond the scope of our present paper.

The types of RDIs considered above are widely distributed in both developed and developing countries. In our opinion, project management (PM) and regional development agencies (RDAs) are the most interesting and important ones among them; thus, we shall study them in more detail. We have chosen these institutions, because they are different, but complement each other at the same time. While the former are aimed at implementing super–large–scale initiatives that can become growth points in a particular region, the latter are designed to build a business network in a region so as to promote the stability of the positive growth impulses that have emerged. At the same time, here and further, we shall consider the term “region” in a broad sense, i.e. as a certain part of a country’s territory that has sufficient administrative and economic independence.

Project management as an institution of regional development

Project management emerged in the 1960s and became widespread at the end of the past century. It replaced the then popular New Public Management concept, because it had its shortcomings such as an inefficient combination of process activity with program–target planning [15]; besides, it advocated the prevalence of economic efficiency over social justice and morality, thus conflicting with the principles of democracy [16].

The management model named Good Governance was designed to eliminate those shortcomings and become not only the best option for organizing public administration, but also the main factor in alleviating poverty [17; 18]. It marked the beginning of the use of program–target approach in various spheres, in particular in the Russian budget sector reform [19], in the framework of which the PM principle that considers the state program as a system of projects aimed at its implementation has become widespread [4] [20].

Since then, the interest in PM has been continuously increasing among both managers and researchers. Thus, according to the ScienceDirect database, which is owned by Elsevier, one of the world’s largest publishing houses, and which contains about 2.5 thousand scientific publications and 26 thousand e–books [5], the number of articles in scientific journals that are more or less related to project management was 19.5 thousand, while their annual number increased 3.8–fold in the period from 1996 to 2019 (Tab. 1). The total number of articles devoted to this topic in all sources contained in ScienceDirect (books, abstracts, encyclopedias, reports, etc.) for the period under consideration is 36.1 thousand.

Table 1. Number of scientific articles in journals registered in the ScienceDirect database in 1996–2019, units

|

Year |

Number |

Year |

Number |

Year |

Number |

Year |

Number |

|

2019 |

1649 |

2013 |

1239 |

2007 |

607 |

2001 |

350 |

|

2018 |

1451 |

2012 |

1012 |

2006 |

562 |

2000 |

353 |

|

2017 |

1517 |

2011 |

858 |

2005 |

506 |

1999 |

349 |

|

2016 |

1532 |

2010 |

685 |

2004 |

429 |

1998 |

372 |

|

2015 |

1630 |

2009 |

675 |

2003 |

412 |

1997 |

350 |

|

2014 |

1491 |

2008 |

640 |

2002 |

364 |

1996 |

438 |

|

Compiled with the use of ScienceDirect data. |

|||||||

The subject matter of scientific research in the years under consideration has also undergone significant changes. Thus, at the initial stage, the study of theoretical aspects of PM prevailed: relationship between the project and project management [21]; combination of a wide range of modern projects and various management styles [22]; possibilities of using PM in various fields such as medicine [23], designing production systems [24], entertainment industry [25], etc.; implementation of modern concepts and methods of project management in different countries, such as China [26], Russia [27], etc.

More recent studies have focused on empirical research, such as the results of the use of PM standards at German and Swiss enterprises [28] or the experience of its implementation in 30 metalworking companies in Portugal [29], as well as the identification of criteria for best management practices based on the performance of company managers [30]. Comparative analysis of PM implementation has been developed in various industries [31; 32] and in countries with different mentalities and cultures [33; 34]. Modern research in the field of PM is devoted to the effectiveness of its tools and its impact on territorial socioeconomic development.

Project financing (PF) is recognized as one of the most effective tools in project management. The term has no unambiguous definition yet. According to some authors, the essence of PF is most fully revealed in a definition provided by the Basel Committee on Banking Supervision which operates under the Bank for International Settlements. According to the definition, PF should be understood as a special way to attract funds for a specific long–term investment project (usually large, complex and expensive one) secured by future cash flows from its implementation [35; 36]. Others consider PF as “a multi–tool financing scheme, designed specifically for the implementation of a company’s project, and the future cash flows of the project under this scheme will be the main source for ensuring repayment of borrowed funds and payment of income to investors” [37, p. 55]. Still others perceive PF as “a way to attract long–term credit financing for large projects through “financial engineering” based on borrowing for the cash flow generated only by the project itself”’ [38, p. 14].

Despite the variety of definitions found in scientific literature, the examples given above prove that they are all essentially identical and reflect the following main features of PF: it is implemented for a particular project, usually a new one; it is characterized by high risks due to the lack of assets to secure the repayment of borrowed funds; a future cash flow from the project acts as a guarantee of return of the funds.

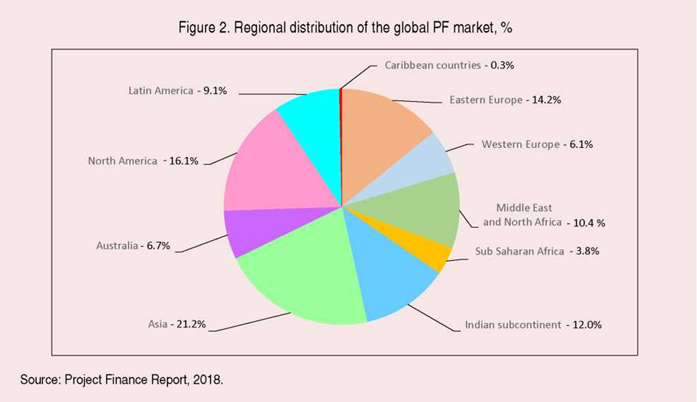

The modem practice of PF originated in the 1930s with the financing of oil exploration in the U.S. [39], but it became widespread at the end of the 20th century — first in major American energy projects and then in the field of public infrastructure in the UK and mobile phone communications around the world [38]. In 22 years (from 1991 to 2012), the U.S. allocated more than 2.5 trillion US dollars to finance about 6 thousand international projects [40]. In 2008, there began a vigorous redistribution of projects toward the Asian subcontinent [39]. Consequently, at the beginning of 2018, Asia became one of the leaders in the global PF market (Fig. 2). In general, the global volume of PF at the end of 2017 amounted to 338.5 billion US dollars [6].

Today, PF is viewed as a high–quality financial instrument that enables better investment management and economic growth. For example, the positive impact of PM on socioeconomic development in European countries is shown with the help of econometric models [41]. In turn, the analysis of 90 countries for the period from 1991 to 2005 using the neoclassical growth model has shown that the strongest effect of PF is observed in low–income countries, which, according to the study [42], can receive up to 0.67% of annual GDP growth if their project financing level increases from the 25th percentile of the sample to the 75th.

In Russia, the interest in PF, which has not yet become a widely used tool, is increasing continuously. In particular, this can be seen in the growing number of publications devoted to this topic. Thus, according to the electronic library eLIBRARY.RU, the number of articles on PF in scientific journals increased 87.5–fold from 2000 to 2019: from 2 to 175, respectively. Their total number for the specified period was 1.2 thousand. Despite a fairly modest amount of works that analyze the empirical experience of implementing PF in Russia and its relationship to economic growth and development of territories, the available publications can help us point out the most promising areas of its application. These include construction, infrastructure, and the fuel and energy complex.

Many studies have noted that despite Russia’s participation in major international projects such as Sakhalin–2, Yamal–LNG, Nord Stream, and others, its PF is in the state of stagnation due to a variety of reasons, mainly the insufficiency and fragmentation of the legislative base in the sphere [37], Russia’s general macroeconomic situation flawed by elements of slackness and investment stagnation [43]; declarative governmental decisions in the field of project activities taken in 2014–2016 [13].

Global PM practice has already proven its worth (it is enough to recall such large–scale projects as the Suez Canal, the Sydney Opera House, the Concorde supersonic airliner, etc.), but there still remain certain questions concerning the effectiveness of the projects. For example, the opening of the famous opera house in Sydney undoubtedly influenced the city’s further development. Being one of the landmarks of Australia, the theater is annually visited by about two million people, and an infinite number of tourists take a selfie in front of it. However, this super–successful project was close to complete failure at the stage of its implementation: its construction timing was delayed by 14 years instead of the planned four years, and the cost sheet exceeded the planned one by almost 15 times [7].

Another example is the famous Olympic stadium in Montreal an amazing architectural structure that is still not only one of the largest sports venues in Canada, but also the main attraction of Montreal. Its 175i meter tower, tilted at an angle of 45 degrees, offers an extraordinary view of the surrounding area, which can be admired after getting via the funicular to the observation platform located on the top of the tower. However, the famous Canadian stadium is also one of the most disastrous projects: its construction, which was planned to be completed in 1972, stretched for almost 20 years, and the original estimate of 134 million US dollars at the time of opening the stadium in an incomplete form to host the 1976 Olympics was exceeded by 8.2 times, thus creating a large hole in the city’s budget for 30 years [44]. The total cost, including the subsequent construction and reconstruction of the stadium, was 1.4 billion US dollars [8].

These cases are not unique: cost overruns in the construction of the Concorde supersonic airliner amounted to 1,100%, the Suez Canal — 1,900%, the Hubble Telescope — 525%, the Humber Bridge in the UK — 175%, etc. [9] The projects that have changed the course of world history in the long term can be viewed as a clear example of ineffective management at the stage of their planning and implementation [10].

All this makes it possible to conclude that PM is a labor–intensive process, associated with high risks and complexity of the tasks at hand. However, this practice makes it possible to achieve economic breakthrough and bring countries to a new level of development. The experience of “economic miracle” countries (China, Vietnam, Malaysia, etc.) confirms that the breakthrough effect is possible only through the implementation of megaprojects that contribute to the technological breakthrough and acceleration of economic growth. Catchup development institutions play a key role in enabling such a breakthrough, as noted earlier [1; 10].

There are reasons to believe that the reform of the state system of project activities carried out in Russia in 2018–2019 may become a significant step toward the formation of similar institutions in our country [13]. In particular, in 2018, the Government of the Russian Federation issued Resolution No. 158 dated February 15, 2018 “On the Project Finance Factory program”, which defines the mechanism for financing investment projects in order to ensure economic growth and increase the availability of this tool in Russia. The Ministry of Economic Development of the Russian Federation is the chief curator of the Project Finance Factory, Vnesheconombank (VEB) is the operator, acting not only as an accumulator of state guarantees and subsidies received from the Ministry of Finance of the Russian Federation, but also as an expert in the selection of investment projects for participation in the program. The launched mechanism actually reconfigures the architecture of PM in Russia, contributing to the transformation of the state from an ordinary participant into an actual driver of PF [43] and thereby contributing to its becoming a key tool for the implementation of national projects [13; 45].

Regional development agencies: opportunities and risks

According to the European Association of Development Agencies (EURADA), Regional development agencies are public–private legal entities, established between the national and the local level, with the intention of working through different channels with private companies, public institutions, and civil society towards the attainment of improved economic development [11].

The legal status of RDAs differs in almost all European countries. RDAs are semi– autonomous public corporations in Germany, public–private sector corporations in the Czech Republic, Estonia, Slovakia and Poland, intermunicipal agencies in Spain, private legal nongovernmental organizations in France, public limited liability companies in the Netherlands, Italy, Ireland and Portugal, non–departmental non-governmental organizations in the UK, limited liability companies in Sweden, nonprofit organizations in Latvia, municipal enterprises in Greece [46].

Despite the fact that the organizational and legal models of RDAs are as diverse as the countries to which they belong, modern researchers identify a number of specific criteria for a typical RDA, as well as environmental factors crucial to the success of its activities in the region. The specific criteria include the following: the agency’s semi–autonomous position in relation to central authorities, strategic support provided to local firms through soft policy tools, and comprehensive support using a wide range of policy tools [47]. The success factors include a fairly large population, the region’s entrepreneurial potential, skilled labor force, and a consensus on a local/regional development strategy [48].

The progenitor of modern RDAs is considered to be the Tennessee Valley Authority created in the U.S. in 1933 to address issues related to the economic development of the Tennessee Valley, the region most affected by the Great Depression [49]. The establishment of the Authority actually determined the main goal of all subsequent RDA activities — to contribute to the socio–economic development of a particular territory. Despite the overall goal of RDAs, the tasks to achieve it varied depending on the political and economic goals of the state and the specifics of the time in which they were developed. In this regard, we will consider three types of RDAs, which differ in functional characteristics.

1. RDAs to ensure regional leveling within the country. This type includes RDAs that address issues of development of a separate territory and regional leveling within the country. The history of their formation dates back to the 1960s and 1970s, when the regional administration of Western Europe began to change due to the transition from the traditional “top–down” policy to the “bottom–up” policy and the increasing role of agencies that are not part of the government machinery. Traditional policies based on the attempts of the central government to promote equality between regions by increasing the economic activity of underperforming areas using the “carrot and stick” method and relying on “hard” tools such as infrastructure development and financial subsidies, did not allow achieving the intended goals, and one of the reasons was the lack of understanding of the specific features of a particular territory.

The new model of regional policy coming from the regions themselves (from the bottom up), was aimed at developing and improving the competitiveness of local firms and was implemented using “soft” tools, such as personnel training and consulting. To implement this kind of policy, regions needed some structures on site; the structures had a certain degree of independence from the central government and could act as an intermediary between the region and the government: on the one hand they transferred the interests of the region “upward”, on the other hand they served as a conductor of funds allocated “from above” for the development of the territory. The role of such structures was performed by RDAs created at that time, and their primary task was to level the development of regions within the country [50; 51].

The process of creating RDAs during that period extended not only to European countries such as the Netherlands, Austria, Denmark, and Scotland [51; 52], but also to other developed countries. For example, in Australia, RDAs were implemented in the form of nongovernmental land agencies, they aimed to develop regions by selling land to governmental structures and participating directly in housing construction; in Canada, the Department of Regional Economic Expansion was formed, which after a series of mergers and transformations was reformed into the Canada Economic Development for Quebec Regions in 2005 [53; 54].

Studies of that period show that most of RDAs were focused not so much on increasing the investment attractiveness of the region, as on strengthening the competitiveness of local firms and addressing employment issues in a particular territory [47]. However, over time, their activities shifted toward promoting the region as a point for the inflow of investment in the modernization of production and the development of high–tech industries.

For example, the first RDA in Scotland, the Highlands and Islands Development Board, was established in 1965. One of its tasks was to distribute state subsidies for the economic and cultural development of the sparsely populated northwestern territory of the country. In 1975, a similar body was formed for the lowlands of Scotland — the Scottish Development Agency (SDA), headed by an independent board and funded by the Scottish Office of the UK Department of Trade and Industry. SDA was initially focused on supporting local firms by providing capital and restructuring traditional industry sectors. Up to 75% of all investment was made in traditional Scottish industries (engineering, textiles, food processing, etc.). This policy effectively addressed the challenges of maintaining regional employment, but did little to promote progressive sectoral changes in the economy. In this regard, in the early 1980s, there was a revision of SDA’s strategy toward a venture approach focused on new high–tech firms; this measure led to the redistribution of investment in advanced industries (electronics, biotechnology, etc.) from 25 to 50%. In addition, against the background of a general decline in the number of firms invested, the targeting of investments increased, SDA offices were established abroad to attract foreign capital, and there was a noticeable increase in consulting services (by almost 700% during the 1980s), especially in areas such as technology transfer and market intelligence [52].

In 1991, both organizations were transformed into non–departmental nongovernmental entities funded by the Scottish government: Highlands and Islands Enterprise (HIE) and Scottish Enterprise (SE), respectively, which together with the Scottish Development International (SDI) represent the modern RDA system in Scotland. Each structure oversees a specific region of Scotland: HIE — the North–West; SE — the Central, Southern and Eastern parts. SDI represents Scotland on the international market through an extensive network of representative offices in more than 20 countries.

According to HIE performance results in 2018–2019, 564 projects were supported for a total of 54.6 million pounds; as a result, more than 1,000 jobs were created, trade between supported enterprises increased by almost 118 million pounds, and international trade — by 46 million pounds per year [12]. The number of projects supported by SE over the same period was 69 for a total of 24.5 million pounds, of which the share of small and medium–sized enterprises in the region was 17.9 million [13]. In addition, SDI signed a number of strategic agreements with foreign investors and modern manufacturers; thus, new prospects in the development of high–tech industries opened up for the country. For example, a Strategic Alliance was signed with Boeing UK to develop and promote the supply chain of modern aircraft components, contributing to the creation of 200 new jobs in Scotland. One of the initial areas of work of the Alliance was to invest 11.8 million pounds in a project to develop an ultralight metal base for aircraft components, the project was implemented by a research center at the University of Strathclyde. In addition, contracts were signed with the U.S. cloud technology company Elcom Systems Limited that specializes in electronic procurement, the contracts aimed to expand the company’s activities in Glasgow; contracts were also signed with the U.S. space-to-cloud data and analytics company Spire with the goal of opening a new office in Scotland; these activities will not only promote the creation of new jobs in Scotland, but also enable the country to become a leader in research in the field of meteorology [14].

This innovative strategy contributes to the modernization of Scottish industry and its diversification associated with the transition to a high–tech economy and the development of industries such as the electrical industry, energy, and innovation technologies.

2. RDAs that provide economic leveling within an international association of countries. The second type of RDAs is agencies whose goal is to address regional differentiation between countries within the European Union. They emerged at the end of the 20th century, when the EU was being formed. In the transition to a market economy after the 1991 events many potential EU member states mainly in Central and Eastern Europe (CEE) faced a problem of considerable regional imbalances, and finding a solution to this problem was complicated by the lack of a clearly defined regional development policy and was considered within the framework of various macroeconomic strategies. By requiring EU candidate countries to create decentralized regional organizations that increase the territory’s potential and help reduce the differences between the level of development of EU member states, the European Commission actually motivated these states to adopt regional development policies within the framework of existing EU regulations and initiated the process of establishing RDAs on the territory of CEE [55]. In turn, the European Association of Development Agencies (EURADA), which was established in 1992 and which currently unites 76 RDAs from 22 EU countries, promoted the dissemination of best practices in regional economic development for the benefit of the entire European community and actively participated in the creation of agencies in CEE countries. In the 1990s, EU specialists established RDAs in Hungary, the Czech Republic, Poland, Slovakia, Estonia, Lithuania and other CEE countries [56].

Despite the fact that this group includes mainly RDAs from CEE countries, in which RDAs were founded due to the desire of these countries to join the EU, the group can also include EU member states, where RDAs have also played a significant role in alignment between nations. Portugal provides a telling example in this regard: the first RDA appeared there only in 1999. Created initially for the purpose of leveling regional imbalances within the country, they quickly shifted toward catchup development within the EU [57]. This gave a certain impetus to the country’s economic development, placing it on the 4th position among the OECD countries in terms of per capita GDP growth in the late 1990s and early 2000s. Thus, the ratio of Portugal’s per capita GDP to the European average increased from 73 to 77% over the period from 1998 to 2002 against the background of a rapid growth in this indicator in the Lisbon Region (from 95 to 105%) and in Madeira (from 58 to 90%) [15]. However, in the following years, GDP growth in Portugal experienced a pronounced slowdown; there was an annual decline in local and regional investment by an average of 1.4%, against the background of average European growth of 2.9% per year; intraregional differentiation has increased [58]. Modern Portuguese RDAs that are regulated as private legal entities implement regional policy according to the principles established by the central government, so the entire Portuguese RDA system can be described as predominantly centralized [16]. Although this policy contributes to regional leveling within the country, it does not allow Portugal to reduce the gap with advanced EU states: over the past years, the ratio of Portugal’s per capita GDP to the average European one has remained at 77% [17].

Over time, the process of establishing the RDA system in CEE countries, which initially contributed to their accession to the EU, has become an effective tool for the central government to implement regional strategies in many countries.

Thus, in Poland, RDAs began to be established at a rapid pace in 1991, when the first six such agencies appeared. During 1991i 1997, 33 RDAs were established, as well as more than 100 business support organizations (specialized funds, associations). They are essentially analogous to RDAs, but unlike RDAs they do not represent the authorities. Initially created to restructure unprofitable state–owned enterprises and support regions within the country, RDAs quickly turned into an instrument of international leveling. Today, RDAs in Poland are actively involved in the implementation of not only regional, but also innovation policy; this has helped reduce the country’s lagging behind the average European level in gross GDP from 46% in 2000–2002 to 71% in 2018 [18].

Romania provides another example of sufficiently effective integration of RDAs into the national innovation system [59]. Its accession to the list of candidate countries for EU membership in 1995 helped distinguish regional development policy from the general socio–economic course and make it an independent direction. The Green Carte of Regional Development created in 1997 marked the beginning of further actions to define the institutional and legislative framework in the field of regional policy, the final consolidation of which took place in 1998 with the adoption of a law on regional development [19] [49]. According to this document, the policy aimed to ensure balanced and sustainable economic growth and reduce regional disparities between individual regions, both within the country and between Romania and EU member states, should be implemented in specific regions through central government bodies and specialized regional bodies with the involvement of business partners. In the period from September 1998 to May 1999, Romania was divided into eight development regions; they were named on a geographical basis and did not receive an administrative status. The territorial division was introduced solely to improve the coordination of regional development projects and the management of funds received from the EU [20].

The current institutional framework for regional policy in Romania includes both the national level represented by the Ministry of Regional Development and Public Administration and the National Council for Regional Development, and the regional level, which includes RDAs and regional development councils. The National Council for Regional Development participates in the development of a national strategy for regional development, considers criteria and priorities for the use of the National Fund for Regional Development, and takes part in the approval of projects proposed by RDAs. Eight regional councils, which are voluntary associations of local governments without forming a legal entity, perform similar functions at the regional level [49].

Regional policy at the local level in Romania is carried out by RDAs, which are non–profit organizations that have a legal status (unlike councils) and operate within their own budget. Their tasks are to design development plans for their region in accordance with national strategies and distribute funds for specific regional projects from the budget that is financed from various sources: the National Fund for Regional Development, regional budgets, foreign investment, private sector funds, etc. [46].

The effectiveness of regional policy in Romania can be assessed on the basis of per capita GDP. Taking into account the fact that the main task of RDAs is to promote social and economic development of the territory, we can say that the growth of per capita GDP directly correlates with their activities [60]. Table 2 provides data on per capita GDP to assess the success of Romania’s integration into the EU.

Table 2. GDP per capita in the regions of Romania by PPP

|

Development region |

2004 |

2006 |

2018 |

|||

|

GDP per capita, PPP, EUR |

GDP per capita, % of EU average |

GDP per capita, PPP, EUR |

GDP per capita, % of EU average |

GDP per capita, PPP, EUR |

GDP per capita, PPP, % of EU average |

|

|

North–West |

7 093 |

33.0 |

8 500 |

35.9 |

18 500 |

61.0 |

|

Center |

7 629 |

35.5 |

9 100 |

38.3 |

18 800 |

62.0 |

|

North–East |

5 070 |

23.6 |

5 800 |

24.7 |

12 600 |

42.0 |

|

South–East |

6 612 |

30.7 |

7 700 |

32.5 |

16 500 |

55.0 |

|

South – Muntenia (Sud – Muntenia) |

6 111 |

28.4 |

7 600 |

32.1 |

15 400 |

51.0 |

|

Bucharest – Ilfov (Bucuresti – Ilfov) |

13 862 |

64.5 |

19 800 |

83.8 |

45 900 |

152.0 |

|

South–West Oltenia (Sud-Vest Oltenia) |

6 183 |

28.8 |

7 200 |

30.4 |

14 900 |

50.0 |

|

West |

8 395 |

39.0 |

10 600 |

44.7 |

20 500 |

78.0 |

|

Romania |

7 301 |

34.0 |

9 100 |

38.4 |

19 900 |

66.0 |

|

EU |

21 503 |

100.0 |

23 600 |

100.0 |

30 200 |

100.0 |

|

Compiled with the use of Eurostat data. |

||||||

We can note a positive trend in leveling off regional disparities between Romania and the EU countries. At the time of joining the EU in 2007, Romania’s per capita GDP was 38.4% of the European average, which is by 4.4 percentage points higher than two years earlier. At the same time, in the most developed region of the country (Bucharest–Ilfov), its value reached 83.8% of the EU level. Positive dynamics continued in the following years: despite the fact that Romania’s per capita GDP lagged considerably behind the EU average (66.0%) in 2018, its growth rate for the period under consideration was almost twice higher than the European average: 2.73% versus 1.40.

However, the implementation of a new regional policy in Romania has also revealed an unforeseen problem: along with the reduction in intergovernmental disparities in comparison with the EU member states, there has been an increase in economic and social inequality between regions within the country. Thus, the gap between the most developed region (Bucharest–Ilfov) and the least developed one (North–East) increased from 2.7 to 3.6 times. A similar increase in the gap between the center and the regions is observed in the rest of Romania; this allows us to conclude that the country is forming a concentric model of development under which the main resources are concentrated in a strictly limited area [61]. All of this suggests that although RDAs in Romania are an effective tool for equalizing disparities between nations, RDA activities require some adjustment in relation to the policy within the country in order to reduce the gap between regions. However, they will continue playing a crucial role in the economic development of regions and in the policy of regional decentralization, because the country’s economy depends on EU policy and its financial support.

3. RDAs that help the country join the world’s leading nations on the basis of the innovative economy. The third type of RDAs includes agencies that are one of the most effective tools in the CUDI system; they are used by almost all of the “economic miracle” countries (China, Malaysia, Vietnam, Botswana, etc.). As a rule, such agencies are general development agencies (GDAs) which coordinate the activities of all other elements of the CUDI system in the country [1; 10]. In most cases, GDA is a federal governmental structure responsible for national innovative development, taking into account the regional factor. For example, in China, GDA is represented by the National Development and Reform Commission which is responsible for designing long–, medium– and short–term development plans for the country at all levels, for their consistency with budgets and for coordinating the work of the national innovation system. In Malaysia, GDA is represented by the Economic Planning Unit; in Botswana — the Ministry of Finance and Development Planning, etc. [10]

The contribution of RDAs to rapid development of the abovementioned countries is determined by the role the agencies perform in the implementation of large–scale megaprojects to upgrade the economy, catch up with developed countries and achieve an “economic miracle”. RDAs help build trust between interacting agents, enhance the effectiveness of their interaction and thus help achieve their goals by coordinating the activities of all participants in the process of implementing a megaproject, starting with its selection by ministries and ending with the involvement of representatives of business structures and civil society in its implementation [13].

Thus, the study of practical experience in the functioning of RDAs has shown that although this tool is effective for leveling disparities both at the national level and in the cross–country context, it can contribute to the formation of a concentric development model in the country, when the main resources are concentrated in a strictly limited area.

In Russian scientific works, the practice of functioning of RDAs that are represented mainly in the form of regional development corporations (RDCs) has not yet become widespread due to their novelty and the insufficiency of their analytical framework. Thus, their history dates back to 2005, when the Far East Development Corporation was established. Despite the fact that RDCs should act as drivers of regional development, one cannot say they are implementing this mission quite successfully and in full. Some RDCs such as the Eastern Yakutia Development Corporation, the Republic of Buryatia Development Corporation, and the Republic of Tatarstan Development Corporation didn’t last even five years and were shut down. There are various reasons for the failures, ranging from the curtailment of investment projects, for which RDCs were created (for example, the project “Integrated Development of Tomponsky Mining District” in Yakutia), to the lack of a full exchange of information with the external environment, which generates managerial malpractices and inhibits regional initiatives [62].

However, there are also positive cases when RDCs successfully implement investment projects in their regions so as to contri ute to the development of the sectors and areas that are considered to be of high priority by the constituent entity of the Russian Federation. For example, the Development Corporation of Bashkortostan Republic (DCBR) is successfully engaged in investment projects in agriculture, petrochemicals, forestry, logistics, and tourism. With the participation of DCBR, large–scale projects have been implemented or are currently being implemented throughout the region. Such projects include the construction of a mining plant in the territory of Abzelilovsky District, a new chemical enterprise the Cosmetic and Textile-Processing Chemicals Plant in the city of Blagoveshchensk, “Ufimsky” Industrial Park, production of satinite in the town of Kumertau, modernization of the production of mechanization means and tools for installation of power lines, cable networks etc. The contribution of these projects alone to the region’s economy amounts to 2.12 billion rubles of investment with the creation of 424 additional jobs [21].

The experience of Russian RDAs has yet to be understood, and key factors for their success and reasons for failures are to be revealed. However, when working to expand and improve RDAs in Russia, one should take into account the foreign experience discussed in this paper.

Conclusion

The analysis of global practice has shown that powerful RDIs such as PM and the system of RDAs has already been created and tested. These institutions, when used effectively, can completely transform the economic landscape of cities and regions in many countries. Russia has already started introducing these institutions into practice, but so far neither PM nor RDAs are able to cope with their mission as drivers of the regional economy. However, there is reason to believe that these institutional initiatives will be expanded and improved in the future. For this purpose, the organizational and methodological experience of those countries that have been able to create effective RDIs can be useful.

Among other things, international experience shows that both PM and RDAs are not a cure–all for regional stagnation. Actually we are talking about the fact that their effective use involves considerable managerial skill. For example, many sites and facilities built with the use of PM, even in the case of a large long–term economic effect, have problems related to manifold underestimation of the amount of funding and the timing of implementation. As for RDAs, they are heterogeneous and functionally different: some are aimed at intraregional leveling, others — at reducing cross–national disparities, others — at catchup development and building an advanced economy. Of course, this division is conditional, because each RDA, as a rule, addresses all three types of problems. However, their certain specialization is still clearly visible; moreover, these tasks can come into conflict and cause negative side effects. Thus, the concentration of resources on the most promising limited territory can lead to the formation of a concentric model of development and to the growth of interregional disparities within the country. On the contrary, reallocation of funds to level up the underperforming regions can reduce the overall effectiveness of the national economy. There are also cases when addressing problems to boost regional growth contributes to the preservation of traditional industries and hinders the introduction of more modern types of business and related innovations.

The accumulated global experience in the emergence of issues and addressing them in the implementation of promising RDIs creates an information base for Russian operators and minimizes management errors.

References

1. Polterovich V.M. Institutions of catching–up development (on the project of a new model for economic development of Russia). Ekonomicheskie i sotsial’nye peremeny: fakty, tendentsii, prognoz=Economic and Social Changes: Facts, Trends, Forecast, 2016, no. 5 (47), pp. 34—56. DOI: 10.15838/esc.2016.5.47.2. (in Russian).

2. Popov E.V., Vlasov M.V., Simakhina M.O. Institutes of regional development of economy of knowledge. Regional’naya ekonomika: teoriya i praktika=Regional Economics: Theory and Practice, 2010, no. 4, pp. 2—7. (in Russian).

3. Tatarkin A.I., Kotlyarova S.N. Regional development institutions as an economic growth factors. Ekonomika regiona=Economy of Region, 2013, no. 3 (35), pp. 18–26. DOI: 10.17059/2013-3-1. (in Russian).

4. Balatsky E.V, Ekimova N.A., Yurevich M.A. Formation of regional development institutes in Russia. Munitsipal’naya akademiya=MunicipalAcademy, 2019, no. 3, pp. 95–100. (in Russian).

5. Balatsky E.V. Regional investment forums in Russia: Attractiveness assessment. Mir izmerenii=Measurements World, 2011, no. 11(129), pp. 42–50. (in Russian).

6. Balatsky E.V. Russian investment forums as the regional development institute. Zhurnal novoi ekonomicheskoi assotsiatsii=Journal of the New Economic Association, 2013, no. 2 (18), pp. 101–128. (in Russian).

7. Moiseev V.V., Nitsevich V.V., Nitsevich V.F. Power and business solutions to the problems of investments in Russia and the regions. Izvestiya Tul’skogo gosudarstvennogo universiteta. Gumanitarnye nauki=Bulletin of Tula State University. Humanities, 2013, no. 4, pp. 330–340. (in Russian).

8. Yurevich M. “Terminal diseases” of regional investment forums. Why they close. Kapital strany=Capital of the Country, 2016. Available at: http://kapital-rus.ru/articles/article/smertelnye_bolezni_regionalnyh_investicionnyh_forumov_pochemu_oni_zakryvaut/ (accessed: 18.04.2020). (in Russian).

9. Jasimuddin S. Foreign investment in Bangladesh: Character and perspective. Asian Affairs, 1994, vol. 25, pp. 163–168. DOI:10.1080/738552619.

10. Polterovich V.M. Federal development agency: It is necessary to design and implement successful strategies. Problemy teorii i praktiki upravleniya=Management of Theory and Practice, 2018, no. 3, pp. 35–41. (in Russian).

11. Polterovich V.M. Regional modernization institutions. Ekonomicheskaya nauka sovremennoi Rossii=Economics of Contemporary Russia, 2011, no. 4 (55), pp. 17–29. (in Russian).

12. Lugovskoi R.A., Tsvetkova T.B. Planirovanie i regulirovanie sotsial’no–ekonomicheskogo razvitiya Rossii [Planning and Management of Socio–Economic Development of Russia]. St. Petersburg: RGGMU, 2011. 110 p.

13. Polterovich V.M. Reform of the project activity state system, 2018–2019. Terra Economicus=Terra Economicus, 2020, vol. 18, no. 1, pp. 6–27. DOI: 10.18522/2073-6606-2020-18-1-6-27. (in Russian).

14. Vafin A.M. Indicative planning as an instrument of implementation of industrial policy in the region. Vestnik ekonomiki, prava i sotsiologii=The Review of Economy, the Law and Sociology, 2013, no. 2, pp. 32–35. (in Russian).

15. Charkina E.S. Razvitie proektnogo podkhoda v sisteme gosudarstvennogo upravleniya: metodologiya, opyt, problemy: Nauchnyi doklad [Development of Project Approach in Public Administration: Methodology, Experience, Problems. Science Research Report]. Moscow: IE RAN, 2017. 54 p.

16. Terry L. Administrative leadership, neo-managerialism, and the public management movement. Public Administration Review, 1998, vol. 58, iss. 3, pp. 194–200. DOI: 10.2307/976559.

17. Graham J., Amos B., Plumptre T. Principles for good governance in the 21–st century. Policy Brief, 2003, no. 15. Available at: https://docplayer.net/21638341-Policy-brief-principles-for-good-governance-in-the-21-st-century-policy-brief-no-15-august-2003-by-john-graham-bruce-amos-tim-plumptre.html

18. Argynades D. Good governance, professionalism, ethics and responsibility. International Review of Administrative Sciences, 2006, vol. 72, iss. 2, pp. 155–170. DOI: 10.1177/0020852306064607.

19. Smotritskaya I.I., Saginova O.V., Sharova I.V. State enterprising and development of the Russian economy. Vestnik Instituta ekonomiki RAN=The Bulletin of the Institute of Economics of the Russian Academy of Sciences, 2015, no. 1, pp. 97–108. (in Russian).

20. Vasilyev A.I., Prokofyev S.E. Project management organisation in public authorities. Upravlencheskie nauki=Management Science in Russia, 2016, vol. 6, no. 4, pp. 44–52. (in Russian).

21. Munns A.K., Bjeirmi B.F. The role of project management in achieving project success. International Journal of Project Management, 1996, vol. 14, iss. 2, pp. 81–87. DOI: 10.1016/0263-7863(95)00057-7.

22. Shenhar A.J., Driv D. Toward a typological theory of project management. Research Policy, 1996, vol. 25, iss. 4, pp. 607–632. DOI: 10.1016/0048-7333(95)00877-2.

23. Scott–Conner C.E.H., Grubbs M.R. Project management techniques applicable within the department of surgery. Journal of Surgical Research, 1996, vol. 65, iss. 1, pp. 87–91. DOI: 10.1006/jsre.1996.0348.

24. Ekmark U., Nelson J., Martensson N. The project management process in manufacturing systems engineering. CIRP Annals, 1997, vol. 46, iss. 1, pp. 339–342. DOI: 10.1016/S0007-8506(07)60838-5.

25. Hartman F., Ashrafi R., Jergeas G. Project management in the live entertainment industry: What is different? International Journal of Project Management, 1998, vol. 16, iss. 5, pp. 269–281. DOI: 10.1016/S0263- 7863(97)00056-2.

26. Yang M.L., Chuah K.B., Rao Tummala V.M., Chen E.H. Project management practices in Pudong, a new economic development area of Shanghai, China. International Journal of Project Management, 1997, vol. 15, iss. 5, pp. 313–319. DOI: 10.1016/S0263-7863(96)00084-1.

27. Voropajev V.I. Project management development for transitional economies (Russian case study). International Journal of Project Management, 1998, vol. 16, iss. 5, pp. 283–292. DOI: 10.1016/S0263-7863(97)00026-4.

28. Ahlemann F., Teuteberg F., Vogelsang K. Project management standards — Diffusion and application in Germany and Switzerland. International Journal of Project Management, 2009, vol. 27, iss. 3, pp. 292–303. DOI: 10.1016/j.ijproman.2008.01.009.

29. Pinto R., Domingues C. Characterization of the Practice of project management in 30 Portuguese metalworking companies. Procedia Technology, 2012, vol. 5, pp. 83–92. DOI: 10.1016/j.protcy.2012.09.010.

30. Alias Z., Baharum Z.A., Idris M.F. Project management towards best practice. Procedia — Social and Behavioral Sciences, 2012, vol. 68, pp. 108–120. DOI: 10.1016/j.sbspro.2012.12.211.

31. Graham R. Managing the project management process in aerospace and construction: A comparative approach. International Journal of Project Management, 1999, vol. 17, iss. 1, pp. 39–45. DOI: 10.1016/S0263-7863(97)00072-0.

32. Cooke–Davies TJ, Arzymanow A. The maturity of project management in different industries: An investigation into variations between project management models. International Journal of Project Management, 2003, vol. 21, iss. 6, pp. 471–478. DOI: 10.1016/S0263-7863(02)00084-4.

33. Chen P., Partington D. An interpretive comparison of Chinese and Western conceptions of relationships in construction project management work. International Journal of Project Management, 2004, vol. 22, iss. 5, pp. 397–406. DOI: 10.1016/j.ijproman.2003.09.005.

34. Bredillet C., Yatim F., Ruiz Ph. Project management deployment: The role of cultural factors. International Journal of Project Management, 2010, vol. 28, iss. 2, pp. 183–193. DOI: 10.1016/j.ijproman.2009.10.007.

35. Mullner J. International project finance: Review and implications for international finance and international business. Management Review Quarterly, 2017, vol. 67, iss. 2, pp. 97–133. DOI: 10.1007/s11301-017-0125-3.

36. Pereverzeva V.V., Yurieva T.V. Project finance in the project management system. ETAP: Ekonomicheskaya Teoriya, Analiz, Praktika=ETAP: Economic Theory, Analysis, and Practice, 2017, no. 5, pp. 36–45. (in Russian).

37. Nikonova I.A., Smirnov A.L. Proektnoe finansirovanie v Rossii. Problemy inapravleniya razvitiya [Project Financing in Russia. Problems and Directions of Development]. Moscow: Izdatel’stvo “Konsaltbankir”, 2016. 216 p.

38. Yescombe E.R. Printsipy proektnogo upravleniya [Principles of Policy and Finance]. Moscow: OOO “Al’pina Pablisher”, 2016. 408 p.

39. Esty B.C., Chavich C, Sesia A. An overview of project finance and infrastructure finance — 2014 update. Boston: Harvard Business School, 2014. 42 p.

40. Subramanian K.V., Tung F. Law and project finance. Journal of Financial Intermediation, 2016, vol. 25, pp. 154–177. DOI: 10.1016/j.jfi.2014.01.001.

41. Todorov T.S. Evaluating Project and program management as factor for socio–economic development within EU. Procedia — Social and Behavioral Sciences, 2014, vol. 119, pp. 819–828. DOI: 10.1016/j.sbspro.2014.03.092.

42. Kleimeier S., Versteeg R. Project finance as a driver of economic growth in low–income countries. Review of Financial Economics, 2010, vol. 19, iss. 2, pp. 49–59. DOI: 10.1016/j.rfe.2010.01.002.

43. Dvoretskaya A.E. Project financing: New trends and machanisms. Bankovskoe delo=Bankovskoe delo, 2019, no. 5, pp. 4–13. (in Russian).

44. Zimbalist A. Circus maximus: The economic gamble behind hosting the Olympics and the World Cup. Washington: Brookings Institution Press, 2015. 174 p.

45. Shvydko A.O. Project financing as a tool for achieving national goals. Upravlenie ekonomicheskimi sistemami: elektronnyi nauchnyi zhurnal=Management of Economic Systems: Scientific Electronic Journal, 2018, no. 9 (115), p. 54. (in Russian).

46. Eroglu N., Eroglu I., Ozturk M., Aydin H.I. Development agencies on the way to regional development: Romania–Turkey comparison. Procedia of Economics and Business Administration, 2014, vol. 1, no. 1, pp. 214–221.

47. Halkier H., Danson M. Regional development agencies in Western Europe: A survey of key characteristics and trends. European Urban and Regional Studies, 1997, vol. 4 (3), pp. 243–256. DOI:10.1177/096977649700400304.

48. Toktas Y., Sevinc H., Bozkurt E. The evolution of regional development agencies: Turkey case. Annales Universitatis Apulensis Series Oeconomica, 2013, vol. 15, iss. 2, pp. 670–681.

49. Toktas Y., Botoc C., Kunu S., Prozan R. The regional development agency experiences of Turkey and Romania. Business and Economics Research Journal, 2018, vol. 9, no. 2, pp. 253–270. DOI:10.20409/berj.2018.103.

50. Yuill D. Regional Development Agencies in Europe. Aldershot: Gower, 1982. 449 p.

51. Halkier H., Danson M., Dambor C. Regional Development Agencies in Europe. London: Jessica Kingsley, 1998. 374 p. DOI:10.4324/9781315000206.

52. Halkier H. Development agencies and regional policy: The case of the Scottish development agency. Regional Politics and Policy, 1992, vol. 2, no. 3, pp. 1–26. DOI:10.1080/13597569208420846.

53. Balatsky E.V. Regional development agencies and their features: International experience. Kapital strany=Capital of the Country, 2012. Available at:

http://kapital-rus.ru/articles/article/agentstva_regionalnogo_razvitiya_i_ih_osobennosti_mezhdunarodnyj_opyt/ (accessed: 18.04.2020). (in Russian).

54. Maude A., Beer A. Regional development agencies in Australia: A Comparative evaluation of institutional strengths and weaknesses. The Town Planning Review, 2000, vol. 71, no. 1, pp. 1–24. DOI: 10.3828/tpr.71.1.y7227415l8171674.

55. Hughes J., Sasse G., Gordon C. Europeanization and Regionalization in the EU’s Enlargement to Central and Eastern Europe. London: Palgrave Macmillan, 2004. 231 p. DOI:10.1057/9780230503182.

56. Özen P. Bölge kalkinma ajanslari. TEPAV, 2005. Available at: https://www.tepav.org.tr/upload/files/1271245092r8246.Bolgesel_Kalkinma_Ajanslari.pdf

57. Salvador R., Juliao R.P Regional development agencies in Portugal. In: 40th Congress of the European Regional Science Association “European Monetary Union and Regional Policy”, 2000. Available at: https://pdfs.semanticscholar.org/cc18/61711fafa6beaea0bae1e0ad8cc39a9a0dc6.pdf?_ga=2.42817901.919716742.1587215455-1302553556.1585572547.

58. Regional’naya politika stran ES [Regional Policy of EU Countries]. Edit. by A.V. Kuznetsov. Moscow: IMEMO RAN, 2009. 230 p.

59. Benedek J., Horvath R. Regional development in Romania. In: Baun M., Marek D. EU regional policy after enlargement. Basingstoke: Palgrave Macmillan, 2008. 226-247 p. Available at: https://www.regionalstudies.org/wp-content/uploads/2018/07/countryreps-romania.pdf.

60. Florescu I.C. The regional development in Romania based on the European Union funds for 2014–2020. In: The 26th International Business Information Management Association Conference. Madrid, 2015. Available at: https://www.researchgate.net/publication/303819710_The_regional_development_in_Romania_based_on_the_European_Union_

funds_for_2014-2020/.

61. Burgess E.W, McKenzie R.D., Park R.E. The City. Chicago, Illinois: The University of Chicago Press, 1925. 240 p.

62. Ekimova N.A. Regional development corporations: Chronicle of failures. Kapital strany=Capital of the Country, 2016. Available at: http://kapital-rus.ru/articles/article/korporacii_regionalnogo_razvitiya_hronika_neudach/ (accessed: 18.04.2020).

[1] We should note that the notion of “region” in the context of RDIs can vary from narrow (applied directly to regions as parts of a country) to broader (meaning a separate territory or country). depending on the purpose of RDI activities.

[2] In order to avoid misunderstandings we note that the concept of “RIF” is quite broad and often includes forums with other names; other forms of RIF include exhibitions, shows, etc. held on a regular basis. A more detailed discussion of these institutions is a subject of a separate paper.

[3] Saint Petersburg International Economic Forum. Available at: https://forumspb.com/about/?lang=ru

[4] It is worth mentioning that project management is not only a tool for implementing the Good Governance concept, but also the New Public Management concept. However, PM has become more widespread within the framework of the former.

[5] Official website of ScienceDirect. Available at: https:// www.sciencedirect.com/

[6] Project Finance Report, 2018. Available at: https://www.iflr.com/Supplement/98839/Supplements/Proiect-Finance-Report-2018.html

[7] Sydney Opera House. Available at: https://www.miroworld.ru/sidnejskij-opernyj-teatr/.

[8] In Depth: World’s Most Expensive Stadium. Available at: https://www.forbes.com/2008/08/06/expensive-stadiums-worldwide-forbeslife-cx_ae_0806sports_slide.html#310a 4a111ead

[9] Project management as a way to implement strategic objectives. Available at: https://www.youtube.com/watch?v=wJd-4e1eFXM

[10] The examples show that the contradiction in their success is related to the methodological issues of assessing the economic effect. Obviously, these unique events and objects have a positive effect in the long–term project, and negative — in the short–term project. We proceed from the prerogative of long–term development.

[11] EURADA. Available at: http://www.eurada.org/studies-of-rdas/

[12] Official website of HIE. Available at: https://www.hie.co.uk/media/5488/hieplusannualplusreportplusandplusaccou ntsplus2018-19.pdf

[13]Official website of SE. Available at: https://www.scottish-enterprise.com/media/3222/rsa-annual-summary-2018-19.pdf

[14] Official website of SDI. Available at: https://www.sdi.co.uk/news-features/news-and-feature-articles

[15] Eurostat data.

[16] EURADA. Available at: http://www.eurada.org/wp-content/uploads/2020/04/RDAs-Portugal-Study.pdf

[17] Eurostat data.

[18] Eurostat data.

[19] Law No. 151/1998, Privind dezvoltarea regionalᾰ în România. Available at: http://legislatie.just.ro/Public/DetaliiDocument/15220

[20] Regional Development Agencies in Romania. Available at: http://www.eurada.org/wp-content/uploads/2020/04/RDAs-in-Romania.pdf

[21] Official website of the Development Corporation of Bashkortostan Republic. Available at: https://kr-rb.ru/investoru/history-uspeha/

Official link to the article:

Balatsky E.V., Ekimova N.A. Modern ways to boost economic growth in regions // «Economic and Social Changes: Facts, Trends, Forecast», 2020, vol. 13, no. 3, pp. 74–92.