Humanity has been awaiting an inevitable end of the world since ancient times. People have feared that the world will perish because of natural cataclysms, cosmic catastrophes, or global wars. At times it seemed that the fatal line was but a half–step away, sometimes the tension would abate, but the fears would not vanish. How valid are they from the standpoint of contemporary economics? Is the apocalypse predestined? And if it is indeed inevitable, what are its driving forces?

Let us try to find answers to these questions.

The Economic Mechanism of the Apocalypse

The fact that a socioeconomic system develops according to certain laws is not questioned and has no mystical or awesome implications. However, there do exist laws that automatically imply the self–destruction of practically any social formation. It is they that constitute a very real underlying economic cause of an apocalypse.

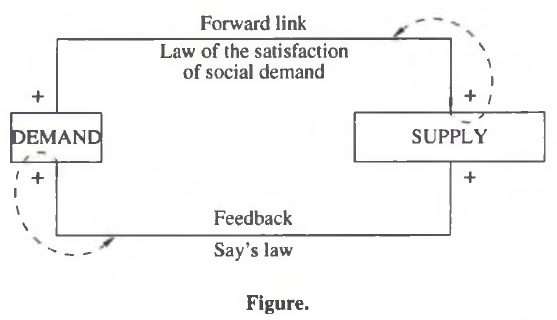

One of the principal “destroyers” of a society is Jean Baptiste Say’s law, which states that supply generates its own demand [1, 2]. At first glance, there is nothing terrifying in this. But only at first glance. Everyone–even if he is a stranger to economics – is well familiar with another law: that of the satisfaction of social demand. What it boils down to is that demand generates supply. The operation of the two laws in combination has implications that cannot simply be brushed aside. The entire socioeconomic system is divided, in this context, into demand (people’s active needs) and supply (production that generates various marketable goods). The two are linked directly and by feedback, which makes it possible to treat the system as a whole as being cybernetic. The law of the satisfaction of social demand forms the forward link; Say’s law, the feedback circuit. This is quite natural, since human needs are the primary system element, and it is they that provide the impetus for the development of the rest of the economic “setting.” In accordance with these laws, the bigger one subsystem is, the bigger the other must be. The socioeconomic system thus has positive forward and feedback links (on the diagram they are designated by plus signs). However, we know from cybernetics that formations of this kind are unstable and sooner or later become “runaway” systems.

The mechanism of this runaway mode is quite simple. People’s initial needs generate a certain market demand for various goods. Production is started, which helps to meet this demand by attracting capital, labor, materials, and other resources. This generates a “different” demand of its own. Through repeated recurrence, this process causes the steadfast expansion of the economic system, and this comes into obvious conflict with its spatial and temporal constraints. In fact, this contradiction is a direct consequence of economic activity, whose purpose, according to Maurice Allais, is to satisfy people’s practically boundless needs, using the limited resources at their disposal [3]. From the standpoint of cybernetics, systems with such characteristics are bound to perish.

This logical conclusion will be considered in greater detail below, but first let us examine how supply can actually spontaneously generate new demand, which did not exist before.

From the financial point of view, Say’s law implies that an economic subject acquires funds by producing and marketing his goods. These funds, in turn, have to be substantiated, which results in a definite “injection” of market demand. It is noteworthy that Say’s law applies to both macro– and microprocesses. For example, at the level of everyday life, it has its microeconomic equivalent expressed by the well–known proverb “cut your coat according to your cloth.” Indeed, the more a person works and earns, the more he is prepared to spend, and this stimulates cumulative demand and compels the other participants in the economic process to intensify their work. Everything in this case is quite transparent. However, the situation becomes much more intriguing if we attempt to get to the bottom of the phenomena underlying this law.

To make clear what is meant, let us identify three manifestations of one and the same economic mechanism.

(1) The qualitative birth of demand. This implies the rise of demand for a new commodity, which automatically causes the demise of old commodity groups. Such a development leads to the natural succession of commodity generations and is of a universal character. An example of the qualitative birth of demand is provided by the evolution of audio equipment. The first to be produced were phonographs and records, then came reel tape recorders, which gradually assumed the form of combined radio and cassette recorders, and, finally, there began the batch production of hi–fi stacked systems with laser disk players. Each new generation of audio equipment edged out the previous one by virtue of its higher consumer characteristics. In such cases the old production is devalued and folds up as the market becomes saturated with the new products.

(2) The simple quantitative birth of demand. This implies the appearance of an absolutely new, exclusive product, which wins over a body of “admirers” and, hence, consumers. Plenty of examples of the simple quantitative birth of demand may be found in the area of the arts or, more specifically, literature. In this way a published novel gives rise to a readership and, consequently, to its team of customers, generating a wave of consumer demand and stimulating publishing activity. This justifies the assertion that every commodity seeks and finds its customer. That is the slogan of any business – it inspires optimism and attracts new people into merchant ranks.

(3) The composite quantitative birth of demand. This is the complementary effect that arises when the appearance of a certain type of product generates a demand for other, complementary goods. For example, if a person buys a car, he cannot do without gasoline, spare parts, and an antitheft system; he has to see about a garage, a servicing agency, etc. These needs stimulate the development of trade (gasoline stations, automobile stores), construction (garages, roads), oil production and refining, the social infrastructure (car servicing), etc. In other words, the normal existence of a new product requires the availability of complementary goods. The operation of Say’s laws and the satisfaction public needs trigger an uncontrolled avalanche of consumer demand and a boundless self–expansion of the economic system. This process is practically independent of people and is governed by properties inherent in commodities, which live a life of their own according to laws of their own.

Once the mechanism of the self–expansion of the economic system has been actuated, the cybernetic principle known as W.R. Ashby’s law, or the law of necessary diversity, comes into play. As applied to society, it operates as follows. The growth of a production system is fraught with the appearance of ever newer elements and links, which inevitably make it more complicated. In accordance with Ashby’s law, the “superstructure” (the controlling subsystem) has to be even more complicated. As a result of this, first, there is a rapid growth of “blank,” nonproductive expenditures on management and, second, the “superstructure” itself becomes ever more highly bureaucratized and inefficient, beginning to live a life of its own.

At a certain point, the infinite growth of the system gets out of control and becomes self–sufficient, shaping the wants and values of individuals as derivatives of its own needs. As has been rightly pointed out by L. Stoleru, the human being ceases to be in control of economic progress and becomes its plaything [4] – both people and nature prove to be completely subordinate to the interests of production. This is a turning point in the evolution of society, at which the cybernetic links in the supply–and–demand chain change places: the forward link becomes a feedback circuit; the feedback circuit, a forward link [5]; the controlling subsystem, a controlled subsystem, and vice versa. This, in effect, amounts to something in the nature of an economic trap for society, “doomed” to infinite progress of production to the point of self–destruction.

In addition to this, the so–called A. Wagner law, or the law of growing state activity, operates in the socioeconomic sphere. Under this law, state expenditures in industrially developed countries increase faster than does the volume of national production [6]. Since these are “forced” expenditures on managing production and maintaining its stability, there is good reason to speak of the Wagner law and the Ashby Law being equivalent. The former is at present probably the more inexorable: it is fulfilled with surprising relentlessness. At the same time, the growth of the share of state expenditures in the gross domestic product of a country inevitably increases the budget deficit, and this is a typical symptom of a crisis of state management, fraught in the long term with a disintegration of the socioeconomic system as a whole. D. Buchanan has shown that the growth of such a deficit is characteristic of societies with a democratic form of organization [7]. This is confirmed by practical experience: at any rate, it is largely only totalitarian regimes that have managed to achieve a steadily balanced budget. The laws of Ashby and Wagner thus show the dilemma facing social development: either financial disarray in the conditions of democracy or economic orderliness in a framework of political totalitarianism. Either variant is but a different manifestation of the tendency toward a social apocalypse.

The third and truly “terrifying” economic law that contributes to society’s self–breakdown is Herman Gossen’s law. It may be formulated as follows: the maximum usefulness (value) of every new inhabitant of the planet declines with population growth. Satiety with any market product–including such a specific one as man – is a universal property of Homo sapiens, and this, in the context of a demographic boom, devalues human life as such. Evidently, Gossen’s law played no small part in the emergence of the stranglers’ sect in overpopulated India in the 19th century; its influence is also clearly apparent in the mentality in contemporary Japan and China, which traditionally experience hardships because of the human overcrowding of socioeconomic space.

It should be pointed out specially that the above–considered tendency of an economic system toward self–expansion is valid irrespective of population growth. Moreover, if the two processes are superimposed, the overall effect is greatly intensified.

Still another regularity is the steady acceleration of economic development. Contemporary societies function in the context of positive inflation, which has the peculiar effect of supporting economic growth. Without inflation, depression quickly sets in; at the same time, it is a powerful factor making the economic mechanism turn faster. Thus, the active inflation–related taxes that manufacturing companies pay to the state entail an all–round curtailment of the goods production and marketing cycle. At the same time, the investment and consumer strategies of economic agents are activated so as to cover inflation–caused losses to their budgets [8]. The growth of prices gives rise to a continuous economic race: industrial and commercial deals are concluded at a faster rate, the work of individuals becomes more intensive, and the pace of their lives is accelerated. In such conditions, people have neither the strength nor the time to take a sober and broad view of the situation, or to act optimally and wisely. Little wonder that this provokes a “runaway mode” of the entire socioeconomic system.

Another point too is extremely important. The fact is that the dynamics of the overwhelming majority of the economic variables exhibits a distinct exponential pattern; indeed, steady-state economic growth is characterized by time–constant increment rates. However, such exponential trajectories reproduce situations of explosive development. They arise during transition regimes and cannot be stable. The economic system is permanently in a state of either rapid growth or equally rapid decline, which produces chronic economic “overheating” succeeded by periods of crisis-degree cooling. This prompts the conclusion that the stabilization of forward and feedback links in the supply–and–demand cycle and the neutralization of the corresponding economic laws is always temporary and unstable: the system lapses into either further exponential self–expansion or a production recession. However, as paradoxical as this may seem, it is tempestuous growth that is a form of the unstable existence of the economic system – otherwise it is doomed to perish. This invites an analogy between society and such an elementary particle as the photon, which does not exist in a state of rest.

Thus, deep within the socioeconomic system there operate laws that create objective prerequisites for its “death.” No wonder that A. Carlisle in his day called political economy a “sinister science” [9, p. 37]. On the whole, it may be said that if the end of the world does come, this will be the result not of a cosmic catastrophe, geological cataclysms, or a nuclear global war, but of society economically “devouring itself.”

Extreme Communities

Are there ways of neutralizing the tendency toward the self–expansion and destruction of society, ways of averting a social apocalypse? If so, what has to be done to achieve this?

First of all, let us try to answer the question of what the economic system must be like, if it is to be in a permanently balanced state. It is known from cybernetics that quasi–balanced, relatively stable systems possess two basic properties: first, a weak energy exchange with their environment and, second, a strong information connection with it [10]. Consequently, society must constitute a quite advanced information system, in which departures from the optimal state are eliminated by minimal expenditures of funds, materials, energy, and labor [2]. Such socioeconomic homeostasis is possible theoretically, but achieving it requires, in my view, a rigorous psychology of economic moderation, shared by the vast majority of the members of society. A philosophy of “economic Buddhism” must reign throughout, a philosophy that may be summarized by the words of one of the characters of the well–known American author of the past century Washington Irving: “Enough is enough for a reasonable man–more is superfluous” [11].

Such a concept, put into effect, would mean people’s acceptance of modest needs in terms of material values: on attaining a certain level of wellbeing, they would no longer engage in a senseless waste of efforts to add further to those values. A dynamic equilibrium would thereby be established in the system of supply and demand. History has on record plenty of examples of peoples living in equilibrium with nature and with themselves on the basis of spiritual practices. There were the Spartans, who denied the value of wealth, the Toltecs, the Mayas, the Aztecs, and the Khazars. However, attacks on these peoples by more active and aggressive ethnic groups led to the destruction of their culture and their complete extinction. This reflects yet another systemic regularity, which does not allow a single element (people) of a system (world) to achieve prolonged and stable harmony in conditions in which other elements (peoples) are steadily developing.

Now the next proposition important for understanding the essence of the problem under consideration is the following: a steady state can be achieved in the framework of two diametrically opposite types of societies, which represent extreme manifestations of one and the same phenomenon.

The first type are the thriving (progressive) postindustrial formations, where social needs are balanced and the stabilization of demand is accompanied by ever more exacting requirements with respect to qualitative characteristics. In this case, we observe the operation of the first type of the above–described mechanism of Say’s law – the qualitative birth of demand; the second and the third type are mainly blocked. The production of new goods takes place against the background of the vigorous elimination of outdated analogues and does not entail a growth of the mass of commodities, although its qualitative composition can change on any scale. It is this type of economic development that serves as a model worthy of emulation.

The second type is the primitive and degenerating (retrogressive) economic communities, where people’s vital interests are pathologically deformed. In this case, the resulting situation of stabilized demand as a consequence of the momentum of hypertrophied individual consumer preferences is simply “frozen.” The philosophy of moderation is in this case transformed into various forms of the philosophy of inactivity. Stoleru cites a characteristic example of this: a fellow, having in three days earned enough to see him through the week, does not come to work in the remaining days [4, p. 56]. Needless to say, such variants of the social structure are foredoomed.

The realization that there exist two types of communities with stable tastes and preferences was translated in economics into the proposition that the curve of demand for work may acquire a downward trend either in poor countries, where the needs of the population are confined to earning a subsistence minimum, or in very affluent countries, where people’s incomes are so high that their interests turn from work to recreation.

It is important to note that progressive postindustrial economic systems are unstable because, on the one hand, they are – for the reasons considered above – subject to natural decay and can gradually and inconspicuously lapse into their opposite: systems of the second type. On the other hand, they, as a rule, prove to be highly vulnerable in military and political terms, and become the targets of pressure by other countries and ethnic groups. The stabilization of the supply–and–demand cycle, hence, turns out to be short-lived, whereas a normal economic system is one of self–expansion.

The Death of an Economic System

The process of economic self-expansion, accompanied by the industrialization and urbanization of society, at a certain stage inevitably divorces humans completely from nature. In conjunction with the parallel process of the overpopulation of living space, this, in cybernetic terms, entails an uncontrolled growth of entropy in the socioeconomic system, which becomes unmanageable. From this moment, the system enters the second phase of “dying.” Primary social failings in the functioning of the system, manifested in a bureaucratization of the sphere of management and a criminalization of public life, now increase in scale. If this course of events is not checked, the third phase sets in – agony – which, as a rule, is manifested in wars, political disorders, and mass diseases (recall if only, the plague epidemics in densely populated medieval cities, and the spread of the Ebola virus and AIDS in our day).

As blasphemous as this may seem at first glance, these destructive processes to a large extent perform a “cleansing” function, for they serve to break the vicious circle that has arisen in the economy, reestablish equilibrium in the supply–and–demand chain, and restore a natural, balanced state of society. This lays an economic foundation for people’s subsequent constructive activities.

In addition to this, the mechanism of the actuation of these processes obeys systems laws and – to use a modem term – is a specific instance of the operation of forces of autoregulation in nature [12]. The economic system, as a certain stable formation, seeks to preserve itself and, in accordance with its capabilities, generates specific impulses that make it possible to resect a “superfluous” part so as not to disappear as a whole.

Particularly interesting among the variety of evidence of growing entropy in the social system is the process of “sexual leveling.” I refer here to the various feminist movements, the rise in the incomes of women compared with men, the popularity among fair sex of such sports as the martial arts, football, hockey, etc., and the rapid growth of sexual minorities. The masculinity of women and the femininity of men signify a leveling of the basic sex–related energy differences (the man as the active principle; the woman, as the passive), a version of thermal death brought about by the universal leveling of energy.

It should be stressed that, despite the seeming analogy with biological populations, the forces of autoregulation in a socioeconomic system are nonbiological – they are of a more general nature. Similar effects occur even in inorganic matter, where every object seeks to retain its initial state of equilibrium by virtue of the existence of systems momentum [12].

The economic death of society thus comes about as a result of the emergence of an antagonistic contradiction between the economic self–expansion of society and the laws of equilibrium of systems. But the economic death of a system is by no means tantamount to its total physical destruction. Here it is appropriate to draw an analogy with the statement of L.N. Gumilev that the historical drama of ancient Novgorod provides an example of the death of an ethnic system, where it is not the people who vanish – they join new ethnic groups – but a definite system of behavior, which at one time held these people together, creating a sense of kith and kin [13, p. 192].

Phasing: A Mechanism of Social Survival

After its death, a socioeconomic system, as a rule, begins to revive destroyed institutions, and this process proceeds in the previous direction. The flourishing of old methods of economic reproduction becomes possible because society, having been thrust back, is prepared to cover the same path again. This is particularly evident in postwar periods, when countries begin to restore their war–ravaged economies and manpower losses. Economic self–expansion is set in motion anew.

Economic death is an enormous upheaval for society, enabling it to resume its “normal” progress towards another death, another apocalypse! Such upheavals are themselves gigantic phases in societal development.

All phasing is based on the unfolding of the socioeconomic process, which at a certain point reaches an obvious dead end. It is this that dictates the need to transform the economic system and change its social and organizational structure. The contradiction that has arisen in its development can achieve such a scale as to confront society with the dilemma: either to perish or to take a radically different road. The harshness of such a dilemma raises fundamentally new waves of the socioeconomic cycle.

It should be understood that the phasing we are talking about differs in principle from the conventional economic cycles and is not associated with economic ups and downs. Different phases are characterized by different socioeconomic paradigms of the evolution of society, and the formulation of aims and ideological doctrines serve to impart a distinct “aroma” to each phase.

A classic illustration of this is provided by the doctrine of occupational dominants [14]. Its essence may be summed up as follows. Every state, in its development, passes through various stages of the social division of labor, and this is reflected in the occupational composition of the labor force. In fact, this composition is one of the complex characteristics of the phase through which the country is passing. As occupational compositions “mature,” the types of the social division of labor change, each of them having a corresponding occupational dominant, that is, an occupational group with the highest share of the total work force. The types of the social division of labor and the regularities of their succession can be arranged in the following chronological order: agricultural, industrial, information, service, etc. Russia, for example, has passed through the phases of agricultural and industrial communities and is now “stuck” at the information type of the division of labor [15], whereas the developed Western countries are already actively shaping service communities [16]. It is important to note that the transition of society from one type to another is dictated by the impossibility of the dynamic development of the system within the old framework.

In view of all this, it is hardly possible to agree with Gumilev, who considered that all nations exist for just about the same period [13]. In my opinion, the lifetime of an ethnic group depends on its “collective intellect,” which is manifested in its adaptation potential, in its readiness to accept a timely change of the socioeconomic paradigm of its development. If an ethnic group has the appropriate mental and organizational flexibility, its lifetime may greatly exceed the average period of the existence of an ethnic group, witness the peoples of India and China. In other words, by paying the price of a “minor” restructuring, society can avert global conflicts and avoid the ill–famed Armageddon.

References

1. Balatskii E.V. Marginal Properties of Economic Systems, Mirov. Ekon. i Mezhd. Otn., 1995, no. 7.

2. Balatskii E.V. Perekhodnye protsessy v ekonomike (metody kachestvennovo analiza) (Transition Processes in the Economy: Methods of Qualitative Analysis), Moscow: IMEI, 1995.

3. Allais М., in Editions Clement Juglar, 1995. Translated under the title Ekonomika как nаuка, Moscow: RGTU, 1995, p. 27.

4. Stoleru L. L’Equilibre et la croissance economiques, Paris: Dunod, 1969. Translated under the title Ravnovesie i ekonomicheskii rost, Moscow: Statistika, 1974.

5. Petrushenko L.A. On the Possibility of Social Modeling, Izv. LETI, 1963, no. 48.

6. Sumarokov V.N. Gosudarstvennye finansy v sisteme makroekonomicheskogo regulirovaniya (State Finances in the System of Macroeconomic Regulation), Moscow: Finansy i statistika, 1986.

7. Sokolovskii L.E. Financing the Budget Deficit and the Internal State Debt, Ekon. i Matemat. Met., 1991, no. 2.

8. Balatskii E.V. Inflation Taxes and Economic Growth, Ekon. i Matemat. Met., 1997, no. 3.

9. Barre R. Economie politique, Paris: Presses universitaires de France, 1983. Translated under the title Politicheskaya ekonomiya, vol. 1, Moscow: Mezhd. Otn., 1995.

10. Wiener N. Cybernetics, or Control and Communication in the Animal and the Machine, New York, 1961. Translated under the title Kibernetika, Moscow: Nauka, 1983.

11. Irving W. The Alhambra, New York: MacMillan, 1896, p. 291. Translated under the title Novelty, Moscow: Pravda, 1987, p. 349.

12. Petrushenko L.A., Printsip obratnoi svyazi (The Feedback Principle), Moscow: Mysl’, 1967.

13. Gumilev L.N. Ot Rusi к Rossii: ocherki etnicheskoi istorii (From Rus to Russia: Essays in Ethnic History), Moscow: Ekopress, 1992, p. 192.

14. Dobrynina L.V. A Quantitative Estimate of the Level of the Social Division of Labor, in Kontseptsiya zanyatosti v sotsial’no–orientirovannoi ekonomike (A Conception of Employment in a Socially–Oriented Economy), Moscow: NIEI, 1990.

15. Bogomolov Yu.P, Balatskii E.V., and Lavrent’eva O.V. Regional Features of the Reproduction of Skilled Personnel, Ekonomist, 1992, no. 5.

16. Kostecki М. The Establishment of a “Service” Economy, Probl. Teor. i Prakt. Upr., 1995, no. 1.

Official link to the article:

Balatskii E.V. The Apocalypse Cometh?// «Herald of the Russian Academy of Sciences», Vol. 68, No. 5, 1998, pp. 413–418.