Today Russia is completing a large–scale restructuring of its national economy, accompanied, among other things, by marked shifts in the distribution of resources and manufactured products among industrial enterprises of different ownership types. Although the process of massive privatization is still going on, it has basically outlived its usefulness, having reached the saturation point. It therefore seems opportune to discuss the following problems:

—the overall trends of industrial restructuring by different forms of ownership;

—the relative efficiency of industrial enterprises of different ownership types;

—the effect of privatization on critical trends in industrial production; and

—the advisability of further transfer of state enterprises to other forms of ownership.

A study of these problems acquires particular urgency because the effectiveness of privatization in terms of its effect on economic growth has not yet been duly reflected in scientific literature. Furthermore, Russia is now at a turning point in its development when old managerial paradigms must give way to new ones, or at least be seriously corrected. Our analysis allows us to make out the case for a stronger role of the state economic sector in macroeconomic policies.

Basic trends of industrial restructuring

The key directions of the ongoing shifts in industrial property structure are represented by the dynamics of the three main functional indicators of its structural segments [1–3].

According to the data of Table 1, there were major changes in the management of industrial facilities in 1994–1996. Thus, by 1997 90% of all industrial plants had been privatized, thereby restricting considerably the possibilities of state influence on industrial policy. At the same time, such fragmentation of the sector into small, maneuverable and independent economic structures created favorable conditions for competition. This trend was most graphically manifested in light industry and machine-building where the share of private enterprises had reached by 1997 90 and 90.4% respectively; the smallest share of private ownership was in electric power engineering (28.9%) and coal mining (30%).

Table 1. The structure of industrial production with respect to ownership types, %

|

Type of ownership |

1993 |

1994 |

1995 |

1996 |

|

Share of enterprises |

|

|

|

|

|

State |

15.0 |

6.6 |

4.9 |

3.0 |

|

Municipal |

4.4 |

2.3 |

2.8 |

1.4 |

|

Public (volunteer) organizations |

0.8 |

0.9 |

0.9 |

0.6 |

|

Private |

61.3 |

72.1 |

72.3 |

87.1 |

|

Mixed without foreign participation |

17.3 |

16.5 |

16.9 |

6.0 |

|

Mixed with foreign participation |

1.2 |

1.6 |

2.2 |

2.2 |

|

Share of employees |

|

|

|

|

|

State |

47.1 |

25.7 |

15.9 |

13.6 |

|

Municipal |

2.2 |

2.0 |

1.9 |

1.5 |

|

Public (volunteer) organizations |

0.7 |

0.6 |

0.6 |

0.6 |

|

Private |

14.2 |

22.0 |

27.3 |

35.0 |

|

Mixed without foreign participation |

35.1 |

46.1 |

52.8 |

47.2 |

|

Mixed with foreign participation |

0.7 |

1.0 |

1.5 |

1.9 |

|

Share of manufactured products |

|

|

|

|

|

State |

43.6 |

19.9 |

9.7 |

9.2 |

|

Municipal |

1.3 |

1.6 |

1.3 |

1.2 |

|

Public (volunteer) organizations |

0.3 |

0.2 |

0.2 |

0.3 |

|

Private |

9.3 |

15.0 |

18.9 |

25.2 |

|

Mixed without foreign participation |

43.7 |

60.9 |

66.9 |

60.8 |

|

Mixed with foreign participation |

1.8 |

2.4 |

3.0 |

3.4 |

In 1993–996, there were major shifts in the structure of ownership types. While in 1993 state enterprises were the dominant industrial sector in terms of output and human resources, in 1996, domestic enterprises of a mixed ownership type ranked first, private enterprises second, and state enterprises only third.

A shift in industrial priorities from state to joint–stock ventures occurred in 1994, the year when the “capitalization” policy won the final victory in the Russian industry. For instance, the integral proportion of quasi–state types of ownership dropped from 37.9% to a negligible 9.9% in 1993–1996. The integral shares of the state industrial sector (%) can be seen from the following.

|

|

1993 |

1994 |

1995 |

1996 |

|

State sector |

37.9 |

19.4 |

12.2 |

9.9 |

|

Non–state sector |

62.1 |

80.6 |

87.8 |

90.1 |

Country–by–country comparisons show unambiguously that during the period of economic reform Russia became one of the most “capitalist” countries in the world. It actually found itself in the same class with countries such as Holland (8.1 %) and Luxembourg (4.2 %) [4], whose economies are in principle incommensurable with the Russian economy. For all its conventionality the comparison shows dearly enough the scale of “quantitative” change.

Differentiation of productivity of labor by type of ownership

The data on the relative productivity of labor, the most representative characteristic of an enterprises performance, shown in Table 2, make it possible to group all property types into three clusters.

Table 2. The relative productivity of labor at industrial enterprises of different ownership types (average sectoral productivity = 100%)

|

Type of ownership |

Productivity of labor |

|||

|

1993 |

1994 |

1995 |

1996 |

|

|

Share of enterprises State |

93 |

77 |

61 |

68 |

|

Municipal |

59 |

80 |

68 |

80 |

|

Public (volunteer) organizations |

43 |

33 |

33 |

50 |

|

Private |

65 |

66 |

69 |

72 |

|

Mixed without foreign participation |

125 |

132 |

127 |

129 |

|

Mixed with foreign participation |

257 |

240 |

200 |

179 |

The first cluster is municipal enterprises and enterprises of volunteer (public) organizations. These enterprises are characterized by an extremely unstable trend in their productivity of labor. It is safe to say that these types of ownership are still in an active formative stage and their relative efficiency rank has not been finally determined yet.

The second is private entities and corporations with the participation of foreign capital. These types of ownership have a clear-cut logic of development. For instance, while domestic private structures were slowly but surely raising their efficiency, joint ventures were, on the contrary, losing their initial edge “surrendering” to the Russian economy their administrative–managerial and technological innovations. In a manner of speaking, intersectoral diffusion of efficiency left its imprint on these two ownership types. As a result, private Russian enterprises, on the one hand, used the mechanism of imitating positive innovations to gain a firm foothold on the national industrial market while foreign and joint ventures, on the other, gradually lost their margin of safety and felt more and more painfully the pinch of a critical economic situation.

The third is state enterprises and domestic stock corporations. Inner tensions make themselves felt in the development of these entities. For instance, at mixed ownership enterprises the relative productivity of labor was maintained within a sufficiently narrow range (125–132%) which testifies to their high economic stability. Fluctuations of the original figure show, however, that this result was achieved by competition. As for the state entities, their strenuous attempts to compete with enterprises of other ownership types were crowned with a certain amount of success. In 1996, there appeared some signs of a turn of the tide, albeit an insignificant one, toward a higher relative productivity of labor.

Mixed ownership enterprises that benefited from main structural shifts were the best performers throughout this period. The state and municipal enterprises were, on the contrary, pulling the Russian economy down, largely justifying a strategy of their transfer to the category of non-state structures.

The leveling of productivity by different patterns of ownership can be regarded as one of the main positive trends in this area. The productivity variation factor in the various structural segments of industry [5] was characterized by a steady downward trend and, as a result, its level was down nearly 25% in 1996 from 1993. The productivity variation factor at enterprises of different forms of ownership was as follows (%):

|

|

1993 |

1994 |

1995 |

1996 |

|

Variation factor |

322 |

316 |

296 |

238 |

This fact testifies to a gradual completion of transition, a period characterized by high instability of all economic phenomena. However, entry into a new phase of economic development calls for a new privatization strategy.

The size of industrial facilities

Data on the dynamics of medium–size industrial facilities of different forms of ownership with respect to employee numbers (Table 3) lead us to several important conclusions.

Table 3. The average size of industrial facilities of different ownership types

|

Type of ownership |

Number of employees |

|||

|

1993 |

1994 |

1995 |

1996 |

|

|

State |

570 |

492 |

379 |

440 |

|

Municipal |

91 |

110 |

79 |

103 |

|

Public (volunteer) organizations |

159 |

84 |

78 |

191 |

|

Private |

42 |

40 |

44 |

38 |

|

Mixed without foreign participation |

368 |

368 |

365 |

753 |

|

Mixed with foreign participation |

106 |

79 |

80 |

83 |

First, there is a clearly discernible positive correlation between the indicators of Tables 2 and 3. It means that the growth in size was, as a rule, accompanied by the growth in performance of enterprises. That picture appeared against the background of an overall disaggregation of industrial facilities. In other words, it was the enterprises vigorously resisting the fragmentation of their industrial potential that consolidated their market positions. It should be stressed that this trend is true only for the dynamics of ongoing processes; in statics, such correlations cannot be observed. In other words, relative productivity of labor does not directly depend on the absolute size of enterprises.

Second, there was a realignment of forces between the state and private sectors in 1996. Thus, while in 1993–1995, state enterprises were the most powerful entities in terms of their concentrated production potential, in 1996, domestic corporations, a variety of the private capitalist form of ownership, became obvious leaders according to this indicator. Consequently, as early as 1997, the industrial potential of capitalized enterprises was finally mobilized and they began to trample down the state sector. It confirms once again that in 1997 the Russian economy, which had entered a new phase, came to grips with the problem of upgrading the mechanism of interaction between the state and enterprises of various forms of ownership, putting on the back burner the problem of a further buildup of private capitalist economic structures.

Third, 1996 saw a transition to the aggregation of enterprises of practically all forms of ownership. It was particularly noticeable at state–run enterprises and corporations without foreign capital. In fact, 1996 ushered in an epoch of big business in Russia’s domestic industry when all the advantages of powerful economic structures came to the fore. During that period it became obvious that further fragmentation of industrial facilities was tantamount to the loss of their competitiveness, which predetermined what amounted to the reversal of the disaggregation trend.

An analysis of Table 3 makes it possible to group all forms of ownership into the above–mentioned three clusters (see Table 2). The structure of the first cluster is characterized by chaotic leaps in the size of municipal enterprises and enterprises of public organizations which testifies to the absence of a clear-cut strategy in these forms of property.

The enterprises in the second group (private companies and joint–stock ventures with the participation of foreign capital) had a perfectly clear course of development. Thus, while private companies acquired their optimal size as early as 1993 (in the following years there were just minor fluctuations around that level), joint ventures and foreign enterprises did not achieve it until the following year. However, modem industrial enterprises, based on “pure” private ownership, are just “pitiful midgets” that can only play a subsidiary role in small business. Such is the discouraging result of the four–year development of companies in the second ownership group. The same picture is characteristic of joint–stock companies with the participation of foreign capital which until recently gravitated to small rather than big business. Their secondary role is most graphically manifested when we analyze the situation in industrial subsectors. Thus, in 1996, the gap in size between mixed–type enterprises with and without foreign capital assumed truly fantastic proportions, particularly in capital–intensive sectors such as electric power engineering (22 employers as against 1499), the fuel sector (174 and 2072), in the nonferrous metal industry (149 and 1897) in the chemical and petrochemical industries (86 and 1581), in machine–building and metal–working (78 and 1096). The foregoing figures show that this group of economic entities is still a mere element of the Russian industry’s infrastructure and not its vanguard.

The real driving force of future change in industry is the third group of entities – state enterprises and domestic corporations. At present, they alone have the potential for major industrial maneuvers and large–scale industrial projects. From this perspective, the competition between state enterprises and domestic corporations that came to a head in 1995 will continue in the future assuming increasingly visible forms.

The methodology of assessing the effect of structural shifts on the dynamics of industrial production

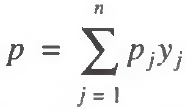

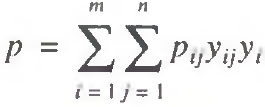

A qualitative assessment of the effect of structural shifts (by form of ownership) on industrial output can be made by using the following two identities:

x = pL (1)

(2)

where x is industrial output, p the average productivity of labor in industry, L the number of employees in industry, pj productivity of labor at industrial enterprises of ownership form j, and yj the share of workers employed at enterprises of ownership form j.

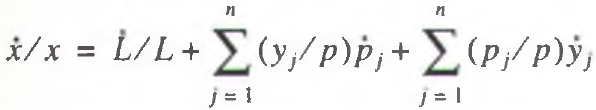

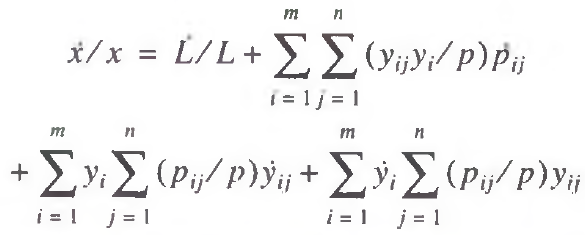

By rewriting the identities using logarithmation and differentiation procedures and combining them in a single correlation, we arrive at the following formula:

(3)

By proceeding from continuous to discrete magnitudes, we find the formula sought:

(4)

The expression in the left–hand part of (4) is the growth rate of industrial production; the second addend in the right–hand part is the estimated contribution of shifts to the employment structure in various ownership forms; the component Ω is a remainder accumulating the effect of the remaining factors.

Practical studies may rely on the following algorithm of handling formula (4): only the second component of its right–hand part is subject to direct calculation; the increment rate is derived directly from statistics; the component Ω is calculated as the remainder balancing the right– and left–hand parts.

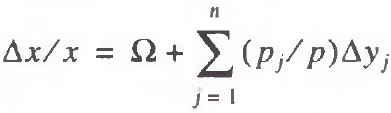

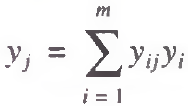

In a number of instances, shifts in the distribution of employees by ownership forms may be analyzed side by side with sectoral shifts in industry. In this case, two types of structural effects are subject to assessment. A generalized form of formula (2) may be used for corresponding calculations:

(5)

where pij is productivity of labor at enterprises of ownership form j in industrial subsector i; уij the share of employees at enterprises of ownership form j in subsector i;yi, is the share of employees in industrial subsector i.

Using formulas (1) and (5) the following expansion is produced:

(6)

The third addend in the right–hand part (6) shows the effect of employment shifts in industrial subsectors, related to ownership form, on the rate of industrial output; the fourth component makes it possible to assess the effect of shifts in the sectoral structure of industrial employment.

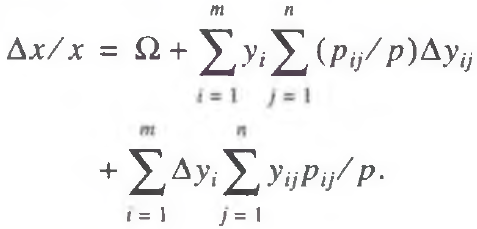

As in the previous instance, it is advisable to pass on from (6) to a more convenient correlation:

(7)

Working with expansion (7), we use the same algorithm as in the case of formula (4): are only the second and third components of the right–hand part of (7) are subject to direct calculation; the increment rate is derived directly from statistics; the component Ω is calculated as the remainder balancing the right– and left–hand parts.

The assessment of the effect of industrial economy restructuring on production dynamics

An analysis of calculations, based on formula (7), leads to a number of important conclusions (Table 4).

Table 4. The effect of shifts in employment structure in various ownership types on industrial production dynamics, %

|

|

1993–1994 |

1994–1995 |

1995–1996 |

|

The increment rate of industrial output, total Including increment due to: |

–21 |

–3 |

–4 |

|

shifts in ownership structure |

13.2 |

3.2 |

0.3 |

|

sectoral shifts |

2.7 |

4.3 |

3.6 |

|

other factors |

–36.9 |

–10.5 |

–7.9 |

First, the shifts in employment structure by property form within industrial subsectors as well as shifts in the distribution of human resources have made a steady positive contribution to the dynamics of industrial production. Thus these two types of structural change served as shock absorbers of a developing crisis. In other words, if it were not for the above–mentioned shifts, the depth of the production slump would have been immeasurably greater than what was actually the case. In this sense, the massive dumping of state property into private hands and, consequently, the entire industrial privatization drive had an objective economic basis. It is this fact that justifies to a large extent the measures taken by the government to raise the overall efficiency of the industrial sector in the Russian economy.

Second, the relative importance of the two types of structural shift radically changed in 1993–1996. While in 1993–1994, the effect of shifts in property pattern clearly exceeded that of intersectoral shifts in industry, a year later they became nearly equal (although intersectoral changes slightly tipped the balance), and in 1995–1996, it was the intersectoral shifts that began to play the main role in anti–crisis shock absorption. The above trend arose from two factors. The first was the decreasing potential of the privatization drive which had reached its peak by 1996 thereby exhausting the possibilities of further restructuring in the industrial economy of various ownership forms. The second factor was the basically inexhaustible effects of intersectoral shifts. Indeed, the magnitudes of shift effects in the structure of industrial subsectors were commensurate in all the years under review and even had a certain upward trend while a similar indicator of shifts in ownership structure dropped every year by about an order of magnitude (see Table 4).

The calculations, made according to formula (4) for ten industrial subsectors, supplement considerably the above picture.

First, it may be pointed out that the process of privatization played an entirely different role in various subsectors. For instance, shifts in the ownership pattern produced a stable positive effect on output dynamics only in the fuel industry and machine-building. Its impact, however, waned several times with each passing year. In electric power engineering, construction material and light industries, the above shifts, on the contrary, had a negative effect on the output thereby aggravating the crisis. In the chemical, petrochemical, woodworking, and pulp and paper industries, a positive trend gave way to a negative one in 1995–996. In other words, the above sectors had undergone a qualitative change in the pattern of privatization shifts by 1997.

Thus, the previous large–scale privatization was objectively necessary and, therefore, justified. At the same time, the inadequate sectoral elaboration of a privatization strategy resulted in unjustified changes in state enterprises’ form of ownership. The main thing, however, was that by 1997 the positive privatization of previous years had already bogged down, and Russia today faces the need of cutting short the process it initiated and upgrading the established structure. What it comes down to is that the thrust of the government’s regulatory efforts had to shift to settling scores with state and municipal enterprises in order to make their activities more efficient and productive. Corporate state entrepreneurship can play an important role here. If need be, private companies and corporations in a number of industries that had not measured up to the expectations could be nationalized.

The latter thesis is directly linked with the government’s macroeconomic policy and calls for a special commentary.

The regulatory cycle “privatization–nationalization”

As is correctly pointed out in [6], privatization and nationalization (deprivatization) are conjugate twin categories. International experience shows that privatization processes periodically give way to nationalization processes and vice versa. Such periodicity is one of the manifestations of G. Soros’ doctrine of a credit–regulatory cycle according to which not only the economic system (competitive environment) itself but the state regulation system is subject to periodic fluctuations. In other words, the economy is constantly fluctuating between insufficient and excessive regulation. Therefore the cyclicity of state regulation is manifested in a succession of amplification and attenuation phases of the government’s pressure on the economy [7].

Characteristically, the need for an oscillating mode “privatization–nationalization” no longer causes any doubts. For instance, the restructuring experience of the British economy shows the instability of the demarcation line between private property and state-owned firms [8]. A similar problem existed in Eastern Europe: privatization may last indefinitely but the reverse process of the folding of privatized enterprises is still inevitable.

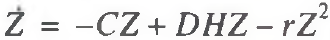

The phenomenon of “ambiguity” of privatization may be illustrated with the aid of the Lotka–Volterra model. For example, Welfens and Jasinsky [8] propose the following base model for the dynamics of state and private sectors of the economy:

(8)

(8)

(9)

(9)

where H and Z are the number of private and state firms; А, В, C, and D are parameters. Product HZ in (8) and (9) characterizes the set of all the possible contacts between private and state economic structures, and parameters В and D reflect their share that gives rise to new economic entities of one type or other.

In a more realistic case where the growth in the number of firms conforms to a logistic law, models (8) and (9) are transformed to the form (h and r are parameters):

(10)

(10)

(11)

(11)

Models (8), (9) and (10), (11) generate an oscillating pattern of trajectories H and Z. Inasmuch as economic growth is a function of H and Z, the state has to produce “ebbs” and “flows” in the privatization drive to make economic development smooth. Such reasoning confirms the objective character of the “privatization–nationalization” cycle. Yet it should be pointed out in all fairness that all the varieties of models (8), (9) and (10), (11) need thorough verification and appropriate assessment of model parameters. Without such verification, they can only serve as a hypothetical and purely theoretical rationale for observable “privatization- nationalization” cycles.

It is common knowledge that any pulsations in a regulation system correlate with the credit cycle. Now that the Russian economy faces serious problems with credits, it is safe to say that active efforts on the part of the state in support of the domestic industry including the expansion of its sphere of influence by controlling state sector enterprises are badly needed.

In other words, the time is ripe, in our view, to supplement privatization by deprivatization. At the same time, it is necessary to prevent further “evaporation” of the state sector. Otherwise, the Russian economy will once again take the path of one–sided development losing market flexibility that was, strictly speaking, the goal of the privatization drive.

It should be emphasized that the descriptive analysis we have made also implies an active aspect which is of great regulatory importance. Among other things, the following algorithm may be proposed in order to use the estimates of structural effects for the development of regulatory cycles. If the expansion of the non-state sector steps up over a long period the rate of economic growth of industrial production, the regulation of the scope and efficiency of state enterprises should be based during that period on the least possible interference of the state in the affairs of private companies. Attention should be focused on state enterprises. If this positive trend is reversed, that is, if the enlargement of the private sector slows down the rate of industrial growth and it assumes a stable and systemic character, it is advisable to exert more rigorous control not only over state enterprises but also over non–state economic entities and, if necessary, to nationalize them.

Although the above algorithm of the “nationalization–privatization” regulatory cycle seems quite logical in terms of simple estimates, it does not suggest a need for its mechanical application; rather, it can serve as a useful auxiliary tool for the adoption of managerial decisions under shortage of information.

The methodology of estimating the rate of structural shifts

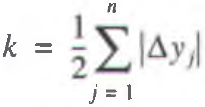

A standard coefficient (further referred to as the aggregate intensity coefficient of structural shifts) can be used to estimate the intensity of ongoing shifts by form of ownership:

(12)

Formula (12) deals with shifts in employment pattern, examined earlier in analyzing the effect of privatization processes on economic growth. If need be, similar correlations can be used to estimate shifts in production (output) structure as well.

Formula (12) is quite appropriate and effective for aggregate estimates. For a finer analysis, however, it should be supplemented by corresponding correlations. More detailed estimates are needed because the ongoing shifts in industry’s employment pattern are comprised of two processes: shifts in the ownership pattern within each industrial subsector and shifts in the structure of the industrial subsectors themselves. Mutual superimposition of the two trends yields a resultant, estimated according to formula (12). It is self–explanatory that in a number of instances sectoral shifts may reinforce the trend of employment restructuring in various ownership forms and in some cases attenuate it. The following methodology of factor analysis, applied to the rate of structural shifts, can be used to explore the role of sectoral changes proper within industry.

In estimating the rate of structural shifts, we cannot apply expansions and the general methodological pattern, which are used to estimate the effect of structural changes on economic growth, because of the modulus sign in formula (12). Therefore a somewhat different procedure should be applied.

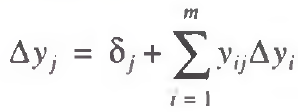

The following identity is true of share characteristic уj.

(13)

It automatically follows from (13) that

(14)

Expansion (14) shows what groups of factors are responsible for the resultant change in the share of those employed at enterprises of ownership form j. For instance, the second component in the right–hand part (14) estimates the effect of sectoral changes in industry. Subject to direct assessment in practical estimates are the left–hand part and the second component of the right–hand part (14); component δj, is calculated as the remainder balancing the right–ana left–hand parts.

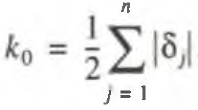

On obtaining estimates of δj, it is possible to calculate the rate of shifts in ownership form that would be achieved if there were no shifts in the employment pattern between industrial subsectors (that is, if the second component of the right–hand part of (14) were zero). Let us therefore take into consideration a “purified” intensity coefficient of structural shifts:

(15)

On the basis of the aggregate and purified rate coefficients of structural shifts, it is easy to determine the contribution of sectoral changes according to the formula:

(16)

(16)

where ω is the rate of shifts in ownership types, determined by shifts between industrial subsectors. Addend ω is calculated as the remainder in formula (16) bringing the aggregate and purified coefficients into conformity.

Estimating the restructuring rate of the industrial economy

Estimates based on formulas (12) and (15) show that the intensity of the privatization drive suddenly dropped after 1994. For instance, after 1993–1994, the transformation rate of industrial personnel structure slowed down in the following year by a factor of 2.2, and a year later by a factor of 1.3.

|

|

1993–1994 |

1994–1995 |

1995–1996 |

|

The aggregate coefficient of shift intensity in ownership forms |

21.6 |

9.9 |

7.7 |

|

Including sectoral shifts |

0.13 |

0.13 |

–0.81 |

The overall “deceleration” of the privatization drive increased nearly three times in two years alone. While in the time intervals between 1993 and 1994 and between 1994 and 1995 sectoral shifts inside industry served the purposes of privatization, in other words, stepped up the restructuring of the industrial sector of various ownership types, in 1995 and 1996, they began to weaken the main trend of reforms. It is highly symptomatic because, in line with this trend, changes in all segments of the national economy during the first spiral of economic reform were spontaneously synchronized and operated in the same direction. By 1996, when the second stage began, changes in the structure of ownership types and in the structure of industrial subsectors had obviously clashed in an equally spontaneous way.

In addition, it could be pointed out that the conclusion, based on Table 4, about intrasectoral shifts gradually acquiring greater importance than shifts in property structure has been confirmed. For instance, in 1993, 1994 and 1994, 1995, sectoral shifts accounted only for 0.6 and 1.3% respectively of the aggregate intensity coefficient of structural shifts and in 1995, 1996 for as much as 8.5%. Thus by 1997 the transformation potential of privatization had been largely depleted, and in the future, traditional economic changes–sectoral and regional–will operate as the basic structure–forming factors.

* * *

The above analysis leads us to the following conclusions:

(1) Great hopes were pinned on privatization as a factor of economic stabilization at the initial stage of Russia’s economic crisis [9]. As time went on, however, the privatization drive degenerated into a mere formality of striking industrial enterprises off the government’s balance sheets. The absence of a well–founded strategy and tactics of the Russian economy’s capitalization prevented the potential of the Russian industry of different ownership forms from being fully utilized. Nevertheless, even such a spontaneous and poorly organized action produced certain positive results. The rate of decline in industrial output would have been even higher without it. In fact, the policy of implementing structural shifts in accordance with ownership forms became one of the shock–absorbers of critical developments in the Russian industry.

(2) The main feature of the current stage of economic development is the fact that the positive potential of privatization that could be obtained within a short period has been fully depleted. We can therefore predict with a high degree of credibility that no further “dumping” of state–owned industrial facilities into “capitalist” hands can deter an overall systemic crisis in industry. It is necessary in this connection, in elaborating macroeconomic measures, to develop and apply the procedures of nationalizing the enterprises whose privatization did not pay off. It means that in the nearest future the first phase of the “privatization–nationalization” regulatory cycle will already give way to the second.

(3) The estimates demonstrate convincingly that by 1997 the so–called “big–time” privatization had been practically completed [9]. During the past few years, the rate of shifts in ownership types has dramatically declined, and nothing is likely to change this situation.

It means that, in the future, economic growth can only be achieved by “small–time,” or creeping, privatization that will not take effect until a few years later. The latter will probably affect some sectors of the light and food industries which, until recently, were slow in assuming capitalist forms of ownership because of the powerful pressure of imported substitute goods. At present, however, a competitive environment is gradually developing where domestic production in these sectors is becoming not only quite feasible but also economically advantageous.

(4). An estimate of the economic indicators of enterprises of different forms of ownership showed that a sufficient potential was only available to state–controlled and joint–stock ventures for the implementation of large–scale production programs. It is joint–stock structures, based on domestic capital, that hold out the greatest hope of transforming the Russian industry, although with an underdeveloped and basically deficient stock market it would be more correct to regard such structures as quasi–joint–stock [9]. In the context of the specific conditions existing today, such enterprises cannot be expected to produce an “explosive effect” of production growth. Yet, the analysis shows that it is they that have the best adaptation potential for the maximum economic payoff. From this standpoint, corporations, based on Russian capital, merit special attention of the state regulation system.

Acknowledgments

The author would like to thank O.V. Machul’skaya for her assistance in collecting information, making estimates and discussing the main propositions of this article.

References

1. Balatskii E.V. The State Sector of the Russian Economy in the Transition Period, Vestn. Ross. Akad. Nauk, 1998, no. 5.

2. Promyshlennost’ Rossii: Statisticheskii sbomik (The Russian Industry: a Statistical Handbook), Moscow: Goskomstat Rossii, 1997.

3. Russkii statisticheskii ezhegodnik: Statisticheskii sbomik (The Russian Statistical Yearbook: a Statistical Handbook), Moscow: Goskomstat Rossii, 1997.

4. Evgrashin A.I. The Practice of French Indicative Planning, Ross. Ekon. Zh., 1998, no. 2.

5. Balatskii E.V. Shifts in the Sectoral Structure of Russia’s Transitional Economy, Vestn. Ross. Akad. Nauk, 1998, no.3.

6. Kulikov V. [Review of] Upravlenie gosudarstvennoi sobstvennost’yu: Uchebnik pod red. V.l. Koshkina i V.M. Shapiro (The Management of State Property: a Textbook, V.l. Koshkin and V.M. Shapiro, Eds.,) Ross. Ekon. Zh., 1998, no. 2.

7. Soros G. Alkimiya finansov (An Alchemy of Finances), Moscow: Infra–M, 1996.

8. Welfens P.J. Privatization and Foreign Direct Investment in Transforming Economies, Dartmouth, 1994.

9. Privatizatsiya: opyt Vostochnoi Evropy i Azii (Privatization: the Experience of Eastern Europe and Asia), Moscow: Fond “Kul’turnaya initsiativa,” 1992.

Official link to the article:

Balatskii E.V. The Effect of Restructured Ownership Types on Industrial Production// «Studies on Russian Economic Development», Vol. 10, No. 1, 1999, pp. 30–37.