INTRODUCTION

Since 2022, due to the aggravation of the geopolitical situation, Russia has faced the problem of lack of technological sovereignty. After the collapse of the USSR, the country lost or almost lost many knowledge–intensive sectors of the economy – civil aircraft construction, microelectronics, pharmaceuticals and so on. Restoration of the lost technological sovereignty implies active re–industrialisation, including the construction of many large technology–intensive enterprises in the country, which requires huge amounts of investment. However, Russians still remember the times when the country’s unique plants and factories were closed down for no apparent reason or sold for next to nothing to foreign owners with subsequent closure. In this regard, the problem of investment deficit in Russia is aggravated by the need to closely monitor new production facilities and to build an incentive system aimed at ensuring efficient operation of state–owned enterprises. The chain “loans – construction – corporatisation – loan repayment” should be organised in such a way that loans are regularly both granted and repaid. The latter is possible through corporatisation of the enterprise that has been built and started functioning, while retaining strategic control over its work.

These problems give rise to searches and experiments to solve them. One of such solutions is seen in the introduction of the “people’s capitalism model” (PCM), which implies vesting ownership in the form of a block of shares in strategically important enterprises. Of course, this measure will not solve all the problems associated with the restoration of technological sovereignty, but it will contribute to it. The practice of PCM implementation has a long history and mixed results. In this regard, the renewal of this initiative requires a full understanding of the opportunities and limitations inherent in it. This is the purpose of this article.

THE CONCEPT OF THE MODEL OF PEOPLE’S CAPITALISM: ESSENCE AND VARIETIES

The concept of PCM has a long history. The reign of US President D. Eisenhower was marked by the aggravation of the contradictions of capitalism associated with the confrontation between lab our and capital, socialist ideas, and the philosophy of entrepreneurship. This required the formation of a moralistic idea capable of inspiring society and neutralising socialist sentiments in it. Such an idea was embodied in “people’s capitalism”, the progenitors of which are considered to be the American economists M. Nadler and A. Burleigh. Later, PCM ideas were developed in the works of J. M. Clark, L. Erhardt, M. Salva– dori, D. Lilienthal, J. Galbraith, and others.

Despite the fact that the ideological basis of PCM originated in the 1920s in the USA and was connected with the “democratisation of capital” and the emergence of joint–stock companies, the term “people’s capitalism” itself appeared only in the mid–1950s. In 1956, a travelling exhibition demonstrating the achievements of American capitalism was organised in the USA, for which a brochure “Dynamic Economy – Capitalism of All the People” was published. The brochure proclaimed the transformation of the American system of capitalism into “people’s capitalism”, as a result of which 60 per cent of Americans became homeowners, 10 million – owners of shares, 115 – insured their lives [1]. After its release, the New York Times wrote that “once it [the name “people’s”] had not occurred to us earlier, it was a great disadvantage in the worldwide struggle for people’s minds” [2, p. 3]. Since then, the term “people’s capitalism” has firmly established itself in the political and scientific lexicon, as well as in the public consciousness of the population.

Initially, it was most likely an advertising slogan highlighting the participation of the masses in a business process that should become socially oriented and lead to a continuous improvement in the standard of living of the population, both through technological progress and through the deep desire for justice embedded in American culture and religion [1]. The PCM doctrine was formed of three components: “diffusion of ownership”, expressed in the placement of shares among the broad masses of the population; “managers’ revolution”, aimed at increasing the role of hired managers in the management of the company; “income revolution”, focused on reducing inequality in society. A little later, PCM became widespread in West Germany and Austria, where it was expressed in the implementation of the policy of “productive participation” (distribution of shares of enterprises among employees), “diffusion of ownership” (issuance of “people’s” shares), anti–cartel legislation protecting small and medium–sized businesses [3]. In the UK, under M. Thatcher, PCM took the form of a programme of privatisation and the formation of an ownership class [4].

The modern PCM has been developed in Russia, where a number of features of this socio–economic model of society development have been pointed out in the scientific community: ownership of no more than 25% of shares by the general subject of ownership (while the rest are distributed among the employees of the enterprise with their mandatory transfer to the enterprise fund upon dismissal); distribution of profits from the revenues of the raw materials sector of the economy and natural monopolies in the proportion of 20% – to shareholders, 80% – to the state in the form of direct and indirect taxes; permission to sell to foreign investors no more than 20% of shares of raw material sector enterprises; exemption from the tax burden of production sector enterprises with less than 30 employees, etc. [5]. It is obvious that the above requirements are redundant for PCM, therefore, at the legislative level “people’s enterprise” was defined as a joint– stock company in which employees own less than 49% of the charter capital. [1]

It is worth noting that along with PCM there are related concepts. For example, the theory of “American economic republic” by A. Burleigh, the profit–sharing system of M. Weizmann, etc. Recently, an unconventional interpretation of the “sharing economy” based on the principle of access to resources rather than their possession has become widespread [6,7]. This understanding fundamentally deviates from the original “classical” PCM, therefore, it will not be used in this paper.

PRACTICAL IMPLEMENTATION OF THE MODEL OF PEOPLE’S CAPITALISM

PCM has been implemented in different countries, in different periods of time and with varying degrees of success. Without seeking to provide an exhaustive historical picture of such practices, let us consider the most typical and textbook examples from the available arsenal. The purpose of these examples is to clarify the essence of the PCM model and the possibilities of its projection into business practice.

The USA. The first attempts to introduce PCM within the framework of the experiment on “democratisation of capital” were made in the 1920s in the USA, when joint–stock companies, whose authorised capital was formed with the participation of workers, became widespread. This made it possible not just to turn workers into co–owners of enterprises, but to form an ideology of owners in their minds. In 1929 there were already 456 thousand joint–stock companies in the USA, most of which belonged to the manufacturing and extractive industries [2]. This widespread democratic form of participation in the ownership of companies was due to the fact that these areas required quite large investments, and the sale of shares allowed to painlessly attract the necessary amounts for investment. The Great Depression put an end to this endeavour, but after the Second World War the USA returned to the theory of “people’s capitalism” and tried to modernise it.

The new wave of formation of the class of owners led to the fact that the number of shareholders in the USA increased from 6 million people in 1927 to almost 30 million people in 1965, and their share among those employed in corporations increased from 12.5 to 27.8% over the same period. However, the majority of shares (65 per cent) were concentrated in the hands of 1.4 million shareholders, among whom 200,000 owned a half of their total value (32 per cent). At the same time, only 2.5% of families with annual income up to 3 thousand dollars had shares, while the share of shareholders among families with annual income over 25 thousand dollars was 45.3%. The annual dividends of the first rarely exceeded $ 3, in connection with which there was a complete lack of any interest on the part of small shareholders in the activities of the company, which only strengthened the power of the owners, who concentrated the majority of shares [2]. These facts allowed J. Galbraith to characterise the idea of “people’s capitalism” and the annual general meeting of shareholders as “the most elaborate form of indoctrination of illusions to the people” [8, p. 94].

Thus, the first experiments with PCM in the U.S. in general did not give noticeable positive results.

Austria and Germany. Apparently, the countries of the “second wave”, where PCM became widespread, were post–war Austria and West Germany. There, after the Second World War, the share of state ownership was quite impressive due to the large–scale nationalisation of the economy. In these conditions, the idea of people’s capitalism was used by big financiers as an ideological screen to disguise the planned sell–off of state–owned enterprises. For example, Austrian propaganda was careful to indoctrinate society that there were only two paths to further development: either through “decentralisation of property” (i.e., PCM), whereby the previously disadvantaged classes become owners and thus rise to the middle class, as was the case in Canada and the USA, or through a social state concentrating all property in its hands, whereby the population jointly owns these state–owned enterprises, as was the case in the USSR and the socialist bloc countries [9]. The German ideologists developed this thesis by arguing that capitalism is able to overcome all its inherent class contradictions through the formation of “collective capitalist property”. According to the German political technologists, this should make it possible to put the interests of workers and society as a whole in the first place in the activities of enterprises, promptly solve social problems, reduce the gap between different segments of the population, and thus contribute to the transformation of capitalism into a society of social justice, and universal equality [2].

In order to achieve the task of building PCM in West Germany in 1950–1960, about 40 projects were launched in the 20th century to form ownership of wage labourers, which provided not only for direct sale of shares in enterprises at reduced prices, but also for the establishment of various kinds of tax and social benefits for their acquisition. For example, the “Savings Encouragement Act” of 1959 introduced a 20 per cent premium on savings deposits when they were frozen for five years or used to purchase shares, bonds, and other securities. The Act of 1961 “on the Promotion of the Formation of Property of Employees” established tax and social security benefits for entrepreneurs and employees if the former provided funds for the formation of property for their employees (up to a maximum of DM 312 per year per person) and the latter used the funds to acquire property, the sale of which was prohibited for a period of five years. [2].

In 1967, in order to develop these initiatives and due to the low response of the German population, the decree “On the Compulsory Interest of the Workers of Large Enterprises in the Results of Production Activities” was adopted, according to which a special fund was to be created from the company’s profits in enterprises with more than 100 employees. Each month from this fund each worker was allocated a sum of money, which was not handed out, but was placed in securities (shares, bonds), thus turning the worker into an owner – even against his wishes. However, it was possible to dispose of these securities only after 5–8 years, receiving interest on them during the rest of the time. In 1969, the West German government supplemented this PCM with a new programme to issue “people’s bonds”, which became another means of raising money from the population and accumulating public debt during the economic downturn of the country [2].

Great Britain. In Great Britain the idea of PCM was launched by M. Thatcher. It was an ambitious privatisation programme, which provided for the transfer of state property into private hands and the formation of a large class of owners, whose number increased from 2 to 11 million people respectively during Thatcher’s rule from 1979 to 1990. A significant part of shares was purchased by employees of privatised enterprises, who had certain privileges when buying them. For example, when buying shares in British Gas company 130,000 employees became shareholders, each of whom had the right to buy 52 free shares and 1481 shares at a 10% discount from the initial price. As a result, the size of the ownership class during Thatcher’s reign increased from 7 per cent to 20 per cent of the total adult population [4].

In addition to the socio–political effect aimed at restructuring the political consciousness of the society, PCM solved purely economic problems associated with reducing budget expenditures, revitalising competition, increasing production efficiency and attracting investment into the economy. It is believed that the realisation of the PCM idea allowed M. Thatcher, who gained power at the bottom of the economic cycle, to maintain economic growth in the country and significantly increase its competitiveness in the global marketplace.

Russia. In addition to new initiatives, Russia already has experience with PCM. The first experiment of PCM implementation is associated by the majority of the country’s population with the negative practice of voucher privatisation. Thus, the Decree of the President of the Russian Federation of 14.08.1992 No. 914 “On the introduction of the system of privatisation cheques in the Russian Federation” envisaged the transition from socialism to capitalism by means of transferring state property into private property with the help of vouchers, which every Russian could receive free of charge in the amount of 10 thousand rubles and then purchase shares of enterprises with them. As a result of privatisation, only 13% of the population bought shares, the rest sold their vouchers, thus contributing to the formation of a class of oligarchs in Russia.

The idea of PCM in Russia continued with the entry into force of Federal Law No. 115– FL dated 19.07.1998 “On the Specifics of the Legal Status of Joint Stock Companies of Employees (People’s Enterprises)”, aimed at regulating the practice of establishing and operating companies in which employees own at least 49% of the authorised capital. However, this form of joint stock companies is not widespread in Russia: by 2017, there were no more than fifty such enterprises in the country [10].

Starting from 2022, there is a restart of PCM implementation in Russia. Thus, in autumn 2022, Vladimir Potanin, President and Chairman of the Management Board of PJSC “Mining and Metallurgical Company Norilsk Nickel”, announced the launch of a “people’s capitalism” programme in his company. Its essence is to increase the shareholding owned by the company’s employees to 25% within 10 years. This, according to preliminary estimates, will affect almost 80 thousand employees of the company [11]. At the moment, according to Potanin’s estimates, employees hold about 10% of shares. The implementation of this programme envisages both vesting of shares in the company’s employees and their sale on the stock market in the longer term [12].

Norilsk Nickel programme has several objectives.

Firstly, the transfer of shares to employees is expected to expand the circle of co–owners involved in the company’s business success. Although the new shareholders will not be able to play a decisive role in management, they will be interested in the results of their own labour and the company as a whole, as their personal wealth will depend on these results. Secondly, PCM will allow the company to attract additional financing both by selling shares and by increasing their market value due to the reduction of their free float (on the stock exchange). В Thirdly, according to Potanin himself, the implementation of the programme of “people’s capitalism” will restore “some historical justice”, when after the privatisation of the company in 1994, its employees, who owned about 25% of shares, “could not take full advantage of this kind of investment and sold their shares” [13]. Fourth, the involvement of the company’s employees as co–investors increases their responsibility for the development of the territory where they and their families live: since the social projects implemented by Nornickel are oriented towards the improvement of this territory, making it more comfortable and environmentally friendly, construction of housing and social and cultural facilities [14].

The mechanism of the “people’s capitalism” programme includes an opportunity for employees who have been with the company for at least one year to acquire digital financial assets (DFAs). These assets are equal in value to the price of Nornickel shares and subsequently entitle them to receive dividends paid by the company. This approach makes it possible to fragment the purchase of shares by splitting it into parts and to make investments for people who do not have large savings. For DFAs distributed through the “Atomise” blockchain platform, there is a one–year period during which the acquired assets cannot be sold; they are scheduled to be redeemed at market value after five years. To implement this mechanism, in 2022 “Digital Assets”, the issuer of the DFAs, acquired 0.27% of “MMC Norilsk Nickel” shares (≈400,000 shares) for RUB 6.27 bln, and in May 2023 the first participants of the People’s Capitalism programme applied for these assets. [2]

THE SIGNIFICANCE OF THE PEOPLE’S CAPITALISM MODEL: EMPIRICAL ASSESSMENTS

Some initiatives to form PCMs have been reviewed above and their scale has been shown. However, for an objective assessment of these endeavours it is necessary to have an idea of their economic and social efficiency. Unfortunately, it is impossible to give an unambiguous answer to this question due to the lack of comprehensive statistical data and the complexity of assessing this difficult phenomenon. In this regard, let us consider some empirical data that allow us to at least roughly outline the real effectiveness of PCMs.

USA and other countries. After the first attempts to introduce PCM in the USA failed in the late 20th century, new initiatives were taken in this direction. Among them, the most popular was the corporate property vesting programme for employees – Employee Stock Ownership Plan (ESOP) (“equity capitalism”), which was widely spread in the USA, France, Great Britain, China, and other countries. Under an ESOP, employees of companies are allowed to buy their shares below market value, allowing them to build up a portfolio of shares by the time they retire and receive an extra boost to their pension. This is why ESOPs are often associated with a retirement savings programme.

A study of the efficiency of employee ownership of company property in the United States between 1988 and 1999 showed that after the implementation of the ESOP programme there were higher annual growth rates of sales (by 2.4%) and employment (by 2.3%) [15]. In 2010, it was found that not only did companies’ sales and employment increase, but also their survival rate over a long period of time increased as well as their labour productivity. At the same time, calculations showed that the total increase in the influence of employees on the development of new products, work organisation and marketing by one point gave an increase in the company’s sales by $ 19 thousand [16]. Despite the fact that another analysis conducted in 2012 did not reveal a clear relationship between “share capitalism” and the financial performance of companies, it showed a significant reduction in staff turnover, a high degree of employee involvement in the production process and their perception of their company as a “great place to work” [17]. This is largely due to the higher wealth of shareholder employees and their retirement benefits upon termination of employment. According to the study, in companies with ESOPs, the average income of shareholder employees was 30 per cent higher than those who did not own company property, and the average value of pension benefits in companies with ESOPs was several times higher than in companies without ESOPs. [3]

At the same time, other studies have shown that companies with an ESOP programme outperform non–shareholder companies on a range of financial indicators on an annual basis. For example, an analysis of a six–year period in 382 companies with an ESOP programme (two years – before ESOP implementation, four years – after) showed an average 2.7% increase in return on assets compared to their pre–ESOP projections. At the same time, these companies outperformed the industry average by approximately 7%, and 303 companies outperformed the industry average by 14%; share price growth averaged 1.6% across all companies. In addition, the reports showed a 5.5% increase in return on equity for companies with ESOPs, a 10.3% increase in return on net income, a 5.7% increase in operating cash flow per employee, and an average 2.9% decrease in corporate debt. [4]

The conclusions drawn in the reviewed studies are confirmed in practice. For example, a 10–year experience of implementing an employee incentive programme at pump manufacturer Ingersoll Rand has resulted in a significant reduction in employee turnover (from 20 to 3%), an increase in employee engagement (from 20 to 90%) and an increase in employee income (up to 80%).[5] Motivational programmes formed the basis for the creation of Ownership Works in 2022, a non–profit organisation aimed at helping companies launch motivational programmes. Today, the project already has around 60 partners, including major corporations, investment companies and various funds such as Harley–Davidson, Silver Lake, TPG and others. [18, 19].

Thus, over time, PCM initiatives, not only in the US but also in other countries, have become increasingly productive and encouraging.

Austria and Germany. The results of PCM in post–war Austria and West Germany are extremely mixed. For example, as a result of the actions implemented by the German government and its entrepreneurs, the number of co–owners of many West German enterprises among workers reached 40–60 per cent of their total number, but the share of the total value of their shares was very small. This external social effect was offset by the extremely dubious economic effect of property ownership by the masses: during 20 years of continuous capitalisation, the 312 “joint– stock” marks allocated under the law “On the Promotion of the Formation of Property of Persons in Wage Labour” increased a worker’s property by only the amount of his annual salary. This contrasts sharply with the “results” of the richest stratum of the population: while between 1950 and 1962 the index of nominal income in the country rose by 143 per cent, the index of businessmen’s profits rose by 236 per cent; the amount of annual remuneration of the financial upper echelons was 10–40 per cent of the profits earned [2].

In Austria, the PCM also failed to guarantee workers permanent jobs, decent wages and living standards. Rather, on the contrary: the initiative accelerated the redistribution of previously nationalised property to oligarchs and strengthened the role of the financial sector in the country’s economy.

Great Britain. In Great Britain, PCM and the accompanying privatisation had a tangible social effect: they changed people’s consciousness turning them from an employee to owner, which had a positive impact on companies’ operations. For example, the privatisation of the transport company National Freight Corporation transformed it into a more profitable and modern logistics organisation. This happened, among other things, because employees had a fundamental change in their attitude to work, increased motivation and interest in its qualitative fulfilment. Equally striking is the example of the miners’ £ 2 million buyout of the unprofitable Tower Colliery mine in Wales, which then operated successfully until its closure in 2008. At the same time, many electricity companies began to modernise, moving to heat–saving and cleaner power stations. The outdated electromechanical equipment of the telephone system was also replaced by electronic and digital equipment, and the abolition of the monopoly in this area paved the way for the mobile phone revolution [20].

Thus, Thatcher’s New Policy and her version of the PCM made it possible to accelerate the modernisation of the economy and revive business activity in the country. It is enough to recall that the rate of economic growth in the UK in the 1980s was 4–5 p. p. higher than in other Western countries: strong growth in industrial production led to a 27 per cent increase in GNP from 1981 to 1988. In addition, the government managed to reduce the rate of consumer price growth from 13.6 per cent in 1979 to 4.9 per cent in 1988.

Russia. Although the practice of establishing people’s enterprises in the country on the basis of Federal Law No. 115–FL dated 19.07.1998 “On the Specifics of the Legal Status of Joint Stock Companies of Employees (People’s Enterprises)” has not become widespread, it still demonstrates positive results. Among the PCM–based enterprises established at that time, some have survived to the present day and are carrying out successful economic activities. For example, CJSC “People’s Enterprise Naberezhnochelninskiy Cardboard and Paper Mill named after S.P. Titov” is still one of the ten largest enterprises of the Russian pulp and paper industry. The most famous producer of raw materials for refractories and ceramics, CJSC “People’s Enterprise Chelyabinsk Ore Management”, is successfully operating. One of the leading places among asbestos– cement enterprises in Russia is occupied by AOR “People’s enterprise Znamya”. Thus, it is impossible to disregard the historical experiment with PCM in any way.

As for MMC Norilsk Nickel’s PCM, it is currently problematic to assess its effectiveness, but it has both supporters and opponents. Thus, according to some experts, the company’s scheme for creating tokens [6] of its property is quite revolutionary and will compete with other tangible and intangible assets in the future due to its security, flexibility, ease of handling, transparency and guarantee of data safety [21]. Other financial analysts have raised concerns about investing in digital financial markets due to their underdevelopment in Russia, lack of legal regulation and vulnerability to hacker attacks, which makes them too risky. [7] A number of experts believe that the introduction of PCM is not so much motivational in nature for employees as it is aimed at enriching the oligarch himself. This opinion is substantiated by the fact that the programme’s backbone bank will be Rosbank, acquired by Vladimir Potanin, where employees wishing to become beneficiaries must have a special account linked to their salary account. This will allow Rosbank to attract new clients, strengthen liquidity and ensure the turnover of additional hundreds of billions of roubles.[8] In addition, there is an assumption that this programme is an anti–sanctions measure to mitigate the negative consequences of the sanctions imposed on V. Potanin. [22].

Thus, MMC Norilsk Nickel’s PCM is a vivid example of the competition between the pros and cons of the new initiative.

THE SIGNIFICANCE OF THE PEOPLE’S CAPITALISM MODEL: THEORETICAL FOUNDATIONS

The empirical evidence discussed above shows that in a number of cases PCM provides significant economic and social benefits in many areas. At the same time, one cannot ignore the fact that there are many critical arguments against this system. Such diametrically opposed opinions do not allow to form a correct attitude to PCM and need at least a preliminary ordering.

Let us try to explain the stability of interest in PCM over 100 years. For this purpose, let us recall a series of remarkable works by M. L. Weizmann devoted to the profit– sharing system [23–25]. In them, results were obtained that shed light on the significance of PCM. In particular, Weizmann considered two alternative models of economic organisation – the traditional system of employment with fixed wages regulated by labour contracts, and the one where a company’s employees, in addition to a minimum wage, are entitled to a share of its profits (this is a more general case compared to PCM). Weizmann’s modelling analysis showed that there are major functional differences between the two systems in favour of the participation (sharing) system [24]. Let us consider its macroeconomic advantages:

1. The traditional employment system is characterised by a tighter labour market and larger social problems; it is in a chronic unemployment mode and any negative shocks only increase this distress. In contrast, the participatory system tends towards a state of full employment and, even when taken out of it, returns to it rather quickly.

2. In the participatory system, the level of productive activity and real wages are systematically higher than in the traditional employment system.

3. The participatory system has a natural “immunity” against inflation and market prices are set lower than in a traditional employment system.

4. The participatory system is more flexible, manoeuvrable and manageable than the traditional employment system; it is more sensitive to monetary and fiscal regulatory measures. In it, the level of production is at its maximum and does not depend on government action, whereas in the traditional system it depends on money issue and government expenditure, hence any deterioration in these parameters leads to a decline in production. Prices and real wages in the traditional employment system, on the contrary, do not depend on state regulation and are determined by the technical characteristics of the production system, whereas in the participatory system they can be adjusted by fiscal and monetary policy instruments.

Thus, the large–scale implementation of the participatory system generates a completely different, more efficient macroeconomic system. It is this circumstance that largely explains the undying interest in PCM as a kind of participatory system.

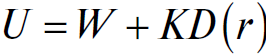

Now let us try to give an answer to the difference of estimates regarding the effectiveness of PCM. To do this, let us use an extremely simple theoretical construct that defines the motivation of employees of a company working on PCM:

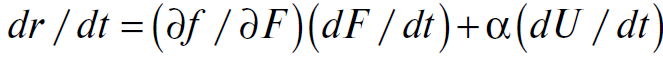

(1)

(1)

where: U – is the remuneration of the company’s employee; W – employee’s salary regulated by labour contractual obligations; K – shareholding owned by a particular employee; D – dividend on shares; r – profitability (efficiency) of the company’s work.

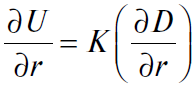

In the traditional employment system, the employee’s compensation function is limited only by the amount of his wages, whereas PCM adds a second component to the right– hand side of (1) in the form of equity income. In formula (1), it is assumed that the amount of dividends (D) depends on the success of the company (r). In the traditional employment system, however, the improvement of the company’s financial position does not affect the income of its employees, who receive their predetermined wages. However, in PCM, the success of the company directly affects the remuneration of employees:

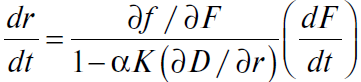

(2)

(2)

where: dU/dr – is the motivation effect, and dD/dr – is the incentive effect. It is easy to see that firm success motivates workers (dU/dr > 0) only if there is a properly tuned incentive effect (dD/dr > 0). If the incentive effect does not work (dD/dr = 0) or is completely broken (dD/dr < 0), then the firm’s success will only irritate workers and cause outbursts of protest and sabotage (dU/dr = 0 and dU/dr < 0 respectively). It is this circumstance that explains the existence of contradictory opinions about the effectiveness of PCMs. Indeed, some companies may have a well organised mechanism for reconciling profitability (yield) and dividend payments to employees, while in others it may be blocked for reasons beyond the control of employees. As a rule, the existence of such a coupling mechanism depends on the goodwill of the majority owner of the company.

Of course, the strength of the motivation effect depends on the size of the shareholding owned by the employee – the coefficient K in the right part of formula (2). If a company employee owns a purely symbolic share capital (K→0), the effect of his motivation will be practically nullified even with a well– adjusted incentive effect.

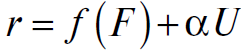

Let us now consider the behaviour of the company in the simplest and most aggregated form possible. Suppose that the efficiency function of the company is described by the following dependence:

(3)

(3)

where: F – factors other than employee motivation affecting the company’s performance (in an alternative interpretation, F can be interpreted as an aggregate managerial resource of the company); f – function linking managerial factors of the firm’s activity with profitability; α – coefficient of participation of the company’s employees, which provides a direct link between the interests of the company and the employee in contrast to the motivation effect, reflecting an inverse relationship between them (to simplify the analysis, the effect of participation is presented in an additive form, which does not violate the generality of the analysis).

Ratio (3) can be translated into a dynamic form:

(4)

(4)

where: t – is time.

Then, taking into account (1) and (2), the basic equation follows from (4):

(5)

(5)

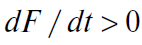

The resulting equation allows us to determine those conditions that ensure the coordination of employee and company interests and thus determine effective PCM, i.e., when dr/dt > 0:

(6)

(6)

(7)

(7)

(8)

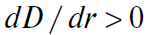

(8)

(9)

(9)

Let us consider the content of the obtained conditions.

Inequality (6) requires that all organisational and investment components of the company’s management system increase, i.e., the quality of management and investments increase. This condition is the key one, because without its fulfilment all other aspects of the company’s work lose their meaning. That is, condition (6) unambiguously says that PCM itself is not a determining element of the company’s work, but on the contrary – a kind of additional tool for fine–tuning.

Inequation (7) shows that there is a positive relationship between the efficiency of the company and the employee’s remuneration. Otherwise, there would be an inherent malevolence of the employee, who would work worse and worse with increasing income. Such situations are not excluded in reality, but they can be regarded as degenerate and be not considered.

Condition (8) postulates the existence of an incentive effect, when the growth of the company’s profitability “spills over” into the dividends of employees. If this effect disappears, a frankly hostile relationship is established between the company and the employee.

Finally, condition (9) is the most non–trivial, because it limits the effect of incentives from above, preventing excessive profit spillovers in favour of workers. Such a requirement is perfectly natural and intuitive. However, apart from this general conclusion, inequality (9) produces another very important thesis: a reasonable incentive system is possible only if the shareholding in the hands of the worker (K) is modest enough and if there is no overly aggressive complicity (α) on his part. This conclusion automatically follows from the fact that when K→0 the upper bound on the restriction on the incentive effect increases to infinity: dD/dr → ∞». This implies that vesting workers in the firm with small blocks of shares is productive and makes them sensitive to the dividend policy. If the distribution of shares among employees is unequal (i.e., some have rather large shareholdings and others have small ones), workers are divided into two groups: those who are affected by the PCM incentive system and those who remain insensitive to it. This may contribute to a conflict of interest among the holders of the company’s shares. Therefore, one of the main principles in the distribution of shares among employees should be the principle of approximate equality of all shares.

Thus, the modelling analysis unambiguously shows that in an effective PCM the employee should not be a “full–fledged” owner of equity capital, but only “one of many” participants. Hence, another important statement follows: for companies with a small number of employees and solid capitalisation (amount of share capital), PCM is unlikely to be an effective support to the corporate management system. Let us emphasise that the enlargement of a shareholding in the hands of an employee (K) and his too active involvement in the financial success of the company (α) lead to his transformation into a “normal”, “full–fledged” owner with the emergence of qualitatively new economic interests.

The conditions (6)–(9) obtained above shed light on the existing discrepancies in assessments of the effectiveness of PCM as a social institution. Since not all of the above conditions are fulfilled in practice, PCM does not always become truly effective.

IMPLEMENTATION OF THE PEOPLE’S CAPITALISM MODEL IN RUSSIA: SUGGESTIONS AND RECOMMENDATIONS

The considered properties of PCM do not allow us to give simple recommendations on its application, but some principles can still be formulated. It should be borne in mind that all the proposals set out below are of an initiative nature, and therefore are subject to a broad expert discussion in order to harmonise the positions of different social groups – majority owners of enterprises, their management and employees, as well as public authorities.

In view of the above, the following measures can be proposed to organise the work of PCMs.

Firstly, PCM enterprises should be provided from the very beginning with the principle of obligatory payment of dividends to the owners of “people’s shares”, i.e., in the hands of the employees of the enterprise. This principle is basic to ensure the effectiveness of the incentive system. Otherwise, when the employee–shareholders do not receive dividends, the PCM is completely discredited and devalued. In practice, this principle can take different forms, for example, in the form of regulating the relationship between the company’s return on equity and dividend payments. The main thing in this case is not to break the very link between the firm’s success and additional remuneration of employees.

Second, based on the principle of mandatory payment of dividends and its normative regulation, it is necessary to calculate the maximum size of the “effective shareholding”, which ensures the fulfilment of condition (9) and prevents a worker from becoming an oligarch. Accordingly, all workers should have shareholdings not exceeding this value. At the same time, the minimum size of a worker’s shareholding that provides him with a reasonable additional income should be determined. Then the policy of distribution of share capital will be based on the aspiration to ensure the principle of homogeneity of the “people’s owner”.

Thirdly, it is possible to provide for priority participation in the equity of the enterprise by residents of the region in which it is localised. For example, the share of equity in the hands of employees of the enterprise may be 25 per cent and the share of equity in the hands of other residents of the region may be 24 per cent. At the same time, this category of people may not be subject to the regulations adopted for those who work at the enterprise. In any case, this issue should be resolved by consensual agreement between the owners of the company. If the said 24% of the capital is not fully demanded by the residents of the region, the residual amount may be sold to other willing parties.

Fourth, in order to ensure a permanent link between the enterprise and its employees and the population of the region, it is necessary to adhere to the principle of continuity with respect to minority owners, according to which when an employee is dismissed and changes his/her place of residence (registration), he/she must sell his/her shares to the enterprise. This procedure can be ensured almost automatically, when a person, when changing his status, loses ownership rights in one of his bank accounts and instead receives regulated monetary compensation in another account.

Fifth, in order to maximise the attention of the regional authorities to enterprises of strategic importance, the practice of their mandatory participation in the share capital of these enterprises should be introduced. For example, the head of the region (city) should become the owner of a block of shares in one of such enterprises in the amount of his monthly salary. It is possible that in order to strengthen this measure, the principle of compulsory participation could be extended to deputy heads of the region (city).

We emphasise once again that these proposals are not a panacea for all problems and are subject to expert discussion with possible adjustments. However, without them, PCM risks going into “free floating” and losing its original advantages.

CONCLUSIONS

The return in Russia to the model of people’s capitalism is caused by the current economic and foreign policy context with the requirement to restore technological sovereignty. It is the new historical context for the country that largely dictates and justifies PCM. There is reason to hope that the competent implementation of this model of economic management will solve a number of currently pressing tasks. The first one is to increase the visibility and transparency of enterprises of strategic importance, as well as the attention to them on the part of both the public and the authorities. The second is to link the interests of the state, ordinary employees of the enterprise and residents of the region of its localisation. The third is to gain access to the population’s money savings for massive investments in enterprises that ensure the country’s technological sovereignty. Fourth, to support the material well–being of the population through its participation in new highly profitable business, which in the future may become global.

There is no doubt that the solution of the above tasks is realistic. For this purpose, at the moment there is both conceptual understanding of the essence and nuances of the PCM mechanism and practical experience in its implementation. It remains only to move step by step, but quickly in the indicated direction.

ACKNOWLEDGMENTS

The article was prepared as part of the state assignment of the Government of the Russian Federation to the Financial University for 2023 on the topic “Development of recommendations for ensuring economic growth in Russia under conditions of sanctions restrictions”.

REFERENCES

1. Botsevich N. N. “People’s capitalism” theory and making internal consensus during the Eisenhower administration. Izvestiya Saratovskogo universiteta. Novaya seriya. Seriya: Istoriya. Mezhdunarodnye otnosheniya = Izvestiya of Saratov University. History. International Relations. 2018;18(4):488–494. (In Russ.). DOI: 10.18500/1819–4907–2018–18–4–488–494

2. Panova M. “People’s capitalism” today. Moscow: Politizdat; 1970. 63 p. (In Russ.).

3. Dashkevich V. V. The challenge of German social policy model. Vestnik Chitinskogo gosudarstvennogo universiteta = Chita State University Journal. 2010;(6):63–67. (In Russ.).

4. Smirnov A. V. “People’s capitalism” of M. Thatcher. In: Proc. 7th sci.–pract. conf. “Economics and management: Problems, trends and future development”. Cheboksary: Interactive Plus; 2017:32–34. (In Russ.).

5. Tonkonogov A. V. The people’s capitalism: A strategic model of Russia’s development in the twenty–first century. Sotsial’no–gumanitarnye znaniya = Social and Humanitarian Knowledge. 2013;(3):21–44. (In Russ.).

6. Markeeva A. V. Sharing economy: Problems and development prospects. Innovatsii = Innovations. 2017;(8):73–80. (In Russ.).

7. Grigor’eva E. A. Sharing economy: History of the issue and attempt at conceptualization. In: Millionshchikov–2020. Proc. 3rd All–Russ. sci.–pract. conf. of students, post–graduates and young scientists with int. particip. dedicated to the 100th anniversary of Grozny State Oil Technical University named after M. D. Millionshchikov (Grozny, September 20–22, 2020). Grozny: Spektr; 2020:366–371. (In Russ.). DOI: 10.34708/GST0U.C0NF.2020.82.28.085

8. Galbraith J. K. The new industrial state. Boston, MA: Houghton Miffin Co.; 1967. 427 p. (Russ. ed.: Galbraith J. K. Novoe industrial’noe obshchestvo. Izbrannoe. Moscow: Eksmo; 2008. 1200 p.).

9. Kozyakova N. S. The political brand of people’s capitalism in the Second Republic of Austria (1950–1960s). Vestnik Moskovskogo gosudarstvennogo oblastnogo universiteta. Seriya: Istoriya i politicheskie nauki = Bulletin of the Moscow Region State University. Series: History and Political Sciences. 2021;(1):125–132. (In Russ.). DOI: 10.18384/2310–676X–2021–1–125–132

10. Goncharuk D. The Law on people’s enterprises is subject to amendments. Parlamentskaya Gazeta. Jun. 30, 2017. URL: https://www.pnp.ru/economics/zakonu–o–narodnykh–predpriyatiyakh–predstoyat–popravki. html (accessed on 29.07.2023). (In Russ.).

11. Devyatova P. People’s capitalism. The President of Norilsk Nickel about the employee motivation program. Argumenty i Fakty. Sep. 17, 2022. URL: https://aif.ru/money/company/narodnyy_kapitalizm_prezident_nornikelya_o_programme_motivacii_rabotnikov (accessed on 29.07.2023). (In Russ.).

12. Parfent’eva I., Tokarev K. Potanin to RBC: “I would like 25% of Norilsk Nickel to return to the people”. RBC. Sep. 17, 2022. URL: https://www.rbc.ru/business/17/09/2022/632485e79a79476f5081b3a8?from=column_1 (accessed on 29.07.2023). (In Russ.).

13. Batyrov T. Potanin announced the launch of “people’s capitalism” at Norilsk Nickel. Forbes. Sep. 17, 2022. URL: https://www.forbes.ru/milliardery/477383–potanin–zaavil–o–zapuske–narodnogo–kapitalizma–v–nornikele (accessed on 29.07.2023). (In Russ.).

14. Kamzolova A. What Vladimir Potanin’s “people’s capitalism” will bring. Rossiiskaya gazeta. Sep. 19, 2022. URL: https://rg.ru/2022/09/19/chto–prineset–narodnyj–kapitalizm–vladimira–potanina.html (accessed on 29.07.2023). (In Russ.).

15. Blasi J., Kruse D., Weltmann D. Firm survival and performance in privately held ESOP companies. In: Sharing ownership, profits, and decision–making in the 21st century. Bingley: Emerald Group Publishing Limited; 2013:109–124. (Advances in the Economic Analysis of Participatory & Labor–Managed Firms. Vol. 14). DOI: 10.1108/S 0885–3339(2013)0000014006

16. Kramer B. Employee ownership and participation effects on outcomes in firms majority employee–owned through employee stock ownership plans in the US. Economic and Industrial Democracy. 2010;31(4):449–476. DOI: 10.1177/0143831X10365574

17. Kruse D. L., Blasi J., Freeman R. Does linking worker pay to firm performance help the best firms do even better? NBER Working Paper. 2012;(17745). DOI: 10.3386/w17745

18. Kotchenko K., Polyanskii D., Khrisanfova A. “People’s capitalism”: Will companies distribute their shares to employees? Investitsii. Nov. 02, 2022. URL: https://quote.ru/news/article/6361063a9a7947551658efc0 (accessed on 29.07.2023). (In Russ.).

19. Keegan P. One way to boost profits and reduce inequality? Turn workers into owners. Bloomberg. 28.10.2022. URL: https://www.bloomberg.com/news/articles/2022–10–28/employee–owned–companies–reduce–inequality–and–boost–profits?srnd=premium–europe&leadSource=uverify wall (accessed on 29.07.2023).

20. Redwood J. Thatcher allowed more people to participate in the wealth of the nation through property ownership and shares. PoliticsHome. 03.05.2019. URL: https://www.politicshome.com/thehouse/article/thatcher–allowed–more–people–to–participate–in–the–wealth–of–the–nation–through–property–ownership–and–shares (accessed on 29.07.2023).

21. Kuz’micheva A. First investments in digital financial assets. Experts assessed the prospects of the new product. RBC. Jun. 20, 2022. URL: https://www.rbc.ru/crypto/news/62d7ab419a794747fa652c53 (accessed on 29.07.2023). (In Russ.).

22. Rychkova E. Capitalism of unheard–of generosity: Why Potanin wants to “distribute” Norilsk Nickel shares to employees. Nakanune.ru. Sep. 19, 2022. URL: https://www.nakanune.ru/articles/119569/ (accessed on 29.07.2023). (In Russ.).

23. Weitzman M. L. Profit sharing as macroeconomic policy. The American Economic Review. 1985;75(2):41–45.

24. Weitzman M. L. The simple macroeconomics of profit sharing. The American Economic Review. 1985;75(5):937–953.

25. Weitzman M. L. The share economy. Cambridge, MA: Harvard University Press; 1984. 184 p.

[1] Federal Law No. 115–FL of 19.07.1998 “On the Specifics of the Legal Status of Joint–Stock Companies of Employees (People’s Enterprises)”.

[2] Digital Assets issued the first tokens for participants of Nornickel’s corporate programme. URL: https://www.nornickel.ru/news-and-media/press-releases-and-news/tsifrovye-aktivy-vypustili-pervye-tokeny-dlya-uchastnikov-korporativnoy-programmy-nornikelya/ (accessed on 29.07.2023).

[3] Research on Employee Ownership, Corporate Performance, and Employee Compensation. URL: https://www.nceo.org/articles/research-employee-ownership-corporate-performance (accessed on 29.07.2023).

[4] Ibidem.

[5] Ingersoll Rand Provides Equity Grant to All Employees. URL:https://www.industryweek.com/talent/article/21142915/ingersollrand-provides-equity-grant-to-all-employees (accessed on 29.07.2023).

[6] A token — is a digital asset (certificate) that represents a certain value, operates on a blockchain or other decentralised network, and guarantees a company’s obligations to its holder. Tokens can be used to grant a stake in a project, access to certain services or products.

[7] The “people’s capitalism” project invented by Nornickel did not find support among financiers. URL: https://zapad24.ru/articles/97842-pridumannyj-nornikelem-proekt-narodnyj-kapitalizm-v-ne-nashel-podderzhki-u-finan.html (accessed on 29.07.2023).

[8] Potanin’s non-people capitalism. URL: https://argumenti-ru.turbopages.org/argumenti.ru/s/society/2023/04/825044 (accessed on 29.07.2023).

Official link to the paper:

Balatsky E.V., Ekimova N.A. Opportunities and limitations of the «People’s capitalism model» // «The World of New Economy», 2023, Vol. 17, No. 3. Pp. 40–54.