1. Introduction: the global hegemon or the global leader?

At present, the issues concerning the U.S. leadership and the approaching decline of its domination are widely discussed. This topic is largely speculative – participants of the discussion use the data that are controversial and sometimes unreliable. However, even Z. Brzezinski believes that the era of unlimited hegemony for the U.S. has mainly come to its end; the superpower, which has been holding the status of the first global empire for almost 25 years, is now becoming a second–place player [3].

However, the United States can still maintain their status of the global leader, under which Z. Brzezinski understands the nation that possesses the capacity sufficient to guide, as it pleases, the development of the world community [3]. J. Arrighi prefers another expression – “dominance without hegemony” [1] – describing the U.S. relations with the rest of the world. This raises a sacramental question: which country will take the place of the U.S. as the next global economic center (GEC)1Here and further on we consider the global economic center as the synonym for the world center of capital, which we understand as the leading country in the world economy. This center has the largest industrial, technological and financial potential among all the countries of the world.. Naturally, the answer to this question turns everyone’s attention to China, which, in recent years, has aspired to become the center of power rivalling the U.S. How justified are these expectations? Can China really become the new GEC? What does this require and how much time will it take?

The author makes an attempt to answer these questions, using historical analogy.

2. Geopolitical inversion and its regularities

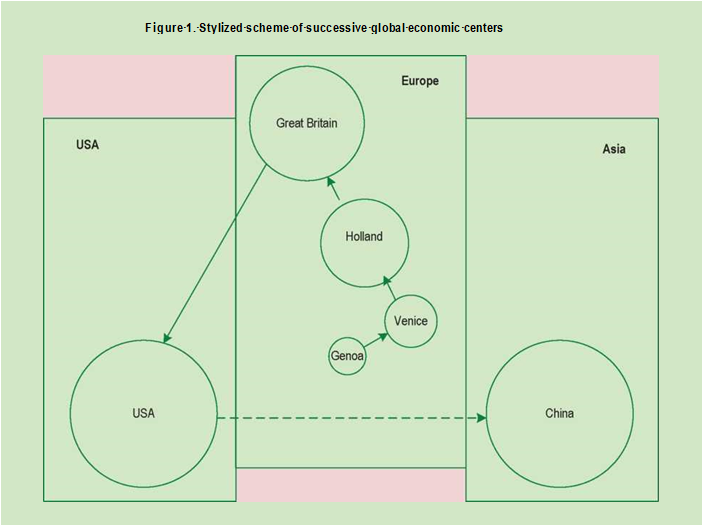

If we are determined to find the answer to the question about the possibility of China’s seizing the leadership from the USA, we should find out whether such precedents have ever taken place in the world history. As it turns out, the competition between the UK and the USA is the closest historical example of such geopolitical inversion (GPI). We shall understand the GPI hereinafter as the process of changing the GEC and seizing the business initiative from one country by another. In this respect, any geopolitical inversion is characterized by a pair of successive global economic centers; for example, the GPI “USA–UK”. However, earlier there were other countries acting as GEC, besides Great Britain and the U.S. G. Arrighi made the most thorough analysis of the sequence of GPI and singled out four global economic centers: the Republic of Genoa, the Netherlands, the UK and the USA [1]. However, in some of his works G. Arrighi, following K. Marx, singles out the Republic of Venice, which “wedged in” between Genoa and the Netherlands for a relatively short time [1]. Let us take a glance at the circulation of capital between these historical global economic centers.

Beginning from the 11th century, Genoa was actively engaged in trade in the Mediterranean. Due to its participation in the Crusades, the city turned into a powerful Republic of Genoa with numerous colonies. By the beginning of the 12th century it became an independent city-state. In the times of the Crusades Genoa surpassed many of the European kingdoms by its wealth and influence, possessing developed trade, shipbuilding industry and banking system. The 13th century is believed to be a period of Genoese domination of the Mediterranean. However, Genoa did not maintain its position as the first global economic center for a long time, and in the end of the 14th century it ceased to be the world leader. Nevertheless, for rather a long time after that, until the mid–17th century, Genoese bankers were managing European finances with such subtlety and skill that, according to F. Braudel, historians could not notice it for quite a while [1]. For instance, the Genoese Banking Consortium funded many enterprises of the Spanish crown and provided loans to the Habsburg dynasty by seizing the initiative from the German banking houses.

The early 13th century witnessed the emergence of a new global economic center represented by the Republic of Venice, which by the end of the 14th century became the dominant trader in the East, and, virtually, the dominant international trader of that period. At that very time the first geopolitical inversion took place, when Venice succeeded Genoa as a new global economic center. At the end of the 15th century the Republic of Venice was extremely rich and powerful, its trade and industry flourished, and its education in arts and sciences was popular all around Europe. Even the common population of Venice was rich due to moderate taxes and soft government policy. Venice was constantly expanding its mainland territories; the city-state was turning into a colonial power. However, in the late 17th century the Republic of Venice faded into the background and took little part in the world trade. Nevertheless, as K. Marx points out, Venice, even in a state of decline, continued to lend large sums of money to the new emerging global economic center – Holland [1].

The Netherlands became the third global economic center, after gaining independence in 1581 and finishing the Eighty Years’ War (1568–1648), which marked the onset of the so-called “Golden age” of the country – a period of economic and cultural prosperity that lasted the whole 17th century. However, that period of economic triumph was brief, and in the beginning of the 18th century Holland was no longer the dominant commercial and industrial nation. Nevertheless, it is noteworthy that in the period of 1701–1776 the Dutch were lending enormous sums of capital to Great Britain, which replaced Holland as the next global economic center [1].

Economic rise of Britain as the fourth center of global capital began in the late 17th century and reached its peak in the mid–19th century; then the country lost its positions and began issuing extensive loans to the USA, the nation that since the 1830s had been rapidly moving to the position of the fifth global economic center. By the 1880s, the U.S. had already become the world’s leading economy, and in the 1970s they started to move their capital to China, which marks a new stage of development of the global market system. From this moment begins the rise of the Celestial Empire, and many analysts now see it as the next probable global economic center.

The process of global economic centers succession is presented in Figure 1 that shows in a very simplified and stylized way the geographical distribution of geopolitical inversion and the scope of the world centers of capital.

Many important features of the historical scheme of geopolitical inversion were disclosed by J.Arrighi; however, the research literature either does not mention them at all or takes their existence for granted and does not formulate them explicitly. We think they should be given special attention.

First of all, let us note that all the above chronology is rather conventional and can not be considered commonly accepted. For example, J. Arrighi himself sometimes interchanges the places of Genoa and Venice in the sequence of GEC [1]. In any case, one should not look for strict time (circular) patterns in the alternation of the national schemes of capital accumulation. Meanwhile, we can trace without much effort a very interesting and typical trend in the globalization of GEC.

3. Globalization of the world centers of capital

If we have a closer look at the five GEC with their key economic characteristics – area and population, we will easily see the important patterns of geopolitical inversion (tab. 1).

Table 1. Main features of global centers of capital

|

Global economic center |

Area, square km |

Population, persons |

|

Genoa |

243 |

«100000* |

|

Venice |

412 |

«200000* |

|

Netherlands |

41526 |

16805037 |

|

UK |

244101 |

63395574 |

|

USA |

9372610 |

320194478 |

|

* The data on Genoa and Venice are given for the peak of their historical development and are very rough. |

||

First, all the GEC evolved in the direction of territorial globalization. The area of each subsequent GEC was greater than that of its predecessor. This pattern applies even to medieval city-states, although it is not so evident with regard to them. For making a numerical assessment of this trend, we considered GEC in their modern borders; the historical borders were a little different and they often changed with the country’s growth and development. However, these minor statistical distortions do not affect the main conclusion – the extension of each new GEC was always very noticeable and it happened in any case without exceptions.

Secondly, along with territorial expansion, all GEC experienced demographic globalization, i.e. they all showed the increase in the number of population. As in the previous case, each subsequent GEC had a bigger amount of population than its predecessor. This trend is observed even in medieval city–states, with some exceptions. For example, the data on the Republics of Genoa and Venice reflect the time of their historical peak [6; 5]. These figures have been rounded off, and they show the superiority of the later GEC. At present, the two cities have experienced demographic reshuffle – the population of Genoa increased up to 604 thousand people and that of Venice – only up to 270 thousand. However, taking into account this historical amendment, even these early GEC fit into the general global trend.

Thirdly, when there was a change of GEC, territorial globalization was much more evident than demographic globalization. As an example of this effect, let us consider the indices of territorial and demographic advantage, which are calculated as the ratio of land area and population of a later GEC to that of an earlier one. The values of these indices for the four geopolitical inversions are provided in table 2, which shows that the indices of territorial advantage of almost all the geopolitical inversions (except for the geopolitical inversion “Venice–Genoa”) exceed the indices of demographic advantage.2The geopolitical inversion “Venice–Genoa” is an exception from the rule, possibly due to small scale of the cities–states and low accuracy of the data.

Table 2. Indices of geopolitical inversions

|

Geopolitical inversion |

Index of territorial advantage |

Index of demographic advantage |

|

Venice-Genoa |

1.7 |

2.0 |

|

Holland–Venice |

100.8 |

84.0 |

|

Great Britain-Holland |

5.9 |

3.8 |

|

USA–Great Britain |

38.4 |

5.1 |

Thus, the formation of a new global economic center required much larger economic space, which in the course of its development was being gradually “filled” with people. In this sense, the spatial factor acted as the leading (primary) one, while the demographic factor played a supportive (secondary) part.

The number of population seemed to catch up with the scale of the economic zone, which “was allocated” for a new center of capital. Moreover, globalization makes its steps in strict sequence: first there is a transition to a more extensive economic territory, which, as a rule, is underpopulated; and only after that the demographic globalization begins. We can say that the effect of territorial globalization comes even before the emergence of a new GEC (a priori), while the effect of demographic globalization comes after (a posteriori) the establishment of the GEC; the sequence of these events is impossible to reverse. This fact is extremely important, and further on we will use it to interpret the current events.

On average, the index of territorial advantage for all the geopolitical inversions is 36.7, whereas the index of demographic advantage – only 23.7. Therefore, the pace of spatial globalization was about one and a half times faster than that of demographic globalization.

Apparently, this effect of globalization of GEC is produced by another fundamental economic phenomenon – scale effect, in accordance with which, the increase in the scale of economic activity leads to the increase in economic efficiency. This fact determines the motivation for the search and formation of a new global economic center; otherwise it would make no sense. The direct consequence of globalization is the acceleration of development of the new GEC, which is manifested in higher rates of economic growth. Moreover, the effect of acceleration covers almost the entire world economy. For example, the per capita income in the countries, which began their growth later, is increasing much faster in comparison with the countries that began their growth earlier [11].

Understanding the globalization trend in the formation of new global economic centers is the starting point in the analysis of the probability of obtaining this status by a country.

4. Stages of geopolitical inversion

Besides the general tendency towards globalization of GEC, there is a strict sequence in the implementation of the stages of their formation. It is possible to work out a detailed chronology of these stages if we take a look at the geopolitical inversion “USA–Great Britain”. For this purpose it is sufficient to make comparative calculations for GDP and per capita GDP in the two countries in U.S. dollars at the current GBP to USD exchange rate; the analyzed period – 1830–2011 [14].

In general, the formation of a new global economic center involves five stages, the sequence of which is rather strict.

The first stage is consolidation of territorial integrity of the country, which significantly exceeds the previous GEC in its area. The USA had already gone through this stage in the time of their formal establishment as a nation in 1776 when the thirteen united British colonies declared their independence [10]. According to our calculations, the area of these 13 states exceeded that of the Great Britain in 3.6 times. The extent of territorial globalization is shown by the fact that the area of only two states – Pennsylvania, and North Carolina – exceeded the area of the whole Great Britain by 6%.

The second stage is the superiority of the new GEC by the number of population. Our calculations show that this happened in 1856. From then on the U.S. has surpassed Britain not only by the size of their territory, but also by the number of residents.

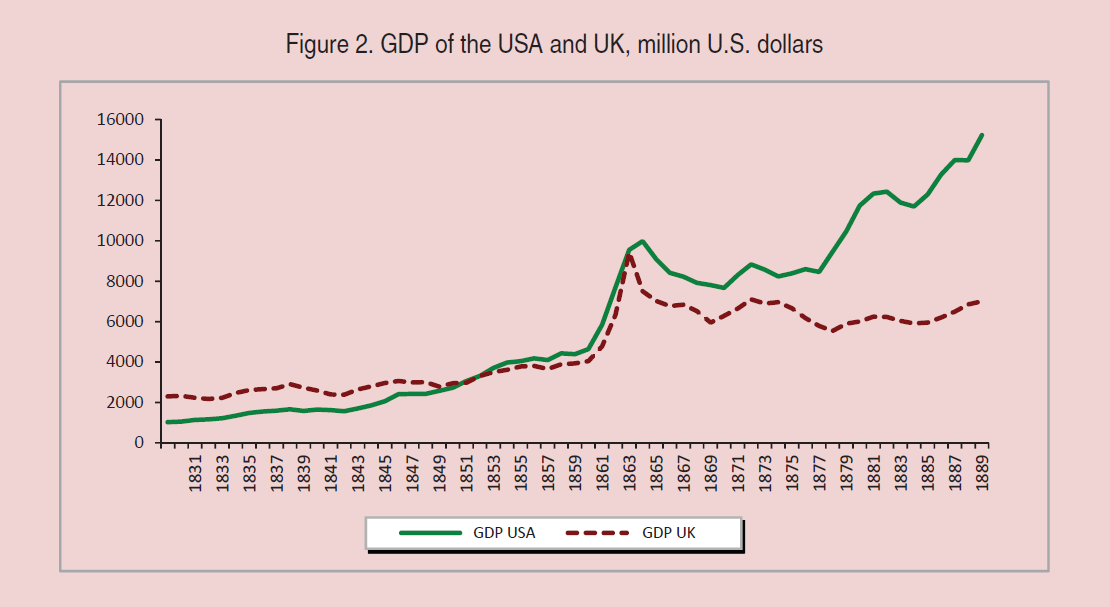

The third stage is production dominance, when the GDP of the new GEC exceeds that of the old GEC. This first happened in 1852, when the U.S. GDP was bigger than the British GDP; the following year, Britain returned its leadership in this respect, but in 1854 the United States finally won this production race. Figure 2 shows the “struggle” between the GDP of the two countries during 1830–1870; in the later period the dominance of the USA only strengthened.

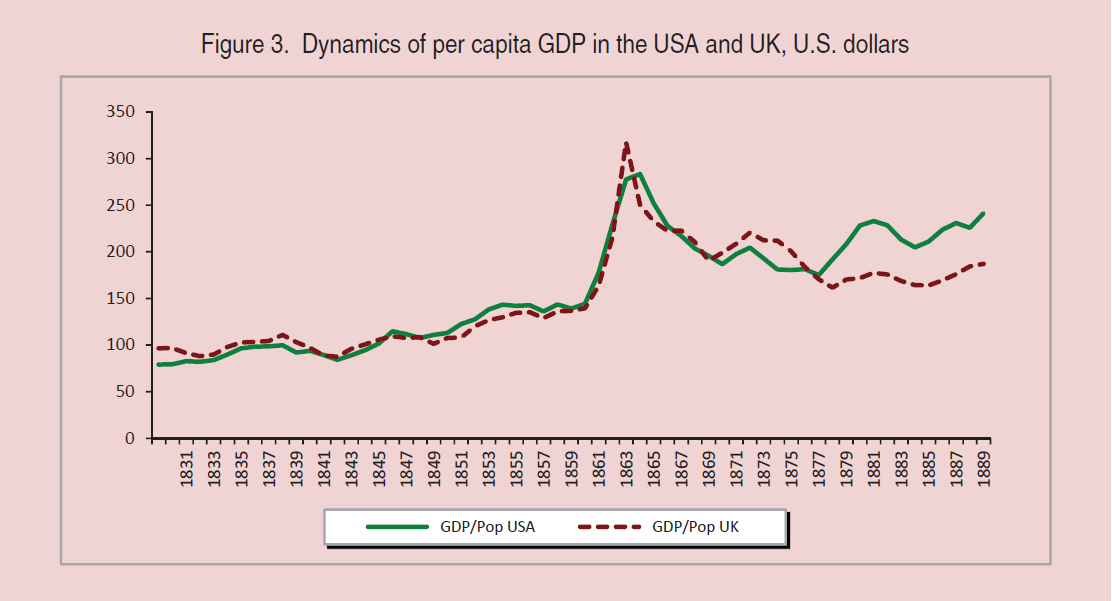

The fourth stage is the superiority of the new global economic center in the production efficiency of its economy. This fact is marked by the superiority of per-capita GDP of the USA over that of the UK. This first happened in 1842, after which the UK regained its position for several years; the U.S. established its superiority for the second time in 1847–1848, and then again lost its leadership for a year; the United States was leader again in 1850–1863, “falling behind” in the following year; in 1865–1867 the U.S. again won back its positions, losing their leadership in the following two years; the U.S. gained leadership once again in 1870, after which the UK prevailed; the line was drawn in 1878, beginning from which the United States were no longer in an inferior position to the UK. Figure 3 shows the “struggle” of per capita GDP of the two countries during 1930–1870; in the later period the U.S. preserved its dominance. These data demonstrate the fact that the struggle for the status of the richest nation was very dramatic, and it had lasted with varying success for 36 years. Taking into account the fact that per capita GDP is connected with labor productivity, we can state that the fourth stage of geopolitical integration, “USA–Great Britain” was a battle for the excellence in technology.

The fifth stage is the monetary dominance of the new global economic center, manifested in the creation of a world financial system based on its own currency. This happened in 1944 with the establishment of the Bretton Woods system that fixed the price of gold in U.S. dollars for the purposes of international trade. From that moment, the U.S. dollar has become a world currency [4].

Table 3 summarizes all stages of geopolitical integration “USA–UK”.

Table 3. Chronology of the stages of geopolitical integration “USA–UK”

|

Event |

Type of dominance |

||||

|

territorial |

demographic |

production |

technological |

currency |

|

|

Date |

1776 |

1856 |

1852–1854 |

1842–1878 |

1944 |

The formation periods between different phases of geopolitical inversion are of the greatest importance in the chronology under consideration. For example, technological dominance was achieved only 24 years after production dominance; and currency dominance was established only 66 years after technological hegemony. These two intervals alone form a historical period of 90 years. Thus, the transition from the old global economic center to a new one implies going through certain stages of development and takes quite a long time. The data obtained can be used for various present-day analogies.

5. Who will become the new leader?

Now, let us try to find out what country will be able to replace the U.S. as the global economic center. We can proceed from the established fact of territorial and demographic globalization of GPI. This means that the contender should surpass the U.S. by its territory. China formally meets this requirement, but a deeper analysis shows that, according to this criterion, it does not pass a “fitness test”, strictly speaking. The point is that, as we already noted, the index of territorial advantage on average for all the geopolitical inversions was 36.7, and its minimum recorded value was 1.7. For the proposed geopolitical inversion “China–USA” this index is vanishingly small – 1.02 (tab. 4).

Table 4. Main features of contenders for the role of the global economic center.

|

Country |

Area |

Population |

||

|

square km |

% (USA=100) |

people |

% (USA=100) |

|

|

USA |

9372610 |

100.0 |

320194478 |

100.0 |

|

Japan |

377944 |

4.0 |

127253075 |

39.7 |

|

China |

9596960 |

102.4 |

1349585838 |

421.5 |

|

Canada |

9984670 |

106.5 |

34568211 |

10.8 |

|

Russia |

17075400 |

182.2 |

143548980 |

44.8 |

Thus, China, as a new global economic center, would not provide the world with any territorial globalization; this fact challenges the very possibility of China becoming a new global center of capital. We can say that China cannot provide global capital with the scale effect, which would initiate its final movement to a new jurisdiction.

It is worth recalling an interesting, but already well-forgotten episode from the history of world economy, when Japan was aspiring to become the new global economic center. After the World War II it adopted the Western institutions and received capital from the U.S.; as a result, in a half-century Japan almost caught up with the United States in terms of GDP and even surpassed it by the value of GDP per capita and labor productivity. However, by the beginning of the 21st century it became clear that Japan would not become the new global economic center – the pace of the country’s development dropped dramatically and it fell irreversibly behind its rival – the U.S.

The tension of rivalry between Japan and the U.S. can be illustrated by the following data. For instance, in 1995, when Japan was in the prime of its economic development, its GDP amounted to almost 70% of the U.S. GDP (at the current exchange rate based on the World Bank data [13]. For comparison: China’s GDP in 2012 was only 50% of that of the U.S. Thus, in 1995 Japan was much closer to the world leader than China is at present. According to our rough estimates, even in 1884 the per capita GDP (and labor productivity, respectively) in Japan was 23% lower than in the USA, and in 1989 it increased by 34%. The superiority of Japan reached its peak of unprecedented 70% in 1995, but in 2001 the country’s per capita GDP was again less, than in the USA. During this period, the Land of the Rising Sun finally lost the competition to the U.S. and actually abandoned its pursuit of global leadership. According to our estimates, Japan had been ahead of the U.S. in terms of per capita GDP for 14 consecutive years – from 1987 to 2000 inclusive. At first glance it seems almost incredible that such long and victorious “rally” ended so obscurely. However, we recall that the 19th century witnessed similar technological confrontation between the USA and the UK, which lasted for 36 years; the United States was able to consolidate its superiority only after completing this long journey.

The case of Japan can be considered a classic example. The point is that this country had no “globalization” prerequisites for becoming a global economic center – its population was 2.5 times lower than in the USA, and its area – 25 times less. Such economic characteristics made it impossible to maintain leadership even in a few spheres. We can say that Japan could not secure its success primarily because of the absence of scale effect. Due to its tiny territory and small population, Japan could not maintain economic superiority over the U.S. economy for very long. Thus, Japan’s failure to meet the two “globalization” criteria led to the failure of its attempt to become the new global economic center. This example proves that the globalization trend cannot be “stepped over”.

Speaking about China, we see that by and large, it meets only one “globalization” criterion – population increase. But it has certain problems in this respect. As noted above, when global economic center changes, the territorial advantage greatly exceeds the demographic advantage, and in the very beginning of geopolitical inversion the new global economic center must have much fewer population than the previous one. Meanwhile, China does not fit into this pattern. At present the country is able to provide global capital with only a 2% territorial gain compared with the U.S., on the background of the demographic gain of 320%. Such a disposition of two globalization factors is non-typical, and the existing disparities are considered excessive. We can say that China outpaced the regular course of history, having increased its population before attracting international capital. These facts show that, strictly speaking, China is not a suitable contender for a new global economic center. At least, the world history has not seen such precedents so far.

Now let us have a look at other hypothetical global economic centers. As it turns out, there are only two of them – Canada and Russia. Moreover, both countries are antipodes of China concerning their population that is much smaller than in the U.S. Besides, Canada can be discarded as a serious contender, because its territorial advantage is too small (the excess of 6.5% do not make any difference to the world capital) regarding a rather serious demographic “failure”3The big advantage for Canada is its common border with the U.S. and also the similar culture of the two countries. However, we think these factors are not enough to outweigh its shortcomings..

It may seem paradoxical, but, in view of the above, Russia is the only potential contender for a new global economic center. It is connected with two points. First, only Russia is capable of providing a really significant expansion of economic space. Second, disastrous demographic situation in Russia is not a fatal parameter and it provides good opportunities in terms of international migration. Here we are talking about the fact that the territorial factor is not subject to significant adjustment, while the demographic factor can be improved quite strongly and quickly.

Let us recall some of the twists and turns in the geopolitical integration “USA–UK”: the U.S. first leaped onto the stage as the world leader in 1852, when its GDP exceeded that of the UK, but it was only in 1856 that the U.S. took over Great Britain in terms of population. Moreover, the reshuffle took place quite rapidly: in 1840, the U.S. population was 30% less than in the UK, while in 1870 it increased by almost 30%. Thus, under certain circumstances, Russia is able to catch up with the U.S. concerning the demographic situation. But let us be clear: here we are talking only about compliance with global trends. In reality, Russia is institutionally not ready even to join the competition for the right to become the new global economic center, let alone actually gain this status.

Since Russia cannot compete for world leadership, the majority of analysts are persistent in their opinion that it is China that can. According to the Pew Research Center, even the Americans themselves view this country as the leader: 47% of respondents think that China is the world’s leading economic power, while only 31% of Americans consider their own country as such; 9% point out Japan, and 6% – the EU as the world leader [7]. Here we can mention a funny, though very telling fact: the British journal “The Economist” placed the following economic game on its website: setting the inflation and GDP growth in the U.S. and China, one can see on the graph the year when China will outstrip America in terms of economic development. Under plausible parameters, this should happen in 2018 [8; 15]. This indicates that wide public is preparing psychologically to the change of the global leader. However, such calculations require some clarification.

As we have shown above, the change of the global economic center takes place in five stages. Proceeding from the fact that China has passed the first two stages, three more are left for it.

First – it has to outrun the U.S. by GDP. Second – it has to outrun the U.S. by the GDP per capita. Third – it has to establish the currency supremacy of the yuan. Let us make an approximate estimate of the time that China would need for passing the second (T) and the third (τ) stage. For this purpose we shall consider three scenarios: optimistic (GDP growth rates in China and the U.S. meet the recorded maximum over the past 15 years – in 2007 and 2005, respectively); pessimistic (GDP growth rates in China and the U.S. meet the recorded minimum – in 2012 and 2013, respectively); and depressive (the chosen growth rates for both countries are the most modest and correspond to a very “cold” economy). Calculations are simplified; they do not take into account possible changes in the population size of the countries. For 2013 the starting value of China’s GDP is 50.6% of the U.S. level and China’s per capita GDP is 12.0% of the corresponding indicator for the U.S. The results of calculations are presented in table 5.

Table 5. Comparative parameters of growth of the U.S. and China's economies

|

Scenario |

Basic parameters |

Calculated parameters |

||

|

Growth rate, USA, % |

Growth rate, China, % |

Equalization period for GDP (Т), years |

Equalization period for GDP per capita (t), years |

|

|

Optimistic |

3,1 |

14,2 |

7 |

21 |

|

Pessimistic |

1,9 |

7,8 |

13 |

38 |

|

Depressive |

1,0 |

5,0 |

18 |

55 |

What do the obtained figures indicate?

First of all, the existing views on the forthcoming dominance of China are overrated. Even under the most favorable scenario for China, it will catch up with the U.S. in terms of GDP only in 2020, and in terms of per capita GDP – in 2034. If things turn out not in favor of China, which is very likely, then the corresponding achievements will be gained only after a long-term period – in 2031 and 2068, respectively. If we average the extreme estimates, they show that China could enter the fourth stage in 2051. Moreover, it is necessary to implement the fifth stage – the transformation of the yuan into the dominant world currency. It has taken the U.S. more than 60 years to achieve that for the dollar. Even if we take into account the acceleration of all the processes and assume that China would need just 15 years to accomplish the fifth stage, the formation of the new global economic center would be completed only in 2066. Even if all the stages are implemented, it will take more than 50 years. Thus, China is unlikely to establish itself as global leader in the foreseeable future. In this sense, the prospects of turning China into the new global economic center seem utopian.

We should add the following. All the extrapolations do not take into account the main thing: physical constraints on economic growth. It is not inconceivable that transformation of China into the global leader would be connected with the complete destruction of its ecology and excessive consumption of all types of economic resources. This is a separate topic for discussion, and it contributes further adjustments to overoptimistic forecasts.

6. A multipolar world

All the above reasoning leads us to the understanding of the fact that globalization factor is practically exhausted. Three potential centers of global capital – China, Canada and Russia – do not meet “globalization” criteria. Does this mean that the very scheme of geopolitical inversion ceases to exist? Can we say that the flows of global capital do not comply with the reasonable deterministic laws anymore, that they are losing the vector of their direction and entering the turbulent regime? What will the landscape of the global economy look like in this case?

To answer these questions, one should take a look at the world history of the last decades from a slightly different angle.

As we have stated above, global capital “lives” according to its own laws that require the presence of a certain geographic center, in which all the economic activity will be most effective. These centers are formed spontaneously in accordance with the logic of capital. S. Zizek argues that the true aim of the capitalist system consists in self-reproduction of capital through its continuous rotation; the main thing in capitalism is the self-propelling circulation of capital (Zizek, 2012). Capital should increase by earning interest on it (rate of return) – this is the logic of capital. At that, the very logic of capital is characterized by anonymity, systemacity, abstractness and objectivity [2]. The whole mechanism of circulation of capital in the modern world, as D. North points out, is impersonal. It is the system of impersonal exchange, according to D. North, became the apotheosis of socioeconomic development of the West [12]. Hence the fact that it is pointless to look for specific people in the periodic reform of the capitalist system; all conspiracy theories simply lose their personalized aspects under the logic of capital.

In this context, the post-war world history can be presented as follows. The global economic center represented by the United States was gradually seeking for a new territorial base for the accumulated world capital. At that, everything pointed to the USSR as the only and a very real new GEC. Its area in 1991 was 2.4–fold more than that of the USA, and its population was greater by approximately 15%. Possessing such economic characteristics, the country had every opportunity to become the new GEC. However, it was impossible due to ideological reasons. The Soviet system officially denied the capital and was not able to provide a comfortable environment for its development. In our opinion, it was the most dramatic moment in the world history: the only country that could allow global capital to take the next step in its development, “rejected” it. It was the first obstacle on the path of globalization of the world capital, there is a possibility that this very fact became the main cause of the two world wars. The obstacle has been removed only in 1991, when the Soviet Union ceased to exist and broke up into many smaller and weaker states.

At that moment, the situation became a stalemate, when none of the countries fully complied with the territorial globalization criterion and could serve as a safe harbor to the global capital. Ten years later, it became clear that Japan failed completely in its attempts to become the new global economic center. However, the U.S. was simultaneously “building” two new centers of global capital: traditional (sovereign China) and nontraditional (the United Europe). In fact, it became clear already in 1991 that the new GEC had to be created artificially by combining the states culturally close to each other. Z. Brzezinski made a comprehensive analysis of the actions undertaken by the U.S. for integrating the European countries; he believes that American policy was dictated not by abstract altruism, but the desire of the U.S. Government to get a strategic partner for solving all the key geopolitical and economic issues [3]. Besides, we may add that the big capital of the U.S. was latently hoping to see the new and more attractive GEC in the European Union (EU). Although it is already clear that this policy also failed – the EU cannot become the new GEC.

In our opinion, the failure with the EU is the same as with China. The point is that the area of Europe, even after its consolidation, only slightly exceeds that of the U.S. (tab. 6). In this sense it is similar to Canada. Thus, the spatial criterion of globalization has been met only formally; the EU does not have a significant advantage in its organization of economic space.

Table 6. Main characteristics of European countries

|

Country |

Area |

Population |

||

|

thousand km2 |

% (USA=100) |

million people |

% (USA=100) |

|

|

USA |

9372.6 |

100.0 |

320.2 |

100.0 |

|

Europe |

«10000.0 |

106.7 |

«730.0* |

228.0 |

|

Ukraine |

603.7 |

6.4 |

46.3 |

14.5 |

|

Belarus |

207.6 |

2.2 |

10.3 |

3.2 |

|

Kazakhstan |

2717.3 |

30.0 |

17.2 |

5.4 |

|

* Including 110 million people living in the European part of Russia. For reference: the population of the EU is 530 million people. |

||||

At the same time, the demographic factor in Europe is more significant than in the U.S., although not as excessive as in China. Moreover, the spatial factor in the EU is very unreliable. The point is that without Belarus and Ukraine, Europe loses a considerable part of its economic space and its area becomes 98.1% of the U.S. territory. Consequently, according to the spatial criterion of globalization, the EU is not fit for the role of the new global economic center.

Summing up all the post-war attempts to build a new GEC, we can say that there were four of them: USA, Japan, Europe and China4Note that the U.S. directly participated in the “testing” of all the potential global economic centers, except for the USSR. For instance, Japan not only adopted American market institutions up to antimonopoly regulation, it is also completely dependent on the U.S. militarily; in fact, Japan is still a military dominion of the United States. China “grew up” after the United States opened its domestic market for Chinese goods and supported the Chinese economy by its investments; China’s accession to the WTO in 2001 became the apotheosis of this “friendship”. The European Union in its present form was made possible through the expansion of American military alliance NATO to the East and admission of the Eastern European countries in it. It was possible to create the common European economic area only on the basis of the integrated military alliance of European countries. At the emergence of political problems in Yugoslavia, the peacekeeping operations on its territory were carried out by the U.S. forces.. What does this mean?

All indicators prove that the world capital globalization factor has been exhausted – no country and no region can claim the role of a full-fledged global economic center. In this situation, the traditional scheme of circulation of global capital by GEC is broken. Instead, it is necessary to establish a new scheme of the efficient coexistence of multiple regional economic centers (REC). Currently, such centers already exist: the U.S., China, the EU, Japan, and Russia. This system is the implementation of the multi-polar world model. We cannot give a characteristic of this system due to the short time of its existence. Most likely, regional economic centers will constantly form temporary alliances and thereby stabilize the world economy.

Meanwhile, we can assume that the attempts to create a new global economic center will be continued, for instance, the establishment of the Customs Union and the even more ambitious Eurasian Union. The Customs Union alone holds great opportunities. Continuing the experience of the United Europe, it possesses much more attractive features. For example, the integration of Russia, Kazakhstan, Ukraine and Belarus would create a single economic space with the area 2.2–fold exceeding the U.S. territory. The population of the Customs Union will be 70% of that in the USA (tab. 6), and the opportunities for further demographic growth in the united territories are almost unlimited. Such characteristics should be recognized as unique and very promising for the modern world.

The above highlights the unfolding struggle between Russia and Europe for Ukraine from a different angle. If the geopolitical situation in this country is not able to shift the balance in favor of one of the competing centers of power, it can at least weaken the position of the Customs Union as a new global economic center.

7. Culture vs economy

We have analyzed purely economic factors in the formation of the global world center. However, this does not answer the question of what to expect in the future. We can definitely say only the following. Neither the EU, nor China or Russia in their present state cannot become the new GEC. According to a number of indications, the U.S. is also close to losing this status. The world is in a state of institutional vacuum – it is not clear which political jurisdiction will determine the flows of global capital. It seems that the United States is the final point, in which the process of globalization of world capital has been completed. What is next?

All the regional economic centers are now facing very serious economic problems. However, none of these problems is unsolvable. The only question is how quickly and at what cost they will be handled. This situation brings the culture factor to the fore. How flexible, creative and wise will the countries be at solving the urgent problems?

It is already clear that the main problem of the U.S. lies not in its economy, but in the cultural environment, which has formed in the country. The disintegration of the society, the absence of its uniting idea, the lack of adequate institutions – these are the main threats to any country, including the USA. Thus, the change of centers of power in the world system will depend on the cultural factor rather than the economic factor.

Paradoxically, Russia, due to its huge territory, will always be the center of gravity for world capital. At present, it is not happening mainly because the country has not adopted modern capitalism. In fact, Russia, on the contrary, is trying to limit it and take it under control. This primacy of the state over the capital moderates the interest in Russia on the part of the world business community. If the country radically changes the attitude to capital, it can become a new global economic center5Note that any Northern country aspiring to the role of the new GEC should be a modern energy superpower. Russia has this feature.. However, global capital, as it has already proved over the previous centuries, will not be too concerned about its new jurisdiction. History shows that capital is not tied to the area of its origin and temporary stay. In this sense, Russia has a real chance to become the stronghold of global capital. What obstacles does it have to face?

First of all, cultural traditions, which are called community traditions against Western individualistic patterns of behavior. Assuming the role of GEC means renouncing all historical traditions, old cultural formats of conduct and public management. What social consequences can this kind of reforms have? How realistic are they? Are they appropriate for the Russian people and national capitalist elite? Is it worth to sacrifice local interests for the sake of gaining global achievements?

The answers to these questions are ambiguous. And this is a separate topic for discussion.

This article describes some objective economic prerequisites for the rise of a new global economic center. And in this regard, as it turns out, Russia has enormous potential. However, we have deliberately left aside a number of factors that can turn the course of history in an unexpected direction. For example, we have not considered a possibility of military–political actions. For example, China’s geopolitics is quite aggressive. In addition to capturing Tibet in 1951, China literally keeps all of its neighbors, Vietnam, Myanmar, Laos, Taiwan, in fear; the 2014 World Economic Forum in Davos revealed the escalated military confrontation between China and Japan. Many of these countries believe that China lays claim to their territory and can at any moment launch a military invasion. The unfolding of military actions can change the geopolitical influence of China, including its territory. In this case, the shift of the global economic center toward Russia would be problematic or at least slowed down.

We also disregarded the environmental factor. For example, the growth of per capita GDP in China up to the U.S. level will, most likely, lead to such an increase of anthropogenic load on the environment that it will not be compatible with normal life of the population.

There is a danger that the United States might prolong the time of its existence as a GEC. This process already manifests itself partly in active implementation of shale oil and gas production technology in the U.S.; the presence of vast undeveloped areas in the country considerably slows down the transition to a new GEC. The American business is planning to transfer high–tech production from Asia to the USA for similar purposes. This measure may prolong the life of the United States as a GEC.

There is a danger that Russia might break up, and Ukraine might be divided. Such a split up of the territory of a new potential global economic center can lead to a radical reshuffle of the interests of big capital, and Russia might as well have no prospects as a GEC. There is a danger of hostile cultural integration of the representatives of global capital and the Russian population. Just like the Anglo–Saxon capital established itself efficiently in the USA and suppressed the local Indian population, it can dominate in Russia, driving the Russians in a kind of economic reservation. Of course, such a “hostile takeover” on the part of global capital will cause fierce resistance and can result in the fact that the world business elite will cease to look upon Russia as a global economic center.

All these circumstances can disturb the natural logic of the movement of world capital to a new global economic center. But in any case, all these factors only disturb the main evolutionary trend – globalization of GEC and search for a new base for global capital.

Editorial note. Some of the conceptual provisions contained in the article of Professor E.V.Balatsky, are open to question, or require additional arguments. The author of the article, in particular, believes that the change of the global leaders is a process characteristic of the development of capitalist relations on the global scale. But are there any limits to capitalist development? When will the process of geopolitical inversion of capitalism fade? Is capitalism eternal? Is there any alternative to it?

The article by E.V.Balatsky gives a “good food” for discussing global development issues. The Editorial Board invites esteemed readers to join this discussion on the pages of our Journal.

References

1. Arrigi D. Posleslovie ko vtoromu izdaniyu “Dolgogo dvadtsatogo veka” [Afterword to the Second Edition of “The Long Twentieth Century”]. Prognozis, 2009, no.1(17).

2. Balatsky E.V. Novye kharakteristiki global’nogo kapitalizma [New Characteristics of Global Capitalism]. Obshchestvo i ekonomika [Society and Economy], 2013, no.3.

3. Brzezinski Z. Eshche odin shans. Tri prezidenta i krizis amerikanskoi sverkhderzhavy [Second Chance. Three Presidents and the Crisis of American Superpower]. Moscow: Mezhdunarodnye otnosheniya, 2007.

4. Bretton Woods system. Wikipedia. Available at: https://goo.gl/r1CtWE.

5. Venetsianskaya respublika [The Venetian Republic]. Polnaya entsiklopediya [Complete Encyclopedia]. Available at: http://www.polnaja-jenciklopedija.ru/istoriya-chelovechestva/venetsianskaya-respublika.html.

6. Genoa. Wikipedia. Available at: https://goo.gl/UuEwKd.

7. Dzis–Voinarovsky N. Kitai – vsemu golova [China – a Head of All]. Portal “Slon.ru”, January 14. Available at: http://slon.ru/world/kitay_vsemu_golova-521428.xhtml.

8. Dzis–Voinarovsky N. VVP Kitaya prevzoshel VVP Ameriki [China’s GDP Has Surpassed the U.S. GDP] Portal “Slon.ru”, January 14. Available at: http://slon.ru/world/vvp_kitaya_prevzoshel_vvp_ameriki-521787.xhtml.

9. Zizek S. God nevozmozhnogo. Iskusstvo mechtat’ opasno [The Year of Dreaming Dangerously]. Moscow: Izdatel’stvo “Evropa”, 2012.

10. History of USA. Wikipedia. Available at: https://goo.gl/BjDJim.

11. Lucas R.E. Lektsii po ekonomicheskomu rostu [Lectures on Economic Growth]. Moscow: Izd–vo Instituta Gaidara, 2013.

12. North D. Ponimanie protsessa ekonomicheskikh izmenenii [Understanding the Process of Economic Change]. Moscow: Izd. dom GU–VShE, 2010.

13. GDP (Current US$). 2013. Official website of the World Bank. Available at: http://data.worldbank.org/indicator/NY.GDP.MKTP.CD/countries/1W?display=default.

14. What Was the U.S. GDP Then? Available at: http://www.measuringworth.com/index.phphttp://www.measuringworth.com/usgdp/.

15. The Dating Game. The Economist Online, 2011, December 27. Available at: http://www.economist.com/blogs/dailychart/2010/12/save_date.

Official link to the article:

Balatsky E.V. Prerequisites for global geopolitical inversion// Economic and social changes: facts, trends, forecast, №2(32), 2014. P. 28–42.