The Walras law is rightly acclaimed as a key law of economics, which postulates general market equilibrium in an economic system. Despite the fact that this law has been widely discussed, criticized, and compared with other theoretical concepts, and even altogether rejected [1], it has been poorly investigated. Let us look at some controversial points in its formulaic notation and the most interesting conclusions drawn from this law.

Flaws of the established formula

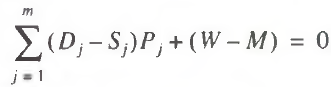

The Walras law says that an economic system is invariably in the state of certain overall equilibrium. That is, even if demand and supply are not in equilibrium in all markets, they are all carefully balanced aggregately within the entire system and aggregate excess demand (as a difference between demand and supply) is still zero. The conventional formula [1] looks as follows:

(1)

where Dj and Sj, are demand and supply respectively in the jth market of goods; Pj is the price of the jth product; M and W are, respectively, the money supply and money demand.

The above formula implies the existence of a money market, in addition to markets of goods. Several assumptions are made. For example, the money market is treated as single and homogeneous; whereas, the price of such specific merchandise as money is taken as equal to one unit, i.e., money is equivalent to itself. Lastly, the above formula implies that money can only be involved in a transaction in a market of goods once, i.e., the velocity of circulation is equal to one unit. In our view, these theoretical premises in the established interpretation of the Walras law are incorrect and invalid for the following reasons.

First, it is fallacious to view the entire money supply in a system as a homogeneous flow. This approach takes only into account cash in circulation. As a matter of fact, modern economies assign a great role to loans and various money substitutes, such as stocks, bonds, notes, and foreign exchange. They all vary in liquidity and perform distinctly different functions. Therefore, one would rather define the money market as an aggregate of heterogeneous markets, each characterizing a corresponding type of the money supply. As the stock and bond markets may be regarded as markets of goods, the money markets should comprise cash, foreign exchange, and long–, medium–, and short–term loans. In other words, the money market requires the same approach as the market of goods.

Second, the assumption that the price of money is equal to one unit is only valid for cash. Here, the principle that money is equivalent to money and the ruble is equal to the ruble, holds indeed. However, the situation changes radically with regard to money in other forms. For example, a loan has a price reflected in the interest rate, which may vary with the length of the term. The price of foreign exchange is determined by exchange rates, also varying depending on their type, which may be spot or futures. Several money substitutes act, thus, as capital, which has its own price and provides for eventual growth of initial funds. Therefore, equation (1) above should be revised. A group of other indices should be added: the price of money substitutes.

This addition is very important as it covers demand and supply in the money market. The interplay of these forces is largely predetermined by the price of money and by interest rates. Moreover, this approach makes the Walras law more dynamic: as time passes, the market of goods and the money market undergo evolutionary changes, particularly, changes in the pricing environment of business. The dynamic development of the Walras formula in this case is also justified by the fact that interest is normally due and payable on loans after a certain period of time. The main point, however, is that the presence of interest in the Walras formula of economic equilibrium automatically implies that the formula includes regulated variables. For example, interest rates are a regulated economic parameter; the exchange rate can also be regulated to a certain extent. Therefore, if equation (1) is applied to a purely competition–based economy, the presence of the price of money allows room in the theory of universal equilibrium for another, implicit, economic agent: the state.

Third, the incorporation of the money market and markets of goods in a single formal model suggests another factor to be accounted for: the velocity of circulation. Even cash may be used repeatedly in commercial transactions, let alone loans where the situation is all the more complicated. The turnover of loanable funds directly depends on the term of the loan: short–term loan funds may be re–lent several times within one year, while long–term loan money is dispensed gradually over several years. Moreover, the average velocity of circulation significantly varies in different economies and tends to change incessantly. The latter factor is due to the evolution of national monetary systems and banking industries. So it also lends the Walras formula some dynamism. The velocity of circulation makes it imperative to revise the index of the money supply in equation (1). The money demand is reflected with due regard to this factor.

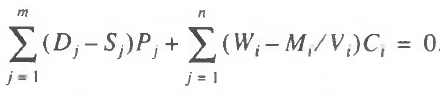

The Walras law in a more precise version may be represented by the following formula:

(2)

where Wi and Mi, are respectively demand and supply of the ith type of money; and Vi and Ci are respectively the velocity of circulation and price of the ith type of money.

This more elaborate formula removes many theoretical rough edges and provides a more accurate description of an actual economy.

Inconsistency in the Walras scheme

Let us verify the following thesis, which follows from the Walras equation. If an economy has markets where supply exceeds demand, there should also be markets where demand exceeds supply. Are there any indeed?

To answer this question, we will have to scan the entire economy to find markets with negative and positive surplus in demand.

The main problems arising in any discussion of the Walras law is that it cannot be verified in principle. It is impossible to make an experiment or collect statistics to establish conclusively the validity (or invalidity) of this law. The reasons are two. First, it is unrealistic to embrace all the markets of an economy at once. Second, it is very hard to evaluate such a market force as demand. Therefore, all further logical constructions and economists' debate on the subject are purely speculative in character.

According to Weitsman, an oversupply of goods is the most significant feature of capitalism [2]. Indeed, any underproduction in a capitalist economy involves the inadmissible loss of profit. If demand for any reason exceeds supply, the situation is promptly adjusted through higher prices. As a result, demand goes down and supply goes up and oversupply is re–established. It is common knowledge that capitalism has no problems producing; sales are in fact the only real challenge it has to meet.

This means oversupply virtually in all markets of goods and services, including resources. As underemployment, in particular, is always present in the capitalist labor market, it means that demand for labor is less than supply. The situation in the fixed capital market is much the same: production capacities are chronically underloaded. The widely current notions of natural unemployment (3 to 5%) and the normally idle fixed assets (7 to 10%) are not accidental. A similar picture is in specialty markets, such as land and real estate, information and innovation. A capitalist economy is based on the general principle that everyone wishing to obtain goods has to pay a stated price. Any compromise is local and temporary and does not affect the general alignment of forces in the economic system.

According to the Walras law, oversupply in the markets of goods formally means that the first addend in the left–hand part of equation (2) is negative and; therefore, the second addend should be positive. Should it?

At first glance, excess demand may seem permanent in the money market under capitalism as money is always in short supply. However, even a cursory study invalidates that customary view. As a matter of fact, all modern capitalist economies have one common, universal feature: inflation. Periods when inflation is zero or changes for deflation are brief. Economically, inflation means money overflow in the channels of circulation and oversupply in a particular market. In our opinion, inflation testifies at least to an oversupply of cash. Moreover, excessive demand for money, if any, can always be satisfied by borrowing. Loans have a price of their own expressed in interest rates. Therefore, the loan market should be absorbing excess demand for cash immediately. How is that market?

All lenders at present minimize the risk of bad loans and require substantial security. Given this, talk of shortage in loanable resources is pointless: virtually all banks today are hunting for borrowers. In fact, security significantly stems the demand for loans and, thus, leads to oversupply.

This means that another sector of the money market operates under the pressure of oversupply. Then it follows that the second addend in the left–hand part of equation (2), as well as the first one, is negative. It appears that the Walras equation is invalid; in other words, we have here a serious theoretical inconsistency.

We face an alternative: either dismiss this law as an invalid hypothesis, or make another scrutiny of the markets looking for one where demand exceeds supply. Let us try the second approach.

Market of leisure and its specific features

The Walras law with its universal idea of equilibrium is undoubtedly highly abstract. A fundamental law of physics, the law of conservation of energy has it that if there is more energy anywhere, there should be less somewhere else. Similarly, the Walras law may be formulated as follows: if there is excessive demand anywhere, there must be oversupply somewhere. The general nature of this language means than it applies to all material goods available to society. In other words, along with conventional economic resources, manufactured goods, and services, it would be valid for the Walras law to cover the unconventional.

Let us consider such consumer activities as a walk in a park, meeting with friends, reading books, seeing movies, listening to music, and going in for sports. They are all done at leisure and take time. Recreations form specific markets that should also be included in the Walras equilibrium [1].

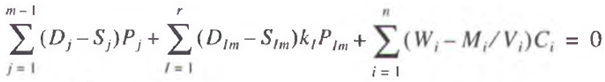

At first sight, a market of leisure is not inconsistent in this scheme. Let us assume that the last mth market among the markets of goods in equation (2) is the market of leisure. Then excessive demand in this market may be presented in the following way: (Dm – Sm)Pm, where Dm, Sm and Pm are respectively demand, supply, and price of leisure. But since no one ever sets the price, that notion remains rather obscure. If a resource has no price, it cannot be included in the scheme of universal equilibrium.

How do we attack this problem? The only possible solution is to assume that the law covers not only the prices officially quoted in the market, but also shadow prices. In particular, even though leisure cannot be bought or sold, it does not mean that it has no price. As a matter of fact, preferring leisure to work looses us a certain portion of income, which is determined on the basis of the average hourly wage Pm at a mark–up rate k > 1. The condition of the market of leisure is then described by the following correlation: (Dm – Sm)kPm, where k is a fairly clear parameter, economically. It reflects individual preferences in assessing overtime pay for which one may forgo one’s lawful leisure (over time almost always involves better pay than normal business hours).

Summing up all what has been said, the equation takes the following form:

(3)

where I is the individual index (this index is due to the fact that each individual forms one’s own market of free time).

Leisure makes the Walras scheme complete. First, consumption requires two resources: time and money. It is the element formula (2) ignores and modified equation (3) takes into account. Second, leisure links two conflicting things: work and recreation. But the most important is that it helped to find a market featuring positive excess demand, and thus removed the inconsistency in the logic. We rescued the Walras by expanding it.

It is noteworthy that the demand bias in the market of leisure is most resistant to change because in reality the possibility for an individual to reallocate his or her time between work and leisure is limited by standards, particularly average working hours.

Capitalization of leisure and its effects

Let us now turn to the logic of interaction between the market of leisure and other markets. According to formula (3), oversupply in the markets of goods means either shortage of money, or shortage or leisure, or shortage of both. Since money is not, as a rule, in short supply (after all, cash can be printed and minted), overproduction automatically leads to shortage of leisure. This conclusion is quite logical, since oversupply indicates that people in general work too much and, respectively, relax too little. In turn, consumption requires not only money, which may be in excess, but also leisure to spend and consume. Lack of time results in underconsumption. Moreover, too much work–both too long hours and too intense toiling–has an evident psychological consequence: one feels an increasing need for a rest and diversion. This means demand for leisure is growing. However, only the affluent can afford real leisure. In this sense, leisure is a specific market factor of production and consumption and has a price and utility of its own. In other words, leisure is capitalized.

The impact inflationary trends have on economic disequilibrium is of particular interest. If oversupply of goods and services drives up prices, leisure should be in ever shorter supply according to formula (3), given that all the other factors remain the same. As supply of leisure in this case remains unchanged, the shortage becomes more acute due to higher demand for leisure.

This reasoning agrees with J. Hicks. He argued against inflation by invoking loss of time and depressed moods under the pressure of permanent revision of institutional and quasi–institutional conventions [3].

It is also noteworthy that growth in productivity, all the other factors remaining the same, has the same consequence as leisure also becomes in shorter supply [2]. In other words, any intensification of production makes people long for a rest stronger. Here, we come to an extremely important aspect of equilibrium: any change in prices and effectiveness of production reorganizes the market of leisure, and vice versa. Economists believe that time and methods of its allocation are the most essential characteristic of an economic system [4]. Then equation (3) becomes especially important as it increases the explanatory force of the Walras scheme of universal equilibrium.

The concept of equilibrium expands the conventional notion of economic crisis. For example, crisis is inseparable from decrease in production, which should result in the removal of disequilibrium in the market of goods as supply comes down to match demand. This triggers a reverse trend in the market of leisure: supply rises as laid–off workers get a forced respite. It can be stated, therefore, that depression is a period of universal relaxation.

Functional distinctions between capitalism and socialism

Conventional wisdom has it that the fundamental difference between capitalist and socialist systems is in the predominant pattern of ownership of means of production: private under capitalism and public under socialism. This contrast, however, reflects rather the social disparateness of the two types of economy than purely economic dissimilarity of the systems. For all the validity of such classification of systems into capitalist and socialist, it provides too little for understanding the basic market–related features in their functioning.

As was noted above, the most distinctive feature of capitalism is the oversupply of goods and services. Socialism, in contrast, is characterized primarily by shortages. It is here that, in our view, the divide lies between capitalism and socialism [3].

In terms of the formula, it means that the first addend in equation (3) is less than zero for capitalism and more than zero for socialism. In other words, functionally, the prime difference between the socialist and capitalist systems consists in the different state of their markets of goods. The explanation is self–evident: whereas any opportunity to produce a marketable commodity promising profit is used to the best advantage under capitalism, personal gain motivation is dampened under socialism and demand fails as a rule to stimulate production. Then, according to the Walras law, difference in the markets of goods should automatically generate differences in other markets. This point rates a more detailed examination.

Let us consider, for the sake of simplicity, a case where the second addend in equation (3) is equal to zero, i.e., the market of leisure is perfectly balanced. Then socialism and capitalism should differ in the state of their money markets. In reality, such differences do occur at certain stages of economic history. For instance, if there is no inflation in a capitalist economy, one may state that the cash market is in equilibrium. Moreover, banks in developed countries employ the so–called loan rationing and lower interest to make demand exceed supply and enable the banks to select lowest–risk clients [5]. That process is universal, so it is valid to state that demand is in excess in domestic money markets.

The socialist reality is just the other way round: money is in surplus. This occurs, in particular, when the prices for a wide range of goods are rising, there is virtually no demand for loans even on the softest terms and banks are overflowing with individual savings. Savings represent deferred demand that cannot be satisfied because of shortages. But this is, to repeat, a simplified situation. A capitalist economy features the oversupply of both goods and money, which automatically leads to unsatisfied demand in the market of leisure. A socialist economy is characterized by goods scarcities and money shortage. The short supply of money manifests itself in lower prices for a wide range of goods (as was in this country in the postwar years). Then leisure is the only disposable resource in a relative surplus. There may be a less polar difference between socialism and capitalism as concerns the state of their respective markets of goods and markets of leisure, while the money markets may have either excess demand or oversupply, in both systems. More complex cases in the functioning of these two systems involve, therefore, primarily the essential difference between the situations in their markets of leisure.

We believe we have at last found one essential difference between capitalism and socialism. The capitalist maxim “Time is money” is familiar to everyone; it is also common knowledge that leisure is dramatically in short supply in the West and personal schedules are sometimes precise to the minute. Under socialism, it is quite the reverse: long hours are wasted hunting for scarce necessities and standing in lines. The excess of leisure under socialism also largely explains such time– consuming recreations as fantastically avid reading (both at home and at work); visiting with friends at home, theater and movie going, socializing and earnest discussions at work and at leisure. Enough to remember that the first computer viruses were invented by bored idle programmers in socialist countries.

We deliberately left out the customary analysis of efficiency and social fairness of capitalism and socialism in order to focus on a completely different set of problems. This approach provides a deeper insight into some of the merits and flaws of the two economic systems: the abundance of goods under capitalism and its dark side, the shortage of leisure, and shortage of goods as a price which is paid for excess leisure under socialism. Hence, a conclusion: however inefficient, socialism will always have advocates among those who cherish leisure; capitalism, for all its injustice, will always have the support of those who appreciate material goods.

Realities of transition from socialism to capitalism

The functional distinctions between capitalism and socialism, as discussed above, explain the changes which occurred in Russia during its transition from socialism to capitalism. First of all, let us consider the following questions: How justified was the price rise in the economic reform involved? Was it the government’s blunder or part of the normal course of events? Could it have been possibly avoided?

It is pointless to deny that Russia’s leadership made serious errors in the process of transition from socialism to capitalism. Equally pointless it will be to assert that any other scenario, without price rise, could be possible. The price jump had been predetermined by the very essence of transition from socialism to capitalism. Let us clarify this point.

As was noted above, the fundamental difference between the two systems consists in the different state of their markets of goods. Whereas, capitalism provides oversupply of goods and services by means of prices which exceed the level of equilibrium, socialism has prices lower than equilibrium, which gives rise to excess demand. This difference has psychological grounds: the profit-motivated capitalist producer will not lower prices to the level of market equilibrium as it will diminish his personal income. Socialist pricing purports to make goods accessible to the public, which leads to permanent underpricing. Equilibrium settles in a market when the market price of a product P. is equal to its marginal utility dU/dNj, i.e., gPj=dU/dNj, where g is the marginal utility of money and Nj is the amount of the jth product to be consumed.

Transition from socialism to capitalism thus implies change from excess demand to oversupply in the markets of goods. This is only, however, possible if the fundamental principles of pricing are changed so that actual prices, previously below equilibrium (gPj<dU/dNj), rise above it (gPj>dU/dNj). Higher prices dampen demand, stimulate supply, and reverse the situation in the market.

It follows from the above discussion that the replacement of the socialist principles of pricing with the capitalist would automatically lead to higher prices. So prices did rise–not only in Russia, but also in all the post–socialist economies. Therefore, the liberalization of prices with their subsequent rise is inevitable and logical. That it was vital, after the initial price jump, to impose stringent controls on the money supply in order to check further inflation, is a different subject.

Now let us examine a few consequences of transition from socialism to capitalism. At the initial stage, high prices and the resulting short supply of money exploded the money markets. Personal savings over many years lost their value and living standards crashed. Demand for loans soared; one could only borrow using connections.

The second stage was the glut of the cash market, which manifested itself in spiraling inflation. Soon the situation on the loan market also changed: supply exceeded demand. That moment ushered in the third phase: capitalism in its pure form. Shortage of leisure was increasingly making up for oversupply in the goods and money markets. The process started almost immediately after the beginning of the reform as people rushed into commerce and new businesses mushroomed nationwide. Making money become almost the universal ambition and people were ready to sacrifice anything for the sake of it. However, sweatshop capitalism is putting on its final form only now that most Russians are finding themselves chronically short of time. Losses of leisure most graphically demonstrate the essence of the recent changes in Russia.

Transition from capitalism to socialism means the precisely reverse change, although the logic of analysis is the same.

Markets of strategic resources

The version of economic equilibrium discussed above, including the market of leisure, is not indisputable or has no alternatives. It may be assumed, in particular, that an economy has some unique goods demand for which is virtually unlimited, although the prices are rather restrictive. That applies, among other things, to strategic resources [4]. For example, many countries with a developed defense industry need uranium and beryllium in vast quantities, which means they consume the entire output irrespective of price. As there is no flexible equilibrium between demand, supply and prices, a paradoxical situation emerges: one, or at least just a few, resource consumers dictate prices because the producer has no alternative market. In this case, the defense industry’s demand may even exceed the potential producing capacities.

However, in view of the narrow and limited market for strategic resources, including it in the Walras scheme can hardly compensate for oversupply in all the other markets under capitalism. Furthermore, the situation in such markets is probably identical in the capitalist and socialist economies. That rules out formulation of a logically conclusive theory of equilibrium.

There are possible alternatives with respect to markets with excess demand. For example, it would be valid to suppose that the market of information is just the case in point. At first glance, information appears to be an essential and hardly accessible resource in the age of the information boom. A close study of the problem, however, reveals quite the opposite: almost any and all information is generally accessible. The problem is the price. Witness Internet providers charging fees for connection. As a rule, the information market is glutted.

Another example is the market of innovation. The first impression it produces is that it is under the pressure of constant excess demand. Indeed, no economy is conceivable without permanent generation and commercialization of all sorts of new know–how. In fact, the world belongs to the those who have adequate organizational and technological novelties. At the same time, an enormous number of shelved inventions and discoveries (indirectly reflected in the number of dormant patents) and a large force of highly qualified specialists testify to the glut in that market. Therefore, the market of know–how is an unlikely candidate for the role the market of leisure has in our concept.

* * *

The introduction of the market of leisure in the Walras scheme of equilibrium, together with relevant methodological refinements, has a few important results. First, it has expanded the analytic applicability of the Walras law and made its interpretation far broader and universal. Second, the market of leisure removed serious inconsistencies, which become apparent if the law is applied to economic realities. Third, a fundamental functional distinction has been revealed between capitalism and socialism. The difference is unlikely to be detected by other methods. Fourth, the expanded version of the Walras law provides understanding of a few important inherent realities of the transition period during which the entire socioeconomic structure changes. The latter is especially important as we turn to the applied aspect of the Walras law of general economic equilibrium for first time in the study of transition. The theory of the transition period in the context of this law conclusively demonstrates that ignoring any present–day theoretic economic constitutes a grave error governments may make.

The problem discussed in this paper has an important sociophilosophical aspect. Once accepted as an established element of the market system, the market of leisure devalues the debate if capitalism is better than socialism or vice versa. Our analysis shows that it depends entirely on one’s personal system of values. Capitalism is likely to appeal to people gravitating to economic goods. And reversely, if one focuses on far more time–consuming nonmaterial values, intellectually and spiritually, he will probably prefer socialism. To a certain degree, capitalism is admittedly less spiritual than socialism.

Needless to say that the above discussion of differences between capitalism and socialism is not to be accepted as dogma. The capitalist system may occasionally acquire socialist features. Sometimes, it’s the other way round, as was in the period of postwar rehabilitation of the Soviet economy, when money and leisure were in short supply while material goods abounded. Convergence of capitalism and socialism is of particular interest in this respect. If markets of goods become leaner and economic agents have more leisure, it stands to reason to suppose that such a capitalist system becomes increasingly socialist. Reversely, with tighter work rules and higher productivity, which result in longer working hours and fuller goods markets, a socialist system goes capitalist. Both systems tend to maintain equilibrium in all markets, but they do it in opposite directions.

References

1. Harris L. Monetary Theory. Translated under the title Denezhnaya teoriya, Moscow: Progress, 1990, p. 143.

2. Weitsman M. A Simple Macroeconomic Theory of Profit Sharing, Ekonomika i matematicheskie metody, 1989, no. 6.

3. Entov V. John Hicks’ Economic Theory, in Hicks, J., Value and Capital. Translated under the title Stoimost’i kapital, Moscow: Progress, 1993, p. 35.

4. Vasilev V.S. Hostages of Time, SShA: Ekonomika, politika, ideologiya, 1996, no. 4.

5. Antonov M.V. and Pomanskii A.B. Loan Rationing and the Algorithm in Efficient Distribution of Borrowed Resources, Ekonomika i niatematicheskie metody, 1994, no. 1.

[1] Such things are integrated in part in the conventional Walras formula. For example, listening to music implies possessing audio equipment, which has a price of its own. However, the purchase of audio equipment does not necessarily imply its intended use. There must also be time for it, but the conventional formula ignores this resource.

[2] The case in point is this: growth in productivity aggravates oversupply which makes further production meaningless and increases demand for leisure.

[3] J. Kornaly coined the term “the economy of scarcity” to characterize the socialist system, which term is now firmly established in the literature.

[4] The section examining the market of strategic resources was written following the discussion of the subject with Dr. A.B. Vissarionov to whom this author is sincerely grateful.

Official link to the article:

Balatskii E.V. Leisure as a Factor of Economic Equilibrium// «Herald of the Russian Academy of Sciences», Vol. 69. No. 6, 1999, pp. 531–536.